Abercrombie & Fitch 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

33

and comprehensive income. The term of the lease over which the

Company amortizes construction allowances and minimum rental

expenses on a straight-line basis begins on the date of initial possession,

which is generally when the Company enters the space and begins to

make improvements in preparation for intended use.

Certain leases provide for contingent rents, which are deter-

mined as a percentage of gross sales in excess of specified levels. The

Company records a contingent rent liability in accrued expenses on

the Consolidated Balance Sheet and the corresponding rent expense

when management determines that achieving the specified levels

during the fiscal year is probable.

STORE PRE-OPENING EXPENSES Pre-opening expenses relat-

ed to new store openings are charged to operations as incurred.

DESIGN AND DEVELOPMENT COSTS Costs to design and

develop the Company’s merchandise are expensed as incurred and

are reflected as a component of “Marketing, General and Admin-

istrative Expense.”

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receivables,

marketable securities, other assets and accounts payable, approximate

fair value due to the short maturity and because the average interest

rate approximates current market origination rates.

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net income per

basic share is computed based on the weighted-average number of out-

standing shares of common stock. Net income per diluted share

includes the weighted-average effect of dilutive stock options and

restricted stock units.

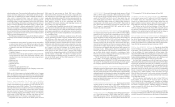

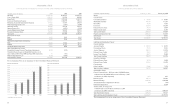

Weighted–Average Shares Outstanding (in thousands):

2006 2005 2004

Shares of Class A Common Stock issued 103,300 103,300 103,300

Treasury shares outstanding (15,248) (16,139) (10,523)

Basic shares outstanding 88,052 87,161 92,777

Dilutive effect of options and

restricted stock units 3,958 4,060 2,333

Diluted shares outstanding 92,010 91,221 95,110

Options to purchase 0.1 million, 0.2 million and 5.2 million shares

of Class A Common Stock were outstanding for Fiscal 2006, Fiscal

2005 and Fiscal 2004, respectively, but were not included in the com-

putation of net income per diluted share because the options’ exercise

prices were greater than the average market price of the underlying shares.

SHARE-BASED COMPENSATION See Note 4 of the Notes to

Consolidated Financial Statements.

USE OF ESTIMATES IN THE PREPARATION OF FINAN-

CIAL STATEMENTS

The preparation of financial statements in

conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities as

of the date of the financial statements and the reported amounts of rev-

enues and expenses during the reporting period. Since actual results

may differ from those estimates, the Company revises its estimates and

assumptions as new information becomes available.

3. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In July 2006, the FASB released Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes – an Interpretation of FASB Statement 109,

Accounting for Income Taxes” (“FIN 48”). FIN 48 provides a comprehen-

sive model for how a company should recognize, measure, present and

disclose in its financial statements uncertain tax positions that the com-

pany has taken or expects to take on a tax return. FIN 48 defines the

threshold for recognizing tax return positions in the financial statements

as “more likely than not” that the position is sustainable, based on its mer-

its. FIN 48 also provides guidance on the measurement, classification

and disclosure of tax return positions in the financial statements. FIN 48

is effective for the first reporting period beginning after December 15,

2006, with the cumulative effect of the change in accounting principle

recorded as an adjustment to the beginning balance of retained earnings

in the period of adoption. An analysis of the impact of this interpretation

is not yet complete; however, the Company expects to record an adjust-

ment to reduce opening retained earnings in the first quarter of Fiscal

2007 by an amount which is not material to its financial statements.

In September 2006, the Securities and Exchange Commission issued

Staff Accounting Bulletin (“SAB”) No. 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current

Year Financial Statements.” SAB No. 108 requires a “dual approach” for

quantifications of errors using both a method that focuses on the

income statement impact, including the cumulative effect of prior years’

misstatements, and a method that focuses on the period-end balance

sheet. SAB No. 108 was effective for the Company for Fiscal 2006. The

adoption of SAB No. 108 did not have any impact on the Company’s

consolidated financial statements.

In September 2006, the FASB released FASB Statement No. 157,

“Fair Value Measurements” (“SFAS 157”). SFAS 157 establishes a

common definition for fair value under GAAP, establishes a frame-

work for measuring fair value and expands disclosure requirements

about such fair value measurements. SFAS 157 will be effective for

the Company on February 3, 2008. The Company is currently eval-

uating the potential impact on the consolidated financial statements

of adopting SFAS 157.

In February 2007, the FASB released FASB Statement No. 159,

“The Fair Value Option for Financial Assets and Financial Liabilities”

(“SFAS 159”). SFAS 159 permits companies to measure many financial

instruments and certain other assets and liabilities at fair value on an

instrument by instrument basis. SFAS 159 also establishes presentation

and disclosure requirements to facilitate comparisons between compa-

nies that select different measurement attributes for similar types of

assets and liabilities. SFAS 159 will be effective for the Company on

February 3, 2008. The Company is currently evaluating the potential

impact on the consolidated financial statements of adopting SFAS 159.

Abercrombie &Fitch

32

actions are included in the results of operations, whereas related translation

adjustments are reported as an element of other comprehensive income

in accordance with SFAS No. 130, “Reporting Comprehensive Income.”

