Airtran 2008 Annual Report Download - page 46

Download and view the complete annual report

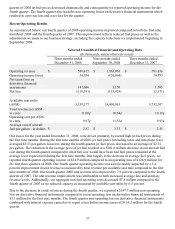

Please find page 46 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Implementation of our Business Strategy in 2008

Prior to 2008, we positioned ourselves as a growth airline. We successfully grew our business at double-digit

rates annually from 2000 through 2007 and at a rate of 4.9 percent in 2008. Nevertheless, in 2008, to respond to

the challenges of a volatile fuel cost environment in much of 2008, a weaker macroeconomic environment, and

very adverse capital market conditions, we recast our plans in order to defer previously planned growth. We

implemented reductions in fleet size, capacity, and capital expenditures. We reduced capacity principally by

deferring scheduled aircraft deliveries, reducing utilization, and by selling B737 aircraft. We reduced our

capacity (as measured by available seat miles) in the last four months of 2008 from a planned ten percent

increase to a reduction of approximately seven percent compared to the comparable period of 2007. We are also

reducing 2009 capacity. By adjusting our business strategy and implementing revised tactics, we believe we

have positioned AirTran Airways to deal with the volatile fuel cost environment, current economic recession,

and reduction in consumer demand. We expect to be ready to resume our historical growth strategy when the

business environment allows. We made the following adjustments to our strategy to respond to the challenges

of a volatile fuel cost environment and weaker macroeconomic conditions.

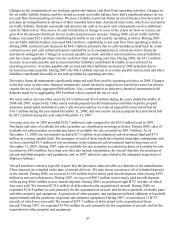

Reduce the Size of Our Operation and Focus on Strengthening Established Markets. We recast our plans in

order to defer previously planned growth and effected strategic reductions in fleet size, capacity, and operations.

More specifically, we reduced capacity by deferring scheduled aircraft deliveries and by selling B737 aircraft.

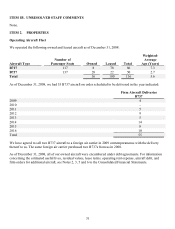

In 2008, we entered into agreements to defer delivery dates for 37 B737 aircraft originally scheduled for

delivery between 2008 and 2012 to delivery dates between 2013 and 2016. As of December 31, 2008, we had

on order 55 B737 aircraft with delivery dates between 2009 and 2016. We have four B737 aircraft scheduled for

delivery in 2009 and no aircraft scheduled for delivery in 2010. Two of the 2009 scheduled aircraft deliveries

are being sold upon delivery. During 2008, we sold eight B737 aircraft and recognized an aggregate gain of

$20.1 million related to the sales of these aircraft. We may reduce or delay further growth in our fleet and are

evaluating possible net reductions in our current fleet including via the sale of additional aircraft.

We anticipate several benefits from postponing our growth and reducing the size of our operation by deferring

deliveries and selling aircraft. First, we avoid the revenue ramp-up period associated with entering new markets

or expanding service in existing markets. Second, the sale of an aircraft generally results in a cash benefit

because the sales proceeds tend to exceed the indebtedness associated with each sold aircraft. Third, the deferral

of aircraft deliveries postpones our obligation to make pre-delivery deposits and to arrange and incur permanent

aircraft financing.

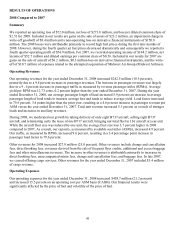

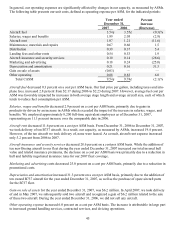

Continue to Aggressively Cut Costs and Reduce Non-aircraft Capital Expenditures. We reduced our average

non-fuel operating costs per available seat mile for each of the six years in the 2002 to 2007 period. During

2008, we managed our employment levels to match our planned capacity. For the year as a whole, our non-fuel

unit cost was relatively flat. In addition to continuing to seek ways to cut operating costs, we reduced non-

aircraft capital expenditures for 2008 by deferring or eliminating a variety of discretionary capital expenditures.

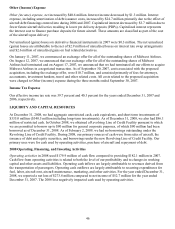

Increase Cash Resources. During 2008, we completed capital market transactions exceeding $375 million,

including: placing convertible debt and common equity securities; executing a letter of credit facility to reduce

our exposure to holdbacks by a credit card processor; and arranging a $90 million revolving line of credit.

During the second quarter, we accessed the capital markets through an offering of 24.7 million shares of our

common stock and through a concurrent offering of $74.8 million of our convertible senior notes. The net

proceeds from these two offerings aggregated $147 million. In July, we obtained a commitment for a letter of

credit facility pursuant to which a financial institution will provide one or more letters of credit in favor of our

largest card processor. The provision of the initial letter of credit resulted in a reduction in the cash remittances

which such credit card processor would have otherwise been entitled to withhold from us. In October 2008, the

letter of credit facility was amended to also provide for a revolving line of credit of up to $90 million.

38