AT&T Wireless 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 71

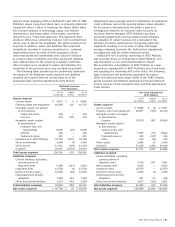

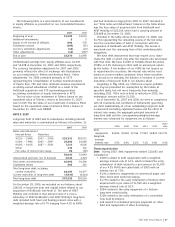

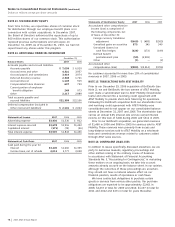

A reconciliation of income tax expense and the amount

computed by applying the statutory federal income tax rate

(35%) to income before income taxes, income from

discontinued operations, extraordinary items and cumulative

effect of accounting changes is as follows:

2007 2006 2005

Taxes computed at federal

statutory rate $6,371 $3,809 $2,001

Increases (decreases) in

income taxes resulting from:

State and local income

taxes – net of federal

income tax benefit 549 234 176

Effects of international operations (178) (200) (70)

Medicare reimbursements (120) (123) (95)

Equity in net income of affiliates — (218) (35)

Tax settlements — — (902)

Other – net (369) 23 (143)

Total $6,253 $3,525 $ 932

Effective Tax Rate 34.4% 32.4% 16.3%

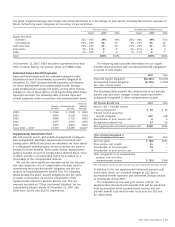

In December 2005, we reached an agreement with the IRS to

settle certain claims, principally related to the utilization of

capital losses and tax credits for years 1997 – 1999. Included

in the settlement was relief from previous assessments and

agreement on multiple items challenged by the IRS in the

course of routine audits. As we had previously paid the

assessments in full and filed refund claims with the IRS, the

settlement resulted in our recognition of approximately $902

of reduced income tax expense in 2005.

Effects of international operations include items such as

foreign tax credits, sales of foreign investments and the

effects of undistributed earnings from international operations.

We do not provide deferred taxes on the undistributed

earnings of subsidiaries operating outside the United States

that have been or are intended to be permanently reinvested.

The amount of undistributed earnings for which we have not

recorded deferred taxes is not material.

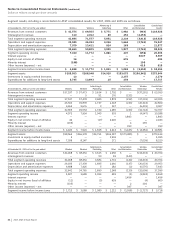

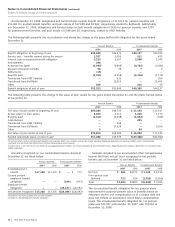

NOTE 11. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits

Substantially all of our U.S. employees are covered by one of

our noncontributory pension and death benefit plans. Many of

our management employees participate in pension plans that

have a traditional pension formula (i.e., a stated percentage

of employees’ adjusted career income) and a frozen cash

balance or defined lump sum formula. In 2005, the

management pension plan for those employees was amended

to freeze benefit accruals previously earned under a cash

balance formula. Each employee’s existing cash balance

continues to earn interest at a variable annual rate. After this

change, those management employees, at retirement, may

elect to receive the portion of their pension benefit derived

under the cash balance or defined lump sum as a lump sum

or an annuity. The remaining pension benefit, if any, will be

paid as an annuity if its value exceeds a stated monthly

amount. Management employees of former ATTC, BellSouth

and AT&T Mobility participate in cash balance pension plans.

Nonmanagement employees’ pension benefits are generally

calculated using one of two formulas: benefits are based on

a flat dollar amount per year according to job classification or

are calculated under a cash balance plan that is based on an

initial cash balance amount and a negotiated annual pension

band and interest credits. Most nonmanagement employees

can elect to receive their pension benefits in either a lump

sum payment or an annuity.

In April 2007, we announced a one-time increase to certain

retiree pension annuity payments, an average increase of

3.2% by group of retiree count. This pension adjustment is for

pre-1996 retirees and is reflected below as a plan amendment.

At December 31, 2007, defined pension plans formerly

sponsored by Ameritech Publishing Ventures and AT&T

Mobility were merged in the AT&T Pension Benefit Plan.

At December 31, 2006, certain defined pension plans

formerly sponsored by ATTC and AT&T Mobility were also

merged into the AT&T Pension Benefit Plan.

Postretirement Benefits

We provide a variety of medical, dental and life insurance

benefits to certain retired employees under various plans

and accrue actuarially-determined postretirement benefit

costs as active employees earn these benefits.

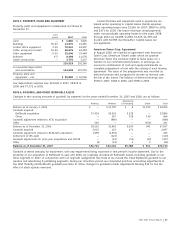

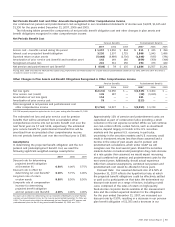

Obligations and Funded Status

For defined benefit pension plans, the benefit obligation is

the “projected benefit obligation,” the actuarial present value,

as of our December 31 measurement date, of all benefits

attributed by the pension benefit formula to employee service

rendered to that date. The amount of benefit to be paid

depends on a number of future events incorporated into the

pension benefit formula, including estimates of the average

life of employees/survivors and average years of service

rendered. It is measured based on assumptions concerning

future interest rates and future employee compensation levels.

For postretirement benefit plans, the benefit obligation is

the “accumulated postretirement benefit obligation,” the

actuarial present value as of a date of all future benefits

attributed under the terms of the postretirement benefit plan

to employee service rendered to that date.

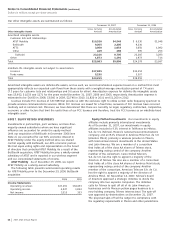

In conjunction with the 2006 BellSouth acquisition, AT&T

Mobility became a wholly-owned subsidiary. BellSouth and

AT&T Mobility sponsored noncontributory defined benefit

pension plans covering the majority of their U.S. employees.

In accordance with GAAP, when an employer is acquired as part

of a merger, any excess of projected benefit obligation over the

plan assets is recognized as a liability and any excess of plan

assets over the projected benefit obligation is recognized as a

plan asset. The recognition of a new liability or a new asset by

the acquirer, at the date of the merger, results in the elimina-

tion of any (a) previously existing unrecognized net gain or loss,

(b) unrecognized prior service cost and (c) unrecognized net

transition obligation. In addition, the accumulated postretire-

ment benefit obligations are to be measured using actuarial

assumptions and terms of the substantive plans, as determined

by the purchaser. As such, and consistent with our practice, we

did not account for the annual dollar value cap of medical and

dental benefits in the value of the accumulated postretirement

benefit obligation for the BellSouth or AT&T Mobility post-

retirement benefit plans (i.e., we assumed the cap would be

waived in the future). All other significant weighted-average

assumptions used were determined based on our policies that

are discussed below in “Assumptions.”