Advance Auto Parts 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-38

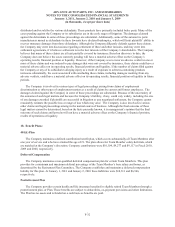

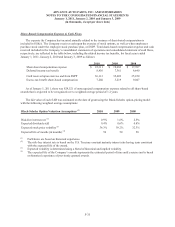

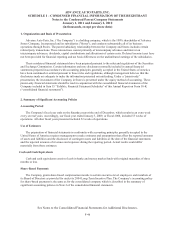

The fair value of each share of performance-based restricted stock is determined based on the market price of

the Company’s common stock on the date of grant. The weighted average fair value of shares granted during Fiscal

2010, 2009 and 2008 was $64.74, $39.53 and $32.21 per share, respectively. At January 1, 2011, the maximum

potential payout under the Company’s currently outstanding performance-based restricted stock awards was 487

shares.

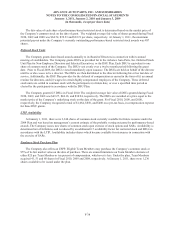

Deferred Stock Units

The Company grants share-based awards annually to its Board of Directors in connection with its annual

meeting of stockholders. The Company grants DSUs as provided for in the Advance Auto Parts, Inc. Deferred Stock

Unit Plan for Non-Employee Directors and Selected Executives, or the DSU Plan. Each DSU is equivalent to one

share of common stock of the Company. The DSUs vest evenly over a twelve-month period following the grant

date. Prior to Fiscal 2009, the DSUs vested immediately upon issuance. The DSUs are held on behalf of the director

until he or she ceases to be a director. The DSUs are then distributed to the director following his or her last date of

service. Additionally, the DSU Plan provides for the deferral of compensation as earned in the form of (i) an annual

retainer for directors, and (ii) wages for certain highly compensated employees of the Company. These deferred

stock units are settled in common stock with the participants at a future date, or over a specified time period as

elected by the participants in accordance with the DSU Plan.

The Company granted 23 DSUs in Fiscal 2010. The weighted average fair value of DSUs granted during Fiscal

2010, 2009, and 2008 was $49.27, $44.18, and $38.94, respectively. The DSUs are awarded at a price equal to the

market price of the Company’s underlying stock on the date of the grant. For Fiscal 2010, 2009, and 2008,

respectively, the Company recognized a total of $1,064, $850, and $480 on a pre-tax basis, in compensation expense

for these DSU grants.

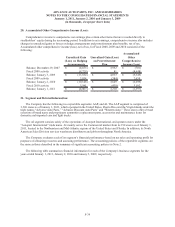

LTIP Availability

At January 1, 2011, there were 2,348 shares of common stock currently available for future issuance under the

2004 Plan and was based on management’s current estimate of the probable vesting outcome for performance-based

awards. The Company issues new shares of common stock upon exercise of stock options and SARs. Availability is

determined net of forfeitures and is reduced by an additional 0.7 availability factor for restricted stock and DSUs in

accordance with the LTIP. Availability includes shares which became available for reissuance in connection with

the exercise of SARs.

Employee Stock Purchase Plan

The Company also offers an ESPP. Eligible Team Members may purchase the Company’s common stock at

95% of its fair market value on the date of purchase. There are annual limitations on Team Member elections of

either $25 per Team Member or ten percent of compensation, whichever is less. Under the plan, Team Members

acquired 41, 51 and 80 shares in Fiscal 2010, 2009 and 2008, respectively. At January 1, 2011, there were 1,236

shares available to be issued under the plan.