Abercrombie & Fitch 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

37

At February 3, 2007, the Company had foreign net operating loss

carryovers that could be utilized to reduce future years’ tax liabilities.

A portion of these net operating losses begin expiring in the year 2012,

and some have an indefinite carryforward period. The Company has

established a valuation allowance to reflect the uncertainty of realizing

the benefits of these net operating losses in foreign jurisdictions. No

other valuation allowance has been provided for deferred tax assets

because management believes that it is more likely than not that the

full amount of the net deferred tax assets will be realized in the future.

11. LONG-TERM DEBT On December 15, 2004, the Company

entered into an amended and restated $250 million syndicated unse-

cured credit agreement (the “Amended Credit Agreement”). The pri-

mary purposes of the Amended Credit Agreement are for trade and

stand-by letters of credit and working capital. The Amended Credit

Agreement has several borrowing options, including an option where

interest rates are based on the agent bank’s “Alternate Base Rate,” and

another using the London Interbank Offered Rate. The facility fees

payable under the Amended Credit Agreement are based on the ratio

of the Company’s leveraged total debt plus 600% of forward minimum

rent commitments to consolidated earnings before interest, taxes,

depreciation, amortization and rent for the trailing four fiscal quarter

periods. The facility fees are projected to accrue at either 0.15% or

0.175% on the committed amounts per annum. The Amended Credit

Agreement contains limitations on indebtedness, liens, sale-leaseback

transactions, significant corporate changes including mergers and

acquisitions with third parties, investments, restricted payments

(including dividends and stock repurchases) and transactions with

affiliates. The Amended Credit Agreement will mature on December

15, 2009. Letters of credit totaling approximately $53.7 million and

$45.1 million were outstanding under the Amended Credit Agreement

on February 3, 2007 and January 28, 2006, respectively. No borrowings

were outstanding under the Amended Credit Agreement on February

3, 2007 or on January 28, 2006.

12. RELATED PARTY TRANSACTIONS There were no materi-

al related party transactions in Fiscal 2006. Shahid & Company, Inc. has

provided advertising and design services for the Company since 1995.

Sam N. Shahid, Jr., who served on A&F’s Board of Directors until June

15, 2005, has been President and Creative Director of Shahid &

Company, Inc. since 1993. Fees paid to Shahid & Company, Inc. for

services provided during his tenure as a Director in Fiscal 2005 and

Fiscal 2004 were approximately $0.9 million and $2.1 million respec-

tively. These amounts do not include reimbursements to Shahid &

Company, Inc. for expenses incurred while performing these services.

13. RETIREMENT BENEFITS The Company maintains the

Abercrombie & Fitch Co. Savings & Retirement Plan, a qualified plan.

All associates are eligible to participate in this plan if they are at least

21 years of age and have completed a year of employment with 1,000

or more hours of service. In addition, the Company maintains the

Abercrombie & Fitch Co. Nonqualified Savings and Supplemental

Retirement Plan. Participation in this plan is based on service and

compensation. The Company’s contributions are based on a percent-

age of associates’ eligible annual compensation. The cost of these

plans was $15.0 million in Fiscal 2006, $10.5 million in Fiscal 2005 and

$9.9 million in Fiscal 2004.

Effective February 2, 2003, the Company established a Chief

Executive Officer Supplemental Executive Retirement Plan (the

“SERP”) to provide additional retirement income to its Chairman and

Chief Executive Officer (“CEO”). Subject to service requirements, the

CEO will receive a monthly benefit equal to 50% of his final average

compensation (as defined in the SERP) for life. The SERP has been

actuarially valued by an independent third party and the expense asso-

ciated with the SERP is being accrued over the stated term of the

Amended and Restated Employment Agreement, dated as of August

15, 2005, between the Company and its CEO. The cost of this plan

was $6.6 million in Fiscal 2006, $2.5 million in Fiscal 2005 and $1.9

million in Fiscal 2004.

The Company established the rabbi trust during the third quarter

of Fiscal 2006, the purpose is to be a source of funds to match respec-

tive funding obligations to participants in the Abercrombie & Fitch

Nonqualified Savings and Supplemental Retirement Plan and the

Chief Executive Officer Supplemental Executive Retirement Plan. As

of February 3, 2007, total assets related to the Rabbi Trust were $33.5

million, which included $18.3 million of available-for-sale securities

and $15.3 million related to the cash surrender value of trust owned life

insurance policies.

14. CONTINGENCIES A&F is a defendant in lawsuits arising in the

ordinary course of business.

