Abercrombie & Fitch 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

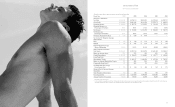

expense for Fiscal 2006 was $1.187 billion compared to $1.001 billion for

Fiscal 2005. For Fiscal 2006, the stores and distribution expense rate was

35.8% compared to 35.9% in the previous year. The decrease in the rate

primarily resulted from the Company’s ability to leverage store-related

costs on a 2% increase in comparable store sales.

The DC’s UPH rate for the year was flat in Fiscal 2006 versus

Fiscal 2005. During Fiscal 2006, while the second DC was being built,

the overall DC’s UPH was impacted by the Company’s first DC

reaching near capacity, a result of the Company’s focus on strategically

flowing inventory to stores throughout the year. The Company expects

the UPH level to increase during Fiscal 2007.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during Fiscal 2006 was

$373.8 million compared to $313.5 million in Fiscal 2005. For the current

year, the marketing, general and administrative expense rate was 11.3%,

flat compared to Fiscal 2005. Fiscal 2006 included a charge of $13.6

million related to the adoption of SFAS 123(R). Fiscal 2005 included a

non-recurring charge of $13.5 million related to a severance agreement

of an executive officer.

OTHER OPERATING INCOME, NET Other operating income

for Fiscal 2006 was $10.0 million compared to $5.5 million for Fiscal

2005. The increase was related to gift cards for which the Company

has determined the likelihood of redemption to be remote and insur-

ance reimbursements received during the first and second quarters for

Fiscal 2006 related to stores damaged by fire and Hurricane Katrina,

respectively.

OPERATING INCOME Fiscal 2006 operating income was $658.1

million compared to $542.7 million for Fiscal 2005, an increase of

21.3%. The operating income rate for Fiscal 2006 was 19.8% versus

19.5% in the previous year.

INTEREST INCOME, NET AND INCOME TAXES Net interest

income for Fiscal 2006 was $13.9 million compared to $6.7 million for

Fiscal 2005. The increase in net interest income was due to higher

interest rates and higher available investment balances during Fiscal

2006 compared to Fiscal 2005.

The effective tax rate for Fiscal 2006 was 37.2% compared to 39.2% for

Fiscal 2005. The decrease in the effective tax rate related primarily to favor-

able settlements of tax audits, favorable changes in estimates of potential

outcomes of certain state tax matters and an increase in tax exempt income

during Fiscal 2006. Fiscal 2005 tax expense reflected a charge related to the

Company’s change in estimate of the potential outcome of certain state tax

matters. The Company estimates that the annual effective tax rate for

Fiscal 2007 will be approximately 39%.

NET INCOME AND NET INCOME PER SHARE Net income

for Fiscal 2006 was $422.2 million versus $334.0 million in Fiscal 2005,

an increase of 26.4%. Net income included after-tax charges of $9.9

million in Fiscal 2006 related to the adoption of SFAS 123(R) and

non-recurring charges of $8.2 million in Fiscal 2005 related to a sever-

ance agreement of an executive officer. Net income per diluted

weighted-average share was $4.59 in Fiscal 2006 versus $3.66 in Fiscal

2005, an increase of 25.4%.

FISCAL 2005 COMPARED TO FISCAL 2004: FOURTH

QUARTER RESULTS: NET SALES

Net sales for the fourth quar-

ter of Fiscal 2005 were $961.4 million, up 39.9% versus net sales of

$687.3 million in the fourth quarter of Fiscal 2004. The net sales

increase was primarily attributable to a comparable store sales increase

of 28% for the quarter, the net addition of 63 stores during Fiscal 2005,

and an increase in direct-to-consumer business net sales (including

shipping and handling revenue) of $8.1 million versus the comparable

period in the fourth quarter of Fiscal 2004.

By merchandise brand, comparable store sales for the quarter were as

follows: Abercrombie & Fitch increased 18% with women’s comparable

store sales increasing by a low-twenties percentage and mens increasing

by a mid-teen percentage; abercrombie achieved a 59% increase in

comparable store sales with girls achieving a high-sixties increase and

boys posting a high-thirties increase; and Hollister increased by 34%

for the fourth quarter with bettys increasing comparable store sales

by a mid-thirties percentage and dudes realizing an increase in the

low-thirties. In RUEHL, there were eight stores open in Fiscal 2005

and four stores open in Fiscal 2004. As a result comparable store sales

results were not meaningful.

On a regional basis, comparable store sales increases for the Company

ranged from the mid-twenties to the low-thirties across the United States.

Stores located in the North Atlantic and Southwest had the best compa-

rable store sales performance on a consolidated basis.

In Abercrombie & Fitch, the women’s comparable store sales increase

for the quarter was driven by strong performances in polos, fleece, outer-

wear and sweaters. The men’s comparable store sales growth was driven

by increases in polos, graphic tees, jeans and personal care, offset by

decreases in woven shirts and accessories.

In the kids’ business, the girls’ comparable store sales increased as a

result of strong sales performances across the majority of the categories,

led by polos, fleece, graphic tees and jeans. Boys’ comparable store sales

increase was driven by the following categories: polos, jeans, graphic

tees and fleece, offset by slight decreases in the woven shirt and

activewear categories.

In Hollister, bettys had strong comparable store sales increases in polos,

fleece, sweaters and graphic tees. The increase in dudes’ comparable store

sales was the result of strong performance in polos, graphic tees, fleece and

personal care categories for the quarter, offset by decreases in woven shirts

and sweaters.

