Airtran 2008 Annual Report Download - page 55

Download and view the complete annual report

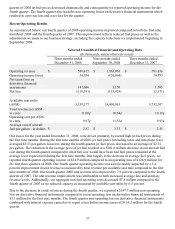

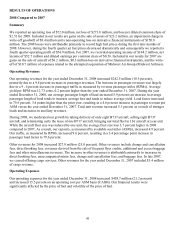

Please find page 55 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Changes in the components of our working capital also impact cash flow from operating activities. Changes in

the air traffic liability balance and the related accounts receivable balance have had a significant impact on our

net cash flow from operating activities. We have a liability to provide future air travel because travelers tend to

purchase air transportation in advance of their intended travel date. Advanced ticket sales, which are recorded in

air traffic liability, fluctuate seasonally and also provide cash as we grow and consequently receive additional

cash for future travel. This source of cash will decline or change to a use to the extent we slow or reverse our

growth or the amounts held back by our credit card processors increase. During 2008, our air traffic liability

balance increased $32.1 million contributing favorably to net cash used by operating activities. During 2007,

our air traffic liability balance increased $64.3 million, contributing to net cash flow from operating activities.

During 2008, restricted cash increased by $44.3 million, primarily due to cash remittances held back by credit

card processors and cash collateral deposits remitted by us to counterparties to certain derivative financial

instrument arrangements. Changes in accounts payable, accrued, and other current and non-current liabilities

also have had a significant impact on our cash flow from operating activities. During 2008, the $37.3 million

increase in accounts payable and accrued and other liabilities contributed favorably to net cash used by

operating activities. Accounts payable and accrued and other liabilities increased in 2008 primarily due to

increased accounts payable. During 2007, the $46.5 million increase in accounts payable and accrued and other

liabilities contributed favorably to net cash provided by operating activities.

Derivative financial instruments significantly impacted cash flow used by operating activities in 2008. Changes

in the fair value of derivative financial instruments, which adversely impacted our loss before taxes but did not

require the use of cash, aggregated $66 million. Also, counterparties to derivative financial instruments held

deposits made by us aggregating $48.8 million which required the use of cash.

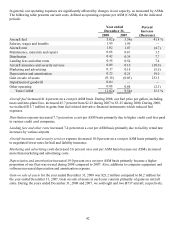

We used cash to increase other assets by $4.5 million and $16.4 million during the years ended December 31,

2008 and 2007, respectively. Other assets include prepaid aircraft maintenance and other deposits, prepaid

insurance and prepaid distribution costs. Cash was provided as we reduced prepaid fuel and stored fuel by

$16.7 million during the year ended December 31, 2008, and was used to increase prepaid fuel and stored fuel

by $27.2 million during the year ended December 31, 2007.

Investing activities in 2008 provided $328.7 million in cash compared to the $82.8 million used in 2007.

Purchases and sales of available for sales securities are classified as investing activities. During 2008, sales of

available for sale securities exceeded purchases of available for sale securities by $88.7 million. As of

December 31, 2008, our investments included $17.5 million in an enhanced cash investment fund and $7.9

million in a money market fund. The managers of each of these funds have limited immediate redemptions and

we have classified $5.5 million of our investment in the enhanced cash investment fund as long-term as of

December 31, 2008. During 2007, sales of available for sale securities exceeded purchases of available for sale

securities by $30.6 million. Investing activities also include expenditures for aircraft deposits, the purchase of

aircraft and other property and equipment, and, in 2007, deferred costs related to the attempted acquisition of

Midwest Airlines.

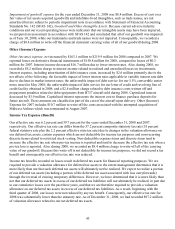

Aircraft purchase contracts typically require that the purchaser make pre-delivery deposits to the manufacturer.

These deposits are refunded at the time of aircraft delivery. We may invest a portion or all of refunded deposits

in the aircraft. During 2008, we received $114.9 million in previously paid aircraft deposits while paying $59.1

million in new aircraft deposits. During 2007, we received $90.7 million in previously paid aircraft deposits

while paying $90.6 million in new aircraft deposits. During 2008, we purchased eight B737 aircraft, of which

four were sold. We incurred $178.6 million of debt related to the acquisition of aircraft. During 2008, we

expended $136.4 million in cash, primarily for the acquisition of aircraft, and for the acquisition of rotable parts

and other property and equipment. Acquisitions of other property and equipment included additions to leasehold

improvements and the purchases of ground and computer equipment. During 2007, we purchased 12 B737

aircraft, of which two were sold. We incurred $293.7 million of debt related to the acquisition of these

aircraft. During 2007, we expended $176.0 million in cash, primarily for the acquisition of aircraft, and for the

acquisition of other property and equipment.

47