Airtran 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AirTran Holdings, Inc.

Notes to Consolidated Financial Statements

December 31, 2008

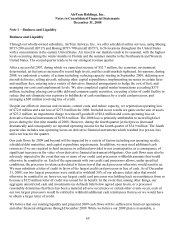

Note 1 – Business and Liquidity

Business and Liquidity

Through our wholly-owned subsidiary, AirTran Airways, Inc., we offer scheduled airline services, using Boeing

B717-200 aircraft (B717) and Boeing B737-700 aircraft (B737), to 56 locations throughout the United States

with a concentration in the eastern United States. Air travel in our markets tends to be seasonal, with the highest

levels occurring during the winter months to Florida and the summer months to the Northeastern and Western

United States. The second quarter tends to be our strongest revenue quarter.

After a successful 2007, during which we earned net income of $52.7 million, the economic environment

deteriorated, jet fuel prices increased to record high levels, and the credit markets tightened. In response, during

2008, we undertook a variety of actions including: reducing capacity starting in September 2008; deferring new

aircraft deliveries; selling aircraft; reducing other capital expenditures; implementing increases in certain fares

and ancillary fees; entering into a variety of derivative financial arrangements to hedge the cost of fuel; and

managing our costs and employment levels. We also completed capital market transactions exceeding $375

million, including: placing convertible debt and common equity securities; executing a letter of credit facility to

reduce (but not eliminate) our exposure to holdbacks of cash remittances by a credit card processor; and

arranging a $90 million revolving line of credit.

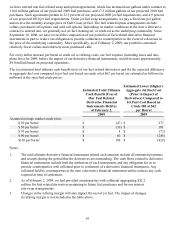

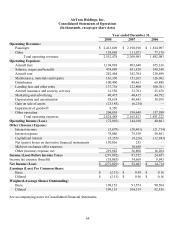

Despite our efforts to increase unit revenues, control costs, and reduce capacity, we reported an operating loss

of $72.0 million and a net loss of $273.8 million for 2008. Included in our results are gains on the sale of assets

of $23.2 million, an impairment charge to write-off goodwill of $8.4 million and a non-operating loss on

derivative financial instruments of $150.8 million. The 2008 loss is primarily attributable to record high fuel

prices during the first nine months of 2008. However, during the fourth quarter jet fuel prices decreased

dramatically and consequently we reported operating income for the fourth quarter of $54.9 million. The fourth

quarter also includes non-operating losses on derivative financial instruments which resulted in a pre-tax loss

and a net loss for the quarter.

Our cash flows for 2009 and beyond will be impacted by a variety of factors including our operating results,

scheduled debt maturities, and capital expenditure requirements. In addition, we may need additional cash

resources if we are required to fund increases in collateral provided to our counterparties as a consequence of

significant increases in the value of our derivative financial instrument obligations. Our cash flows may also be

adversely impacted in the event that one or more of our credit card processors withholds amounts that would

otherwise be remitted to us. Each of the agreements with our credit card processors allows, under specified

conditions, the processor to retain cash related to future travel that such processor otherwise would remit to us.

We may substitute a letter of credit in favor of the largest credit card processor in lieu of cash. As of December

31, 2008, our two largest processors were entitled to withhold 50% of our advance ticket sales that would

otherwise be remitted to us; however, our largest credit card processor was holding back no remittances from us

because a $125 million letter of credit was issued for its benefit. In the event that, among other things, our

aggregate unrestricted cash and investments (as defined) falls below agreed upon levels, or a processor

reasonably determines that there has been a material adverse occurrence or certain other events occur, each of

our two largest processors would be entitled to withhold additional cash remittances from us or we would have

to obtain a larger letter of credit.

We believe that our existing liquidity and projected 2009 cash flows will be sufficient to fund our operations

and other financial obligations through December 2009. While we believe our 2009 plan is reasonable, a

69