Abercrombie & Fitch 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch Abercrombie &Fitch

6 7

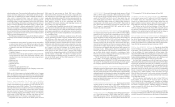

CHAIRMAN’S LETTER

I am delighted to report that our company again achieved record financial results. Briefly put, 2006 was

another excellent year for Abercrombie & Fitch. As we have noted in the past, our success is largely due to

our effective brand positioning and the strength of our business model.

The underlying driver of our success is thinking on a long-term basis while closely monitoring the short

term. Proper execution of our unique strategy enables us to attain, and then subsequently, to strengthen the

iconic status of our brands.

The Abercrombie & Fitch brand has worked hard to achieve its high standards by staying focused on its

core customer, the 18 to 22 year old, and by exemplifying East Coast traditions and an Ivy League heritage.

Ever since, we have reinforced its brand attributes, and today, Abercrombie & Fitch is better positioned then

it has ever been.

We have successfully applied our strategy to our other brands as well. At Hollister, while its iconic status

is not yet that of Abercrombie & Fitch, its logo and brand identity are commonplace in high schools across the

United States, and is now sought after internationally. The unique understanding of building iconic brands,

our competitive advantage, is what differentiates us from the competition and will continue to deliver benefits

as we manage our existing brands and launch new businesses.

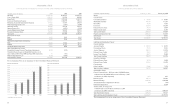

Our success is reflected in the financial results we posted in 2006. Net income per diluted share

increased 25% to $4.59 on net sales of $3.318 billion, which increased 19%, while also increasing the gross

profit rate to 66.6%. These strong financial results enabled us to make significant investments in five key

areas of our organization.

The first area of investment is in new concepts and the expansion of our existing brands to new markets.

RUEHL is a good example of a new concept that is starting to drive sales growth; the average RUEHL store

generated over $3.2 million in sales in 2006. Transactions per store increased 47% over the prior year, and the

brand generated a comparable store sales increase of 14%. We have also reduced the markdown rate and are

improving inventory turns, and target RUEHL to achieve gross margin parity with our other brands by the

end of 2007. Moreover, we accomplished all of this while enhancing brand standards.

Our new concept will open in January 2008. It has been in development for two years. We invested

approximately $7.5 million in 2006 in home office startup activities, and expect to invest from $12 to $15 million

in the concept in 2007.

The second area of investment relates to international growth. We entered Canada by opening three

Abercrombie & Fitch and three Hollister stores. The stores performed exceptionally well in 2006, generating

approximately three times more sales per square foot and more than three times the four-wall profit than our

average U.S. store. We are expanding our kids stores into Canada in 2008.

We opened our London flagship store on March 22, and judging from the media attention and customer

traffic, this store may become one of our most productive and profitable stores. We are also aggressively pursuing

real estate in both Tokyo and key European markets for Abercrombie & Fitch and Hollister.

Third, we are reinvesting in our existing domestic store base. Since the store experience is a key brand

attribute, enhancing the store environment is critical for our long-term success. Rather than let stores wear

down to the point of requiring a full remodel, we refresh stores with upgrade projects including new floors,

sound systems, fixtures and signage. In 2006, we invested $40 million to refresh existing Abercrombie & Fitch,

abercrombie, and Hollister stores, and in 2007 the investment will be approximately $60 million.

The fourth area of investment relates to our home office infrastructure, an investment that supports

growth and generates operating efficiencies. In 2006, we opened a second distribution center with capacity

to accommodate the addition of approximately 800 new stores. Located on our campus, this new distribution

center will service all Hollister stores, as well as our fifth concept. In 2006, we also opened an on-campus

merchandise research and development center called the Innovation Design Center, or IDC. The IDC has

a dedicated team that utilizes quality assurance, wash, lab and graphics machines to produce product samples for

quick approval. Once finalized, the designs are packaged for production, which reduces cost and time to market.

Finally, we increased investment in our technology platform compared to prior years. In 2006 we invested

$25 million in information technology, and plan to continue this investment in 2007 by investing approximately

$40 million in technology initiatives. Our approach is focused on upgrading core systems and the pursuit of best

practice technology. Upgrading merchandise planning, allocation and sourcing systems improves efficiency

and accuracy in producing and delivering products to stores. Implementation of best practice technology is

intended to generate payback in terms of sales growth and operating margin.

In 2006, we invested approximately $400 million in capital expenditures and approximately $50 million in

growth initiatives. By managing the bottom line prudently, we were able to make these investments while

meeting our financial goals. In 2007, we plan to continue to make strategic investments that help drive long-term

growth while continuing to maintain discipline on the bottom line.

While the company’s financial results reflect strong returns on invested capital, our dedication manifests

itself in our product. Each assortment is the result of the collaborative effort of our associates. Their commitment

to protecting and enhancing the quality of every aspect of our brands is our driving force. We operate and

succeed as a team, obsessive about the future of our brands. I am grateful for that passion and our performance

shows that our consumers also appreciate this attention.

Michael S. Jeffries

Chairman and Chief Executive Officer