Abercrombie & Fitch 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

35

Common Stock to the majority of associates who are subject to Section

16 of the Securities Exchange Act of 1934, as amended, and any non-

associate directors of the Company. The 2002 Plan, which is not a

shareholder approved plan, permits the Company to grant up to 7.0

million shares of A&F’s Common Stock to any associate. Under both

plans, stock options and restricted stock units vest primarily over four

years for associates. Under the 2005 LTIP, stock options and restricted

stock units vest over one year for non-associate directors. Stock options

have a ten year contractual term and the plans provide for accelerated

vesting if there is a change of control as defined in the plans.

The Company issues shares for stock option exercises and restrict-

ed stock unit vestings from treasury stock. As of February 3, 2007, the

Company had enough treasury stock available to cover stock options

and restricted stock units outstanding without having to repurchase

additional stock.

FAIR VALUE ESTIMATES The Company estimates the fair value

of stock options granted using the Black-Scholes option-pricing

model, which requires the Company to estimate the expected term of

the stock option grants and expected future stock price volatility over

the term. The term represents the expected period of time the

Company believes the options will be outstanding based on historical

experience. Estimates of expected future stock price volatility are

based on the historic volatility of the Company’s stock for the period

equal to the expected term of the stock option. The Company calcu-

lates the volatility as the annualized standard deviation of the differ-

ences in the natural logarithms of the weekly stock closing price,

adjusted for stock splits.

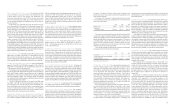

The weighted-average estimated fair values of stock options granted

during the fifty-three week period ended February 3, 2007 and the

fifty-two week periods ended January 28, 2006 and January 29, 2005,

as well as the weighted-average assumptions used in calculating such

values, on the date of grant, were as follows:

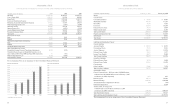

Fifty-Three Fifty-Two Fifty-Two

Weeks Ended Weeks Ended Weeks Ended

February 3, 2007 January 28, 2006 January 29, 2005

Executive Executive

Executive Other Officers and Officers and

Officers Associates Other Associates Other Associates

Exercise price $58.22 $58.12 $60.10 $36.49

Fair Value $24.92 $20.69 $23.01 $14.56

Assumptions:

Price volatility 47% 42% 47% 56%

Expected term (Years) 5 4 4 4

Risk-free interest rate 4.9% 4.9% 4.0% 3.2%

Dividend yield 1.2% 1.2% 1.1% 1.3%

In the case of restricted stock units, the Company calculates the fair

value of the restricted stock units granted as the market price of the

underlying Common Stock on the date of issuance adjusted for antic-

ipated dividend payments during the vesting period.

STOCK OPTION ACTIVITY Below is the summary of stock option

activity for Fiscal 2006:

Fifty-Three Weeks Ended February 3, 2007

Number Weighted- Aggregate Weighted-Average

Stock of Average Intrinsic Remaining

Options Shares Exercise Price Value Contractual Life

Outstanding at

January 29, 2006 9,060,831 $37.18

Granted 411,300 58.16

Exercised (440,457) 31.74

Forfeited or expired (226,950) 53.18

Outstanding at

February 3, 2007 8,804,724 $38.07 $375,970,520 3.7

Options expected to

vest at February 3, 2007 625,242 $54.92 $ 16,162,506 8.4

Options exercisable

at February 3, 2007 8,136,922 $36.67 $358,856,161 3.4

The total intrinsic value of stock options exercised during the fifty-three

weeks ended February 3, 2007 and the fifty-two weeks ended January

28, 2006 and January 29, 2005 was $15.2 million, $139.9 million and

$46.8 million, respectively.

The total fair value of stock options vested during the fifty-three

weeks ended February 3, 2007 and the fifty-two weeks ended January

28, 2006 and January 29, 2005 was $29.5 million, $31.4 million and

$31.0 million, respectively.

As of February 3, 2007, there was $11.0 million of total unrecog-

nized compensation cost, net of estimated forfeitures, related to stock

options. The unrecognized cost is expected to be recognized over a

weighted-average period of 1.4 years.

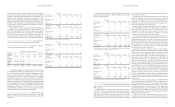

RESTRICTED STOCK UNIT ACTIVITY A summary of the sta-

tus of the Company’s restricted stock units as of February 3, 2007 and

changes during the fifty-three week period ended February 3, 2007

were as follows:

Weighted-Average

Restricted Number of Grant Date

Stock Units Shares Fair Value

Non-vested at January 29, 2006 1,856,847 $36.54

Granted 603,882 $58.73

Vested (204,430) $42.08

Forfeited (212,843) $54.67

Non-vested at February 3, 2007 2,043,456 $40.65

The total fair value of restricted stock units granted during the

fifty-three weeks ended February 3, 2007 and fifty-two weeks ended

January 28, 2006 and January 29, 2005 was $35.5 million, $36.3 mil-

lion and $16.0 million, respectively.

The total fair value of restricted stock units vested during the fifty-

three weeks ended February 3, 2007 and fifty-two weeks ended

January 28, 2006 and January 29, 2005 was $8.6 million, $5.0 million

and $1.0 million, respectively.

