Airtran 2008 Annual Report Download - page 54

Download and view the complete annual report

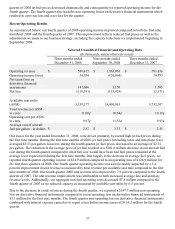

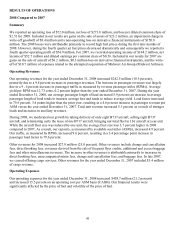

Please find page 54 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other (Income) Expense

Other (income) expense, net increased by $40.6 million. Interest income decreased by $1.3 million. Interest

expense, including amortization of debt issuance costs, increased by $24.7 million primarily due to the effect of

aircraft debt financings entered into during 2006 and 2007. Capitalized interest decreased by $3.7 million due to

fewer future aircraft deliveries resulting in lower pre delivery deposits (PDPs). Capitalized interest represents

the interest cost to finance purchase deposits for future aircraft. These amounts are classified as part of the cost

of the aircraft upon delivery.

Net unrealized (gains) losses on derivative financial instruments in 2007 were $0.3 million. The net unrealized

(gains) losses are attributable to the net of $2.9 million of unrealized losses on interest rate swap arrangements

and $2.6 million of unrealized gains on fuel related derivatives.

On January 11, 2007, we commenced an exchange offer for all of the outstanding shares of Midwest Airlines.

On August 12, 2007, we announced that our exchange offer for all of the outstanding shares of Midwest

Airlines had terminated and on August 17, 2007, we announced that we had terminated all our efforts to acquire

Midwest Airlines in a negotiated transaction. As of September 30, 2007, costs associated with the proposed

acquisition, including the exchange offer, were $10.7 million, and consisted primarily of fees for attorneys,

accountants, investment bankers, travel and other related costs. All costs related to the proposed acquisition

were charged to Other (income) expense during the three months ended September 30, 2007.

Income Tax Expense

Our effective income tax rate was 39.7 percent and 40.3 percent for the years ended December 31, 2007 and

2006, respectively.

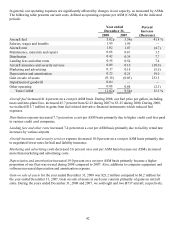

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2008, we had aggregate unrestricted cash, cash equivalents, and short-term investments of

$335.0 million ($340.5 million including long-term investments). As of December 31, 2008, we also had $86.1

million of restricted cash. In October 2008, we obtained a Revolving Line of Credit Facility pursuant to which

we are permitted to borrow up to $90 million for general corporate purposes, of which $90 million had been

borrowed as of December 31, 2008. As of February 2, 2009, we had no borrowings outstanding under the

Revolving Line of Credit Facility. During 2008, our primary sources of cash were from sales of aircraft, the

issuance of debt and equity securities, and borrowings under the new Revolving Line of Credit Facility. Our

primary uses were for cash used by operating activities, purchase of aircraft and repayment of debt.

2008 Operating, Financing, and Investing Activities

Operating activities in 2008 used $179.9 million of cash flow compared to providing $182.1 million in 2007.

Cash flow from operating activities is related to both the level of our profitability and to changes in working

capital and other assets and liabilities. Operating cash inflows are largely attributable to revenues derived from

the transportation of passengers. Operating cash outflows are largely attributable to recurring expenditures for

fuel, labor, aircraft rent, aircraft maintenance, marketing, and other activities. For the year ended December 31,

2008, we reported a net loss of $273.8 million compared to net income of $52.7 million for the year ended

December 31, 2007. The 2008 loss negatively impacted cash used by operating activities.

46