Direct-to-consumer merchandise net sales, which are sold through the

Company’s web sites and catalogue, in the fourth quarter of Fiscal 2005

were $47.5 million, an increase of 18.5% versus net sales of $40.1 million

in the fourth quarter of Fiscal 2004. Shipping and handling revenue for

the corresponding periods was $6.2 million in Fiscal 2005 and $5.5 mil-

lion in Fiscal 2004. The direct-to-consumer business, including shipping

and handling revenue, accounted for 5.6% of net sales in the fourth quar-

ter of Fiscal 2005 compared to 6.6% in the fourth quarter of Fiscal 2004.

The decrease in sales penetration was due to the implementation of brand

protection initiatives that reduced the amount of sale merchandise avail-

able on the web sites and limited the customer’s ability to purchase large

quantities of the same item.

GROSS PROFIT Gross profit during the fourth quarter of Fiscal

2005 was $639.4 million compared to $455.8 million in Fiscal 2004.

The gross profit rate for the fourth quarter of Fiscal 2005 was 66.5%,

up 20 basis points from a rate of 66.3% in the fourth quarter of Fiscal

2004. The increase in gross profit rate resulted largely from a higher

IMU during the fourth quarter of Fiscal 2005 and a reduction in

shrink versus the fourth quarter of Fiscal 2004, partially offset by a

slightly higher markdown rate. The improvement in IMU during the

fourth quarter was a result of higher average unit retail pricing across

all brands. Abercrombie & Fitch, abercrombie and Hollister all oper-

ated at similar IMU margins.

STORES AND DISTRIBUTION EXPENSE Stores and distribu-

tion expense for the fourth quarter of Fiscal 2005 was $293.5 million

compared to $223.8 million for the comparable period in Fiscal 2004.

The stores and distribution expense rate for the fourth quarter of Fiscal

2005 was 30.5% compared to 32.6% in the fourth quarter of Fiscal 2004.

The Company’s total store and distribution expense, as a percent of

net sales, during the fourth quarter of Fiscal 2005 decreased 210 basis

points versus the comparable period during Fiscal 2004 as a result

of the Company’s ability to leverage fixed costs due to significant

comparable store sales increases partially offset by increases in store

management and loss prevention programs during Fiscal 2005. The

leveraging of fixed costs included store payroll expense, rent, utilities

and other landlord expense, depreciation and amortization and

repairs and maintenance expense. The Company believes increases in

store management and loss prevention programs were key in driving

sales and reducing shrink levels during the quarter, which had a favor-

able impact on the Company’s gross profit rate.

The DC productivity level, measured in UPH, was 20% lower in the

fourth quarter of Fiscal 2005 versus the fourth quarter of Fiscal 2004. The

UPH rate decrease resulted from increases in inventory and from a

change in the way the Company flowed merchandise to its stores.

Merchandise was routed to the stores in a more gradual process in order

to avoid stockroom congestion at the stores. This resulted in the DC

approaching capacity levels, which in turn resulted in a lower productivity

rate due to an increased handling of inventory.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during the fourth

quarter of Fiscal 2005 was $80.8 million compared to $66.1 million

during the same period in Fiscal 2004. For the fourth quarter of

Fiscal 2005, the marketing, general and administrative expense rate

was 8.4% compared to 9.6% in the fourth quarter of Fiscal 2004.

The decrease in the marketing, general and administrative expense

rate was due to the Company’s ability to leverage home office pay-

roll, and a reduction in sample expenses and marketing expenses

due to timing of photo shoots, offset by increases in outside services

mostly due to legal costs.

OTHER OPERATING INCOME, NET Fourth quarter other

operating income for Fiscal 2005 was $2.3 million compared to $4.3 mil-

lion for the fourth quarter of Fiscal 2004. The decrease was related to

gift cards for which the Company has determined the likelihood of

redemption to be remote.

OPERATING INCOME Operating income during the fourth quarter

of Fiscal 2005 increased to $267.5 million from $170.2 million in Fiscal

2004, an increase of 57.2%. The operating income rate for the fourth

quarter of Fiscal 2005 was 27.8% compared to 24.8% for the fourth

quarter of Fiscal 2004.

INTEREST INCOME, NET AND INCOME TAXES Fourth

quarter net interest income was $2.4 million in Fiscal 2005 com-

pared to $1.3 million during the comparable period in Fiscal 2004.

The increase in net interest income was due to higher rates on

investments, partially offset by lower average investment balances

during the fourth quarter of Fiscal 2005 when compared to the same

period in Fiscal 2004. The Company continued to invest in invest-

ment grade municipal notes and bonds and investment grade auc-

tion rate securities. The effective tax rate for the fourth quarter of

Fiscal 2005 was 39.0% compared to 39.2% for the Fiscal 2004 com-

parable period.

NET INCOME AND NET INCOME PER SHARE Net income for

the fourth quarter of Fiscal 2005 was $164.6 million versus $104.3 million

for the fourth quarter of Fiscal 2004, an increase of 57.8%. Net income

per diluted weighted-average share outstanding for the fourth quarter

of Fiscal 2005 was $1.80 versus $1.15 for the comparable period in Fiscal

2004, an increase of 56.5%.

Abercrombie &Fitch

16 17