CONTINGENCIES In the normal course of business, the Company

must make continuing estimates of potential future legal obligations and

liabilities, which require management’s judgment on the outcome of var-

ious issues. Management may also use outside legal advice to assist in the

estimating process. However, the ultimate outcome of various legal issues

could be different than management estimates, and adjustments may be

required. The Company accrues for its legal obligations for outstanding

bills, expected defense costs and, if appropriate, settlements. Accruals are

made for personnel, general litigation and intellectual property cases.

SHAREHOLDERS’ EQUITY At February 3, 2007 and January 28,

2006, there were 150 million shares of $0.01 par value Class A Common

Stock authorized, of which 88.3 million and 87.7 million shares were

outstanding at February 3, 2007 and January 28, 2006, respectively, and

106.4 million shares of $0.01 par value Class B Common Stock author-

ized, none of which were outstanding at February 3, 2007 or January 28,

2006. In addition, 15 million shares of $0.01 par value Preferred Stock

were authorized, none of which have been issued. See Note 15 of the

Notes to Consolidated Financial Statements for information about

Preferred Stock Purchase Rights.

Holders of Class A Common Stock generally have identical rights

to holders of Class B Common Stock, except that holders of Class A

Common Stock are entitled to one vote per share while holders of

Class B Common Stock are entitled to three votes per share on all

matters submitted to a vote of shareholders.

REVENUE RECOGNITION The Company recognizes retail sales

at the time the customer takes possession of the merchandise and

purchases are paid for, primarily with either cash or credit card. Direct-

to-consumer sales are recorded upon customer receipt of merchandise.

Amounts relating to shipping and handling billed to customers in a sale

transaction are classified as revenue and the related direct shipping and

handling costs are classified as stores and distribution expense. Associate

discounts are classified as a reduction of revenue. The Company reserves

for sales returns through estimates based on historical experience and

various other assumptions that management believes to be reasonable.

The sales return reserve was $8.9 million, $8.2 million and $6.7 million at

February 3, 2007, January 28, 2006 and January 29, 2005, respectively.

The Company’s gift cards do not expire or lose value over periods

of inactivity. The Company accounts for gift cards by recognizing a

liability at the time a gift card is sold. The liability remains on the

Company’s books until the earlier of redemption (recognized as revenue)

or when the Company determines the likelihood of redemption is

remote (recognized as other operating income). The Company deter-

mines the probability of the gift card being redeemed to be remote based

on historical redemption patterns and at these times recognizes the

remaining balance as other operating income. At February 3, 2007 and

January 28, 2006, the gift card liability on the Company’s Consolidated

Balance Sheet was $65.0 million and $53.2 million, respectively.

The Company is not required by law to escheat the value of unre-

deemed gift cards to the states in which it operates. During Fiscal

2006, Fiscal 2005 and Fiscal 2004, the Company recognized other

operating income for adjustments to the gift card liability of $5.2 million,

$2.4 million and $4.3 million, respectively.

The Company does not include tax amounts collected as part of

the sales transaction in its net sales results.

COST OF GOODS SOLD Cost of goods sold includes among others,

cost of merchandise, markdowns, inventory shrink and valuation

reserves and freight expenses.

STORES AND DISTRIBUTION EXPENSE Stores and distribu-

tion expense includes store payroll, store management, rent, utilities

and other landlord expenses, depreciation and amortization, repairs

and maintenance and other store support functions and direct-to-con-

sumer and DC expenses.

MARKETING, GENERAL & ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense includes photography

and media ads, store marketing, home office payroll, except for those

departments included in stores and distribution expense, information

technology, outside services such as legal and consulting, relocation and

employment and travel expenses.

OTHER OPERATING INCOME, NET Other operating income

consists primarily of gift card balances whose likelihood of redemp-

tion has been determined to be remote and are therefore recognized

as income. Other operating income in Fiscal 2006 also included non-

recurring benefits from insurance reimbursements received for fire

and Hurricane Katrina damage.

CATALOGUE AND ADVERTISING COSTS Catalogue costs

consist primarily of catalogue production and mailing costs and are

expensed as incurred as a component of “Stores and Distribution

Expense.” Advertising costs consist of in-store photographs and

advertising in selected national publications and billboards and are

expensed as part of “Marketing, General and Administrative

Expense” when the photographs or publications first appear.

Catalogue and advertising costs, which include photo shoot costs,

amounted to $39.3 million in Fiscal 2006, $36.8 million in Fiscal 2005

and $33.8 million in Fiscal 2004.

OPERATING LEASES The Company leases property for its stores

under operating leases. Most lease agreements contain construction

allowances, rent escalation clauses and/or contingent rent provisions.

For construction allowances, the Company records a deferred lease

credit on the consolidated balance sheet and amortizes the deferred

lease credit as a reduction of rent expense on the consolidated statement

of net income and comprehensive income over the terms of the leases.

For scheduled rent escalation clauses during the lease terms, the

Company records minimum rental expenses on a straight-line basis

over the terms of the leases on the consolidated statement of net income