Abercrombie & Fitch 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

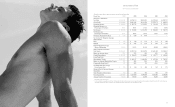

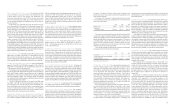

Store count and gross square footage by brand were as follows for the

fifty-three weeks ended February 3, 2007 and the fifty-two weeks ended

January 28, 2006, respectively:

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Total

January 29, 2006 361 164 318 8 851

New 8 19 70 7 104

Remodels/Conversions

(net activity) (2)

(1)

–5

(1)

(1)

(2)

2

Closed (7) (6) – – (13)

February 3, 2007 360 177 393 14 944

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Total

January 29, 2006 3,157 716 2,083 69 6,025

New 66 94 482 70 712

Remodels/Conversions

(net activity) 3

(1)

–39

(1)

(9)

(2)

33

Closed (55) (22) – – (77)

February 3, 2007 3,171 788 2,604 130 6,693

Average Store Size 8,808 4,452 6,626 9,286 7,090

(1)

Includes one Abercrombie & Fitch store and one Hollister store reopened after repair from hurricane damage.

(2)

Includes one RUEHL store temporarily closed due to fire damage.

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Total

January 30, 2005 357 171 256 4 788

New 15 5 57 4 81

Remodels/Conversions

(net activity) (1) (1) 6 – 4

Closed (10)

(3)

(11) (1)

(3)

– (22)

January 28, 2006 361 164 318 8 851

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Total

January 30, 2005 3,138 752 1,663 37 5,590

New 146 20 389 32 587

Remodels/Conversions

(net activity) (46) (4) 38 – (12)

Closed (81)

(3)

(52) (7)

(3)

– (140)

January 28, 2006 3,157 716 2,083 69 6,025

Average Store Size 8,745 4,366 6,550 8,625 7,080

(3)

Includes one Abercrombie & Fitch store and one Hollister store closed due to hurricane damage.

CAPITAL EXPENDITURES AND LESSOR CONSTRUCTION

ALLOWANCES

Capital expenditures totaled $403.5 million, $256.4

million and $185.1 million for Fiscal 2006, Fiscal 2005 and Fiscal

2004, respectively.

In Fiscal 2006 total capital expenditures were $403.5 million of

which $253.7 million was used for store related projects related to

store refresh, new construction, remodels and conversions, including

approximately $40 million related to the refresh of existing

Abercrombie & Fitch, abercrombie and Hollister stores. The remain-

ing $149.8 million was used for projects at the home office, including

the new DC, home office expansion, information technology invest-

ments and other projects.

In Fiscal 2005 total capital expenditures were $256.4 million of

which $204.7 million was used for store related projects, including

new store construction, remodels, conversions and other projects. The

remaining $51.7 million was used for projects at the home office,

including home office expansion, information technology invest-

ments, DC improvements and other projects.

In Fiscal 2004 total capital expenditures were $185.1 million of

which $169.7 million was used for store related projects, including new

store construction, remodels, conversions and other projects. The

remaining $15.4 million was used for projects at the home office,

including home office improvements, information technology

investments, DC improvements and other projects.

Lessor construction allowances are an integral part of the decision

making process for assessing the viability of new store leases. In

making the decision whether to invest in a store location, the Company

calculates the estimated future return on its investment based on the

cost of construction, less any construction allowances to be received

from the landlord. The Company received $49.4 million, $42.3 million

and $55.0 million in construction allowances during Fiscal 2006,

Fiscal 2005 and Fiscal 2004, respectively.

During Fiscal 2007, the Company anticipates capital expendi-

tures between $395 million and $405 million. Approximately $220

million of this amount is allocated to new store construction and full

store remodels. Approximately $60 million is expected to be allo-

cated to refresh existing stores. The store refresh will include new

floors, sound systems and fixture replacements at Abercrombie &

Fitch and abercrombie stores. In addition, the store refresh will

include the addition of video walls at existing Hollister stores and

fixtures to stores throughout the Hollister chain. The Company is

planning approximately $85 million in capital expenditures at the

home office related to new office buildings, information technology

investment and new direct-to-consumer distribution and logistics

systems. In March 2007, the Company decided to allocate approxi-

mately $35 million for the purchase of an airplane. With planned

expansion in Europe and Asia over the next several years, the

Company concluded that acquiring a plane is more beneficial than

continuing multiple fractional share ownership programs in meeting

the business travel needs of its Chief Executive Officer and senior man-

agement team.