The Company previously reported that it was aware of 20 actions

that had been filed against it and certain of its current and former offi-

cers and directors on behalf of a purported class of shareholders who

purchased A&F’s Common Stock between October 8, 1999 and October

13, 1999. These actions originally were filed in the United States District

Courts for the Southern District of New York and the Southern District

of Ohio, Eastern Division, alleging violations of the federal securities

laws and seeking unspecified damages, and were later transferred to the

Southern District of New York for consolidated pretrial proceedings

under the caption In re Abercrombie & Fitch Securities Litigation. The

parties have reached a settlement of these matters. According to the

terms of the settlement, the Company’s insurance company, on behalf

of the defendants, has paid $6.1 million into a settlement fund in full

consideration for the settlement and release of all claims that were

asserted or could have been asserted in the action by the plaintiffs and

the other members of the settlement class. The settlement will not have

a material effect on the Company’s financial statements. The judge

who was presiding over the cases, after notice to the settlement class and

a hearing held on January 30, 2007, determined that the proposed set-

tlement was fair, reasonable and adequate and approved the settlement

as final and binding.

The Company has been named as a defendant in five class action

lawsuits (as described in more detail below) regarding overtime com-

pensation. Four of the cases were previously reported. Of these four,

one was dismissed and not appealed, another was dismissed and unsuc-

Abercrombie &Fitch

36

nized compensation cost, net of estimated forfeitures, related to non-

vested restricted stock units. The unrecognized cost is expected to be

recognized over a weighted-average period of 1.3 years.

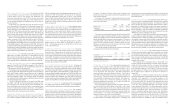

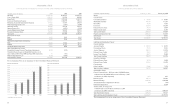

5. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2006 2005

Land $ 32,291 $ 15,985

Building 181,111 117,398

Furniture, fixtures and equipment 568,564 444,540

Leasehold improvements 754,224 625,732

Construction in progress 122,695 79,480

Other 10,168 3,248

Total $1,669,053 $1,286,383

Less: Accumulated depreciation and amortization (576,771) (472,780)

Property and equipment, net $1,092,282 $ 813,603

6. DEFERRED LEASE CREDITS, NET Deferred lease credits are

derived from payments received from landlords to partially offset store

construction costs and are reclassified between current and long-term

liabilities. The amounts, which are amortized over the life of the relat-

ed leases, consisted of the following (thousands):

2006 2005

Deferred lease credits $423,390 $376,460

Amortized deferred lease credits (184,024) (153,508)

Total deferred lease credits, net $239,366 $222,952

7. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount. Store

lease terms generally require additional payments covering taxes,

common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2006* 2005 2004

Store rent:

Fixed minimum $196,690 $170,009 $141,450

Contingent 20,192 16,178 6,932

Total store rent $216,882 $186,187 $148,382

Buildings, equipment and other 5,646 3,241 1,663

Total rent expense $222,528 $189,428 $150,045

*Fiscal 2006 is a fifty-three week year.

At February 3, 2007, the Company was committed to non-cancelable

leases with remaining terms of one to 15 years. A summary of operating

lease commitments under non-cancelable leases follows (thousands):

Fiscal 2007 $215,499 Fiscal 2010 $195,007

Fiscal 2008 $215,670 Fiscal 2011 $178,448

Fiscal 2009 $$206,830 Thereafter $660,227

8. ACCRUED EXPENSES Accrued expenses included gift card liabil-

ities of $65.0 million and construction in progress of $48.0 million at

February 3, 2007. Accrued expenses included gift card liabilities of $53.2

million and construction in progress of $19.5 million at January 28, 2006.

9. OTHER LIABILITIES Other liabilities included straight-line

rent of $45.8 million and $38.8 million at February 3, 2007 and

January 28, 2006, respectively.

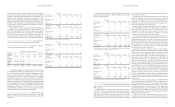

10. INCOME TAXES The provision for income taxes consisted of

(thousands):

2006* 2005 2004

Currently payable:

Federal $236,553 $184,884 $112,537

State 24,885 32,641 19,998

$261,438 $217,525 $132,535

Deferred:

Federal $ (10,271) $ (5,980) $ 2,684

State (1,367) 3,881 1,258

$ (11,638) $ (2,099)) $ 3,942

Total provision $249,800 $215,426 $136,477

*Fiscal 2006 is a fifty-three week year.

A reconciliation between the statutory federal income tax rate and the

effective income tax rate follows:

2006 2005 2004

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of federal

income tax effect 2.3 4.3 3.9

Other items, net (0.1) (0.1) (0.2)

Total 37.2% 39.2% 38.7%

Amounts paid directly to taxing authorities were $272.0 million,

$122.0 million and $114.0 million in Fiscal 2006, Fiscal 2005, and

Fiscal 2004, respectively.

The effect of temporary differences which give rise to deferred

income tax assets (liabilities) were as follows (thousands):

2006* 2005

Deferred tax assets:

Deferred compensation $ 37,725 $ 24,046

Rent 76,890 88,399

Accrued expenses 15,003 14,317

Inventory 5,642 3,982

Foreign net operation losses 2,709 –

Valuation allowance on foreign net

operation losses (2,709)

–

Total deferred tax assets $ 135,260 $ 130,744

Deferred tax liabilities:

Store supplies $ (11,578) $ (10,851)

Property and equipment (120,906) (128,735)

Total deferred tax liabilities $(132,484) $ (139,586)

Net deferred income tax liabilities $ 2,776 $ (8,842)

*Fiscal 2006 is a fifty-three week year