Airtran 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

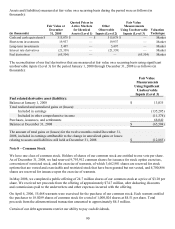

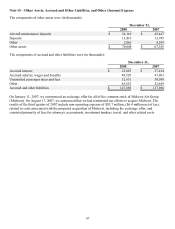

Note 15 – Other Assets, Accrued and Other Liabilities, and Other (Income) Expense

The components of other assets were (in thousands):

December 31,

2008 2007

Aircraft maintenance deposits $ 54,169 $ 49,447

Deposits 13,816 13,789

Other 2,063 4,109

Other assets $ 70,048 $ 67,345

The components of accrued and other liabilities were (in thousands):

December 31,

2008 2007

Accrued interest $ 22,865 $ 27,434

Accrued salaries, wages and benefits 48,520 47,963

Unremitted passenger taxes and fees 32,651 30,050

Other 43,853 32,449

Accrued and other liabilities $ 147,889 $ 137,896

On January 11, 2007, we commenced an exchange offer for all of the common stock of Midwest Air Group

(Midwest). On August 17, 2007, we announced that we had terminated our efforts to acquire Midwest. The

results of the third quarter of 2007 include non-operating expense of $10.7 million, ($6.4 million net of tax),

related to costs associated with the proposed acquisition of Midwest, including the exchange offer, and

consisted primarily of fees for attorneys, accountants, investment bankers, travel, and other related costs.

97