Advance Auto Parts 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

million, and a related LIFO and warehousing cost impact of $3.4 million. This non-cash expense was presented as

an increase to cost of goods sold in our Fiscal 2008 consolidated statement of operations. Following this change in

inventory management approach, we have been more effectively managing slow moving inventory, and we intend to

continue to utilize vendor return privileges when necessary.

Our total inventory reserves decreased by $10.3 million in Fiscal 2010 primarily due to the continued

development of our physical inventory program combined with the increased emphasis on counting specific product

categories to drive improved on-hand accuracy. The decrease in our inventory reserves in Fiscal 2009 was primarily

related to the entire utilization of our reserve for slow moving inventory established in Fiscal 2008 in connection

with the change in approach for slow moving inventory. Future changes by vendors in their policies or willingness

to accept returns of excess inventory, changes in our inventory management approach for excess and obsolete

inventory or failure by us to effectively manage the lifecycle of our inventory could require us to revise our

estimates of required reserves and result in a negative impact on our consolidated statement of operations. A 10%

difference in actual inventory reserves at January 1, 2011 would have affected net income by approximately $1.1

million for the fiscal year ended January 1, 2011.

Warranty Reserves

We offer limited warranties on certain products that range from 30 days to lifetime warranties; the warranty

obligation on the majority of merchandise sold by us with a manufacturer’s warranty is borne by our vendors.

However, we have an obligation to provide customers free replacement of merchandise or merchandise at a prorated

cost if under a warranty and not covered by the manufacturer. Merchandise sold with warranty coverage by us

primarily includes batteries but may also include other parts such as brakes and shocks. We estimate and record a

reserve for future warranty claims at the time of sale based on the historical return experience of the respective

product sold. If claims experience differs from historical levels, revisions in our estimates may be required, which

could have an impact on our consolidated statement of operations. To the extent vendors provide upfront allowances

in lieu of accepting the obligation for warranty claims and the allowance is in excess of the related warranty

expense, the excess is recorded as a reduction to cost of sales.

A 10% change in the warranty reserves at January 1, 2011 would have affected net income by approximately

$2.3 million for the fiscal year ended January 1, 2011.

Self-Insurance Reserves

We are self-insured for general and automobile liability, workers' compensation and the health care claims of

our Team Members, although we maintain stop-loss coverage with third-party insurers to limit our total liability

exposure. Our self-insurance program started in 2001. Our self-insurance reserves for Fiscal 2010, 2009 and 2008

were $97.3 million, $93.7 million and $90.6 million, respectively. Generally, claims for automobile and general

liability and workers’ compensation take several years to settle. The increase in our total self-insurance reserves has

remained consistent over the last two years and is reflective of our continued growth, including an increase in total

stores, team members and Commercial delivery vehicles.

Our self-insurance reserves consist of the estimated exposure for claims filed, claims incurred but not yet

reported and projected future claims and is established using actuarial methods followed in the insurance industry

and our historical claims experience. Specific factors include, but are not limited to, assumptions about health care

costs, the severity of accidents and the incidence of illness and the average size of claims.

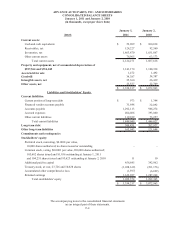

Effective January 1, 2011, we classified $50.3 million of our self-insurance liability as long-term because the

timing of future payments is now more predictable based on the historical patterns and maturity of the program and

is relied upon in determining the current portion of these liabilities. While we do not expect the amounts ultimately

paid to differ significantly from our estimates, our self-insurance reserves and corresponding SG&A could be

affected if future claim experience differs significantly from historical trends and actuarial assumptions. A 10%

change in our self-insurance liabilities at January 1, 2011 would have affected net income by approximately $6.0

million for the fiscal year ended January 1, 2011.