Advance Auto Parts 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Item 7A. Quantitative and Qualitative Disclosures about Market Risks.

On April 29, 2010, we issued $300 million of senior unsecured notes with an interest rate of 5.75% due in 2020

and repaid $275 million outstanding under our revolving credit facility and term loan with the proceeds from the

notes offering. Our revolving credit facility currently remains in place and matures in October 2011. Therefore, we

may be exposed to cash flow risk due to changes in LIBOR in the event we borrow under our revolving credit

facility.

Historically we have used interest rate swaps to mitigate the impact that movements in LIBOR would have on

the interest from our bank debt. As we have paid off our bank debt, these interest rate swaps now present their own

exposure to movements in LIBOR.

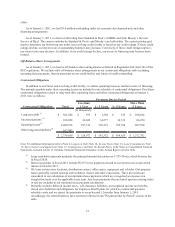

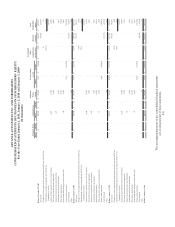

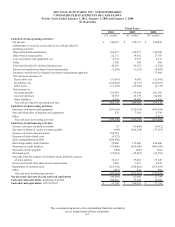

The table below presents principal cash flows and related weighted average interest rates on our interest rate

swaps outstanding at January 1, 2011, by expected maturity dates. The table includes the impact of the anticipated

average pay and receive rates of our interest rate swaps through their maturity dates. Expected maturity dates

approximate contract terms. Weighted average variable rates are based on implied forward rates in the yield curve at

January 1, 2011. Implied forward rates should not be considered a predictor of actual future interest rates.

Fair

Fiscal Fiscal Fiscal Fiscal Fiscal Market

2011 2012 2013 2014 2015 Thereafter Total Liabilit

y

(dollars in thousands)

Interest rate swap:

Variable to fixed

(1)

275,000$ -$ -$ -$ - - 275,000 9,321$

Weighted average pay rate 4.4% - - - - - 4.4% -

Weighted average receive rate - - - - - - - -

(1) Amounts presented may not be outstanding for the entire year.

Item 8. Financial Statements and Supplementary Data.

See financial statements included in Item 15 “Exhibits, Financial Statement Schedules” of this annual report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.