Advance Auto Parts 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-33

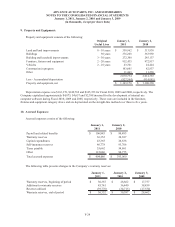

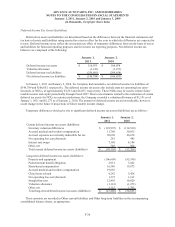

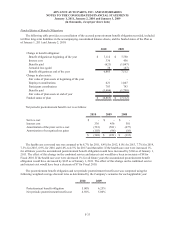

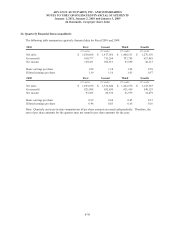

Funded Status of Benefit Obligations

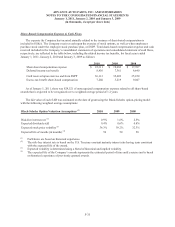

The following table provides a reconciliation of the accrued postretirement benefit obligation recorded, included

in Other long-term liabilities in the accompanying consolidated balance sheets, and the funded status of the Plan as

of January 1, 2011 and January 2, 2010:

2010 2009

Change in benefit obligation:

Benefit obligation at beginning of the year 7,112$ 7,750$

Interest cost 336 456

Benefits paid (621) (1,047)

Actuarial loss (gain) 38 (47)

Benefit obligation at end of the year 6,865 7,112

Change in plan assets:

Fair value of plan assets at beginning of the year - -

Employer contributions 621 1,047

Participant contributions 783 743

Benefits paid (1,404) (1,790)

Fair value of plan assets at end of year - -

Funded status of pla

n

(6,865)$ (7,112)$

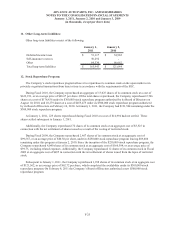

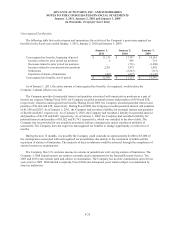

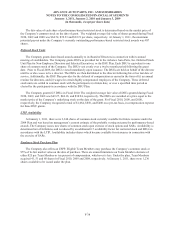

Net periodic postretirement benefit cost is as follows:

2010 2009 2008

Service cost -$ -$ -$

Interest cost 336 456 581

A

mort

i

zat

i

on o

f

t

h

e pr

i

or serv

i

ce cost

(

5

81)

(

5

81)

(6

77

)

Amortization of recognized net gains (103) (96) (16)

(348)$ (221)$ (112)$

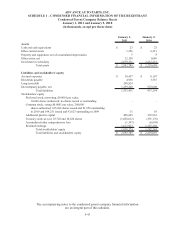

The health care cost trend rate was assumed to be 8.7% for 2011, 8.4% for 2012, 8.0% for 2013, 7.7% for 2014,

7.3% for 2015, 6.9% for 2016 and 6.6% to 4.5% for 2017 and thereafter. If the health care cost were increased 1%

for all future years the accumulated postretirement benefit obligation would have increased by $160 as of January 1,

2011. The effect of this change on the combined service and interest cost would have been an increase of $8 for

Fiscal 2010. If the health care cost were decreased 1% for all future years the accumulated postretirement benefit

obligation would have decreased by $145 as of January 1, 2011. The effect of this change on the combined service

and interest cost would have been a decrease of $7 for Fiscal 2010.

The postretirement benefit obligation and net periodic postretirement benefit cost was computed using the

following weighted average discount rates as determined by the Company’s actuaries for each applicable year:

2010 2009

Postretirement benefit obligation 5.00% 6.25%

Net periodic postretirement benefit cost 4.50% 5.00%