Abercrombie & Fitch 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

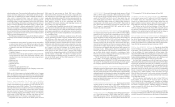

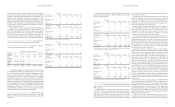

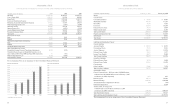

CONSOLIDATED BALANCE SHEETS

(Thousands, except share amounts) February 3, 2007 January 28, 2006

Assets

Current Assets

Cash and Equivalents $ 81,959 $ 50,687

Marketable Securities 447,793 411,167

Receivables 43,240 41,855

Inventories 427,447 362,536

Deferred Income Taxes 33,170 29,654

Other Current Assets 58,469 51,185

Total Current Assets 1,092,078 947,084

Property and Equipment, Net 1,092,282 813,603

Other Assets 63,707 29,031

Total Assets $ 2,248,067 $1,789,718

Liabilities and Shareholders’ Equity

Current Liabilities

Accounts Payable $0 100,919 $ 86,572

Outstanding Checks 27,391 58,741

Accrued Expenses 260,219 215,034

Deferred Lease Credits 35,423 31,727

Income Taxes Payable 86,675 99,480

Total Current Liabilities 510,627 491,554

Long-Term Liabilities

Deferred Income Taxes 0 30,394 38,496

Deferred Lease Credits 203,943 191,225

Commitments – –

Other Liabilities 97,806 73,326

Total Long-Term Liabilities 332,143 303,047

Shareholders’ Equity

Class A Common Stock – $0.01 par value: 150,000,000 shares

authorized and 103,300,000 shares issued at February 3, 2007

and January 28, 2006, respectively 0 1,033 1,033

Paid-In Capital 289,732 229,261

Retained Earnings 1,646,290 1,290,208

Accumulated Other Comprehensive Income (994) (796)

Deferred Compensation – 26,206

Treasury Stock, at Average Cost

14,999,945 and 15,573,789 shares at February 3, 2007

and January 28, 2006, respectively (530,764) (550,795)

Total Shareholders’ Equity

1,405,297 995,117

Total Liabilities and Shareholders’ Equity

$

2,248,067

$

1,789,718

The accompanying Notes are an integral part of these Consolidated Financial Statements.

