Airtran 2008 Annual Report Download - page 85

Download and view the complete annual report

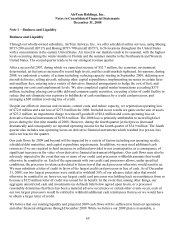

Please find page 85 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have agreed to sell two B737 aircraft to a foreign air carrier in 2009 contemporaneous with the delivery

thereof to us. That same foreign air carrier purchased two B737s from us in 2008. However, these pending

transactions are subject to customary closing conditions, some of which are outside of our control, and therefore

we cannot give any assurances that the closing of these transactions will occur. We have not arranged financing

for such aircraft as we intend for those aircraft to be sold to the buyer substantially contemporaneously with our

purchase from Boeing. We have arranged backstop secured debt financing to fund a portion of the purchase

price of each of the remaining two 2009 aircraft deliveries.

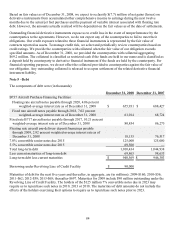

During the year ended December 31, 2008, we sold eight B737 aircraft and recognized an aggregate gain of

$20.1 million related to the sales of these aircraft. In August 2008, we also returned one leased B717 aircraft to

the lessor. During the year ended December 31, 2007, we took delivery of and subsequently sold two B737

aircraft. We recognized a gain of $6.2 million during the year ended December 31, 2007 related to the sales of

these aircraft. The gain on sales of the aircraft is classified as a component of operating expense.

During October 2008, we completed a sale-leaseback financing transaction of three spare aircraft engines. We

realized an aggregate cash benefit of $12.7 million related to the sale-leaseback transaction.

In October 2008, as part of our agreement to defer certain aircraft deliveries and obtain backstop financing for

other aircraft deliveries, we granted an affiliate of Boeing the right to require us to lease, for a period not to

exceed ten years, up to five B717 aircraft. We have no obligation to accept delivery of more than four aircraft in

total (i.e., B737 deliveries and B717 leases) in 2009. If such affiliate exercises its right to require us to lease any

B717 aircraft, we have the option to cancel firm B737 aircraft on order for each such B717 aircraft.

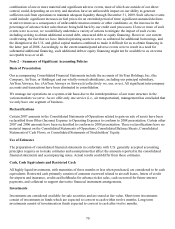

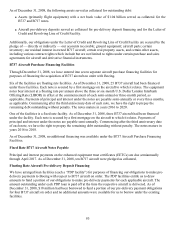

Credit Card Processing Arrangements

We have agreements with organizations that process credit card transactions arising from purchasing air travel

by customers of Airways. Each of our agreements with our credit card processors allows, under specified

conditions, the processor to retain cash related to future travel that such processor otherwise would remit to us

(i.e., a “holdback”). Holdbacks are classified as restricted cash on our consolidated balance sheets. Our

exposure to credit card holdbacks consists of advanced ticket sales that customers purchase with credit cards.

Once the customer travels, any related holdback is remitted to us.

In 2008, we amended our agreements with our two largest credit card processors (based on volumes processed

for us). The agreement with our largest credit card processor expires December 31, 2009. Each of the amended

agreements provides that a processor may hold back amounts that would otherwise be remitted to us in the

event that, among other things, our aggregate unrestricted cash and investments (as defined) falls below agreed

upon levels, or a processor reasonably determines that there has been a material adverse occurrence or certain

other events occur. The amount that each processor is entitled to hold back is determined by a combination of

the level of our aggregate unrestricted cash and investments and our profitability. If our aggregate unrestricted

cash and investments (as defined) is less than the specified amounts at specified testing dates, each processor is

entitled to increase amounts held back to specified percentages (ranging from 25% to 100%) of its exposure to

credit card chargebacks. To the extent such increases are funded with unrestricted cash, the resultant reduced

levels of unrestricted cash and investments may trigger incremental holdback requirements under each of the

two processing agreements. We have the contractual right to reduce the amounts which are otherwise withheld

by our two largest credit card processors to the extent that we provide the applicable processor with a letter or

letters of credit. As of December 31, 2008, a $125 million letter of credit had been issued for the benefit of our

largest credit card processor under our Letter of Credit Facility and the processor was holding back no cash

remittances from us.

As of December 31, 2008, we had advanced ticket sales of approximately $223.5 million related to all credit

card sales. As of December 31, 2008, we were in compliance with our processing agreements and based on our

level of profitability and unrestricted cash and investments, as defined, our two largest processors were entitled

to holdback 50% of their exposure to credit card chargebacks. Had we not been in compliance with the

agreements, or if our level of unrestricted cash and investments, as defined, was lower, our potential cash

77