Advance Auto Parts 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-27

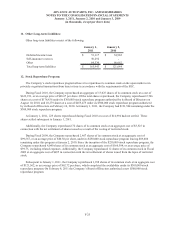

14. Income Taxes:

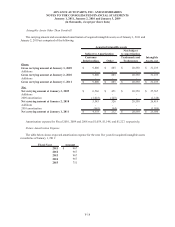

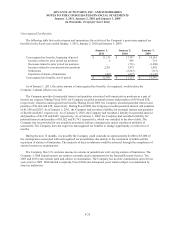

Provision for Income Taxes

Provision (benefit) for income taxes for Fiscal 2010, 2009 and 2008 consists of the following:

Current Deferred Total

2010-

Federal 151,639$ 34,553$ 186,192$

State 18,860 5,950 24,810

170,499$ 40,503$ 211,002$

2009-

Federal 87,198$ 58,085$ 145,283$

State 7,462 8,537 15,999

94,660$ 66,622$ 161,282$

2008-

Federal 128,952$ (1,435)$ 127,517$

State 16,404 (1,267) 15,137

145,356$ (2,702)$ 142,654$

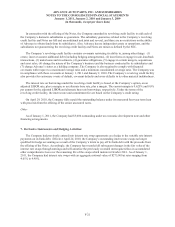

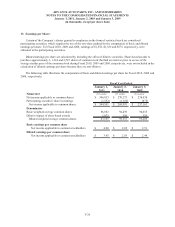

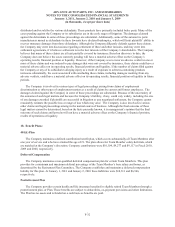

The provision (benefit) for income taxes differed from the amount computed by applying the federal statutory

income tax rate due to:

2010 2009 2008

Income before provision (benefit) for income taxes

at statutory U.S. federal income tax rate (35%) 194,970$ 151,079$ 133,242$

State income taxes, net of federal

income tax benefit 16,127 10,400 9,839

Non-deductible expenses 3,200 3,077 2,177

Valuation allowance - (614) 491

Other, net (3,295) (2,660) (3,095)

211,002$ 161,282$ 142,654$