The Company intends to add approximately 750,000 to 800,000

gross square feet of stores during Fiscal 2007, which will represent an

increase of approximately 11% to 12% over Fiscal 2006. The Company

anticipates the increase during Fiscal 2007 primarily due to the addi-

tion of approximately 67 new Hollister stores, 27 abercrombie stores,

six Abercrombie & Fitch stores and ten RUEHL stores. Additionally,

the Company plans to introduce its next concept with the opening of

approximately three stores in January 2008 and approximately four

additional stores by March 2008.

During Fiscal 2007, the Company expects the average construc-

tion cost per square foot, net of construction allowances, for new

Hollister stores to increase from last year’s actual cost of approximately

Abercrombie &Fitch

21

Abercrombie &Fitch

tions, significant corporate changes including mergers and acquisi-

tions with third parties, investments, restricted payments (including

dividends and stock repurchases) and transactions with affiliates. The

Amended Credit Agreement will mature on December 15, 2009.

Trade letters of credit totaling approximately $48.8 million and $40.6

million were outstanding under the Amended Credit Agreement on

February 3, 2007 and January 28, 2006, respectively. No borrowings

were outstanding under the Amended Credit Agreement on February

3, 2007 or on January 28, 2006.

Standby letters of credit totaling approximately $4.9 million and

$4.5 million were outstanding on February 3, 2007 and January 28,

2006. The standby letters of credit are set to expire primarily during

the fourth quarter of Fiscal 2007. The beneficiary, a merchandise sup-

plier, has the right to draw upon the standby letters of credit if the

Company authorizes or files a voluntary petition in bankruptcy. To

date, the beneficiary has not drawn upon the standby letters of credit.

OFF-BALANCE SHEET ARRANGEMENTS The Company does

not have any off-balance sheet arrangements or debt obligations.

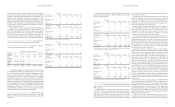

CONTRACTUAL OBLIGATIONS As of February 3, 2007, the

Company’s contractual obligations were as follows:

Payments due by period (thousands)

Contractual Less than More than

Obligations Total 1 year 1-3 years 3-5 years 5 years

Operating

Lease $1,671,681 $215,499 $422,500 $373,454 $660,228

Obligations

Purchase

Obligations $ 216,899 $216,899 – – –

Other

Obligations $ 77,332 $ 66,449 $ 10,883 – –

Totals $1,965,912 $498,847 $433,383 $373,454 $660,228

Operating lease obligations consist primarily of future minimum

lease commitments related to store operating leases (See Note 7 of the

Notes to Consolidated Financial Statements). Operating lease obliga-

tions do not include common area maintenance (“CAM”), insurance

or tax payments for which the Company is also obligated. Total expense

related to CAM, insurance and taxes was $107.4 million in Fiscal 2006.

The purchase obligations category represents purchase orders for mer-

chandise to be delivered during Spring 2007 and commitments for fabric

to be used during the next season. Other obligations primarily represent

preventive maintenance contracts for Fiscal 2007 and letters of credit

outstanding as of February 3, 2007 (See Note 11 of the Notes to

Consolidated Financial Statements). The Company expects to fund all

of these obligations with cash provided from operations.

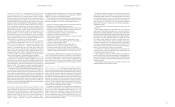

STORES AND GROSS SQUARE FEET Store count and gross

square footage by brand were as follows for the fourteen weeks ended

February 3, 2007 and the thirteen weeks ended January 28, 2006,

respectively:

20

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Total

October 28, 2006 358 171 372 11 912

New 3 8 21 4 36

Remodels/Conversions

(net activity) 1 – – (1)

(1)

–

Closed (2) (2) – – (4)

February 3, 2007 360 177 393 14 944

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Total

October 28, 2006 3,138 753 2,450 100 6,441

New 29 41 152 39 261

Remodels/Conversions

(net activity) 19 – 2 (9)

(1)

12

Closed (15) (6) – – (21)

February 3, 2007 3,171 788 2,604 130 6,693

Average Store Size 8,808 4,452 6,626 9,286 7,090

(1)

Includes one RUEHL store temporarily closed due to fire damage.

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Total

October 30, 2005 354 163 297 6 820

New 6 2 17 2 27

Remodels/Conversions

(net activity) 1 – 4 – 5

Closed – (1) – – (1)

January 28, 2006 361 164 318 8 851

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Total

October 30, 2005 3,077 713 1,941 58 5,789

New 76 8 112 11 207

Remodels/Conversions

(net activity) 4 – 30 – 34

Closed – (5) – – (5)

January 28, 2006 3,157 716 2,083 69 6,025

Average Store Size 8,745 4,366 6,550 8,625 7,080