27

$2,785

Abercrombie &Fitch

26

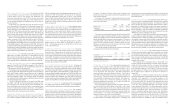

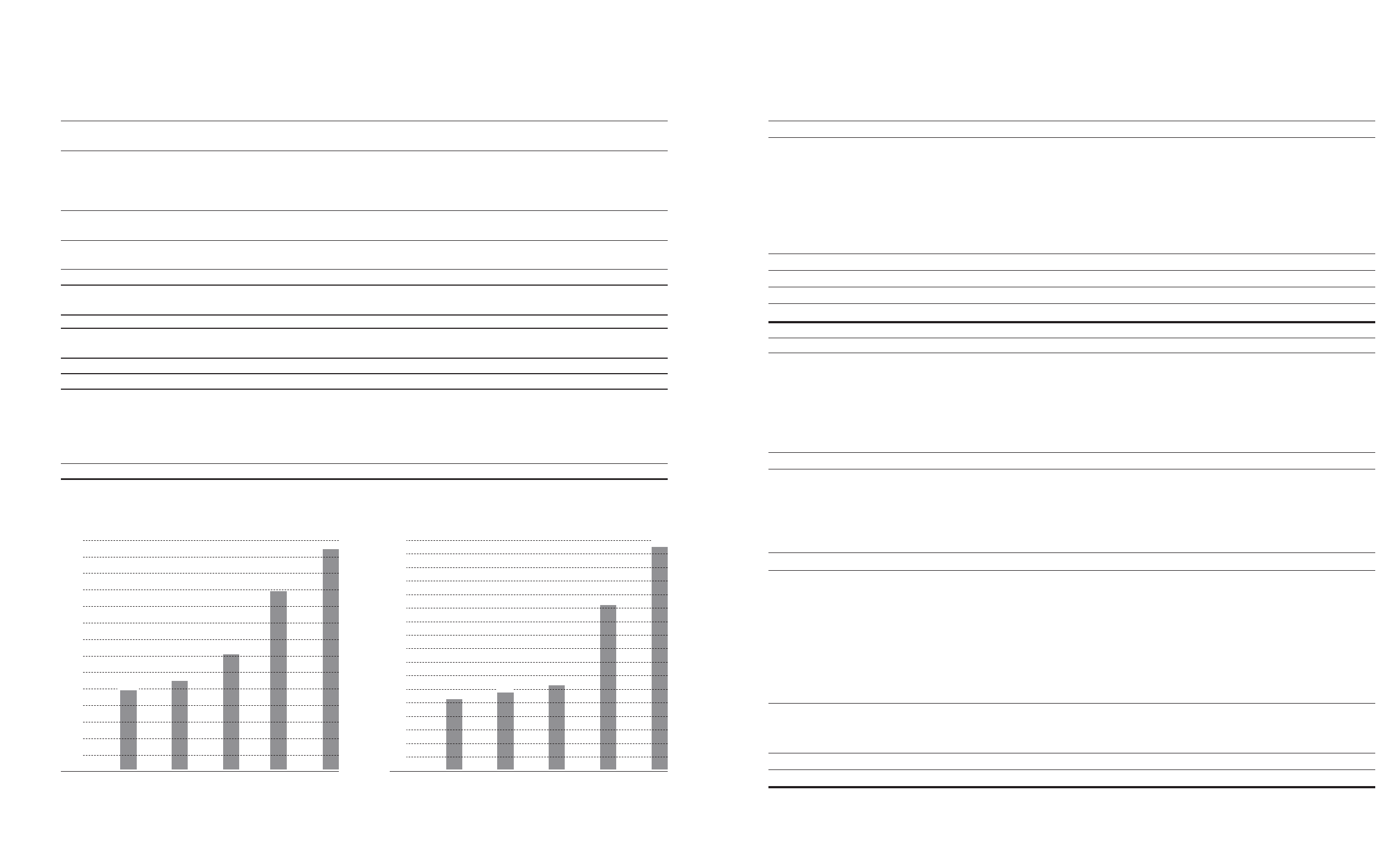

CONSOLIDATED STATEMENTS OF NET INCOME AND COMPREHENSIVE INCOME

2006* 2005 2004

$3,318,158 $2,784,711 $2,021,253

1,109,152 933,295 680,029

2,209,006 1,851,416 1,341,224

1,187,071 1,000,755 738,244

373,828 313,457 259,835

(9,983) (5,534) (4,490)

658,090 542,738 347,635

(13,896) (6,674) (5,218)

671,986 549,412 352,853

249,800 215,426 136,477

$422,186 $333,986 $216,376

$4.79 $3.83 $2.33

$4.59 $3.66 $2.28

88,052 87,161 92,777

92,010 91,221 95,110

$0.70 $0.60 $0.50

$(239) $(78) –

41 (718) –

$(198) $(796) –

$421,988 $333,190 $216,376

(Thousands, except per share amounts)

Net Sales

Cost of Goods Sold

Gross Profit

Stores and Distribution Expense

Marketing, General & Administrative Expense

Other Operating Income, Net

Operating Income

Interest Income, Net

Income Before Income Taxes

Provision for Income Taxes

Net Income

Net Income Per Share:

Basic

Diluted

Weighted-Average Shares Outstanding:

Basic

Diluted

Dividends Declared Per Share

Other Comprehensive Income

Cumulative Foreign Currency Translation Adjustments

Unrealized Gains (Losses) on Marketable Securities, net of

taxes of $20 and $0 for Fiscal 2006 and Fiscal 2005, respectively

Other Comprehensive Loss

Comprehensive Income

The accompanying Notes are an integral part of these Consolidated Financial Statements.

2002 2003 2004 2005 2006*

$ 800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,400

$2,600

$2,800

$1,596

$2,021

$3,000

$3,200

$3,400

Net Sales ($ in Millions)

Net Income ($ in Millions)

2002 2003 2004 2005 2006*

$110

$130

$150

$170

$190

$210

$230

$250

$270

$290

$310

$330

$350

$370

$390

$410

$430

$195

$205

$216

$333

$422

$2,200

$1,708

$3,318

* Fiscal 2006 is a fifty-three week year.