Advance Auto Parts 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

Superior Experience strategies, our DIY sales have also improved throughout Fiscal 2010 as a result of a renewed

focus on customer service. In Fiscal 2010, we narrowed our focus on fewer customer facing initiatives to ensure we

consistently execute these initiatives in an effort to provide better customer service while decelerating our pace of

incremental spending. In Fiscal 2011, we have begun to focus on differentiating Advance from our competition

through our commitment to exceptional service which is reflected in our new promise, ‘Service is our best partSM’

and the convergence of our four key strategies into two strategies – Service Leadership and Superior Availability.

Through these two strategies, we believe we can continue to build on the initiatives discussed below and produce

favorable financial results.

Our comparable store sales results for Fiscal 2010 were comprised of favorable Commercial and DIY sales

results. Our Commercial sales, as a percentage of total sales, increased to 34% for Fiscal 2010 as compared to 32%

for Fiscal 2009. Over the past three years we have completed incremental investments in additional parts

professionals, delivery trucks and drivers in approximately half of our AAP stores with Commercial programs. We

decelerated our pace of completing these investments during the second half of Fiscal 2010 and will continue to roll

out these investments to the entire store chain at a more moderate rate over the next two years. Our growth in

Commercial is dependent on the previous investments we have made and plan on making in the future and

maintaining successful relationships with our existing customers and attracting new customers. If we succeed in

these strategies, we anticipate the pace of our growth in Commercial to continue to exceed the pace of DIY growth.

Our e-commerce website is also expected to contribute to our Commercial sales due to the completion of the roll out

of our business-to-business platform during the fourth quarter of Fiscal 2010. The continued growth in our

Commercial sales emphasizes our focus on an integrated service model and our goal of achieving a 50/50 mix of

Commercial and DIY sales.

Our DIY initiatives include the ongoing improvement of our customer driven staffing model, rollout of more

effective training programs and a number of marketing strategies. We are utilizing a more focused marketing

approach to better target our highest potential customers and our underserved customers, which has resulted in a

more effective use of our advertising spending. Our re-launched e-commerce website has been operational for five

complete fiscal quarters and is beginning to contribute favorably to our DIY sales results. On an ongoing basis, we

closely monitor independent customer satisfaction scores for both Commercial and DIY customers, as a measure of

customer service and product availability, and have experienced improvement since the program’s inception.

Both our Commercial and DIY sales have benefitted from our added parts availability and merchandising

initiatives. We added many new brands to our parts offering in Fiscal 2009 and we continued to rollout custom

assortments of product in our stores in Fiscal 2010. We continue to complete additions to our supply chain network

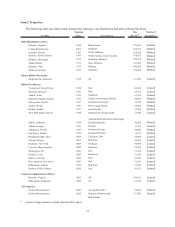

to increase our ability to get the right product to our customers. As of January 1, 2011, we were supporting multiple

daily deliveries to a majority of our stores from our 176 HUB stores and 31 Parts Delivered Quickly, or PDQ®,

facilities. Our HUB stores are larger stores that stock a wider selection and greater supply of inventory. In addition

to driving sales, we believe these initiatives are responsible for the continued improvement in our gross profit rate.

Our gross profit rate for Fiscal 2010 increased 113 basis points compared to Fiscal 2009. We experienced gross

profit rate improvements in both parts and non-parts categories resulting from the custom mix availability, price

optimization and other merchandising capabilities and the impact of our growing global sourcing operation. We plan

to continue increasing the amount of product we source globally which is expected to provide us significant gross

profit improvement and allow us to more quickly source the products our customers need.

Automotive Aftermarket Industry

The automotive aftermarket industry benefitted in 2010 from the economic environment as people kept their

vehicles longer. Other favorable industry dynamics which existed throughout most of 2010 included:

• modest increase in miles driven;

• increase in number and average age of vehicles; and

• relatively stable gas prices.

Many of these favorable industry dynamics are continuing into 2011. We anticipate miles driven will continue

to increase over the long-term future based on historical trends and the increasing number of vehicles on the road;

however, there is the potential of market pressure from the recent increase in gas prices and the rebound of new car