As of February 3, 2007, there was $46.4 million of total unrecog-

Abercrombie &Fitch

34

4. SHARE-BASED COMPENSATION

BACKGROUND

On January 29, 2006, the Company adopted SFAS

No. 123 (Revised 2004), “Share-Based Payment” (“SFAS No. 123(R)”),

which requires share-based compensation to be measured based on

estimated fair values at the date of grant using an option-pricing model.

Previously, the Company accounted for share-based compensation

using the intrinsic value method in accordance with APB Opinion No.

25, “Accounting for Stock Issued to Employees,” and related interpretations,

for which no expense was recognized for stock options if the exercise

price was equal to the market value of the underlying common stock on

the date of grant, and if the Company provided the required pro forma

disclosures in accordance with SFAS No. 123, “Accounting for Stock-

Based Compensation” (“SFAS No. 123”), as amended.

The Company adopted SFAS No. 123(R) using the modified

prospective transition method, which requires share-based compensa-

tion to be recognized for all unvested share-based awards beginning in

the first quarter of adoption. Accordingly, prior period information pre-

sented in these financial statements has not been restated to reflect the

fair value method of expensing stock options. Under the modified

prospective method, compensation expense recognized for the fifty-three

weeks ended February 3, 2007 includes compensation expense for: a) all

share-based awards granted prior to, but not yet vested as of, January 29,

2006, based on the grant-date fair value estimated in accordance with the

original provisions of SFAS No. 123 and b) all share-based awards grant-

ed subsequent to January 29, 2006, based on the grant-date fair value

estimated in accordance with the provisions of SFAS No. 123(R).

FINANCIAL STATEMENT IMPACT Total share-based compen-

sation expense recognized under SFAS No. 123(R) was $35.1 million

for the fifty-three week period ended February 3, 2007. Share-based

compensation expense of $24.1 million and $10.4 million was recognized

for the fifty-two week periods ended January 28, 2006 and January 29,

2005, under APB 25.

The Company also realized $5.5 million, $52.7 million and $17.3

million in cash tax benefits for the fifty-three week period ended

February 3, 2007 and the fifty-two week periods ended January 28, 2006

and January 29, 2005, respectively, related to stock option exercises

and restricted stock issuances.

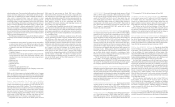

The following table summarizes the incremental effect of the

adoption of SFAS No. 123(R) to the Company’s consolidated financial

statements for the fifty-three weeks ended February 3, 2007:

(Thousands, except per share amounts) Fifty-Three Weeks Ended

February 3, 2007

Stores and distribution expense $ 463

Marketing, general and administrative expense 13,627

Operating income 14,090

Provision for income taxes (4,210)

Net income $ 9,880

Net income per basic share $ 0.11

Net income per diluted share $ 0.11

Net cash used for operating activities $ (3,382)

Net cash provided by financing activities $ 3,382

The following table is presented for comparative purposes and illus-

trates the pro forma effect on net income and net income per share for

the fifty-two weeks ended January 28, 2006 and January 29, 2005, as if

the Company had applied the fair value recognition provisions of SFAS

No. 123 to stock options granted under the Company’s share-based

compensation plans prior to January 29, 2006:

(Thousands, except per share amounts) Fifty-Two Fifty-Two

Weeks Ended Weeks Ended

January 28, 2006 January 29, 2005

Net income:

As reported $333,986 $216,376

Share-based compensation expense included

in reported net income, net of tax

(1)

14,716 6,358

Share-based compensation expense determined

under fair value based method, net of tax (36,689) (27,720)

Pro forma $312,013 $195,014

Net income per basic share:

As reported $3.83 $2.33

Pro forma $3.58 $2.10

Net income per diluted share:

As reported $3.66 $2.28

Pro forma $3.38 $2.05

(1)

Includes share-based compensation expense related to restricted stock unit awards actually recognized

in net income in each period presented using the intrinsic value method.

Share-based compensation expense is recognized, net of estimated

forfeitures, over the requisite service period on a straight line basis. The

Company adjusts share-based compensation on a quarterly basis for

actual forfeitures and on a periodic basis for changes to the estimate of

expected forfeitures based on actual forfeiture experience. The effect of

adjusting the forfeiture rate is recognized in the period the forfeiture

estimate is changed. The effect of forfeiture adjustments during the

fifty-three week period ended February 3, 2007 was immaterial.

Upon adoption of SFAS No. 123(R), the Company began present-

ing the deferred compensation for share-based compensation in the

Condensed Consolidated Balance Sheet as part of paid-in capital and

the related tax benefit in paid-in capital. Additionally, the Company

began presenting the excess tax benefit in the Consolidated Statement

of Cash Flows as part of the financing activities. Prior to adoption of

SFAS No. 123(R), the deferred compensation was presented in the

Condensed Consolidated Balance Sheet as deferred compensation

and the related tax benefit was presented in the Condensed

Consolidated Statement of Cash Flows in operating activities.

PLANS As of February 3, 2007, the Company had two primary share-

based compensation plans, the 2002 Stock Plan for Associates (the

“2002 Plan”) and the 2005 Long-Term Incentive Plan (the “2005

LTIP”), under which it grants stock options and restricted stock units

to its associates and non-associate board members. The Company also

has three other share-based compensation plans under which it grant-

ed stock options and restricted stock units to its associates and non-

associate board members in prior years.

The 2005 LTIP, which is a shareholder approved plan, permits the

Company to grant up to approximately 2.0 million shares of A&F’s