AT&T Wireless 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

| 2007 AT&T Annual Report

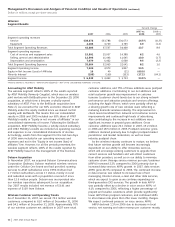

At December 31 or for the year ended: 2007 20062 20053 2004 2003

Financial Data1

Operating revenues $118,928 $ 63,055 $ 43,764 $ 40,733 $ 40,498

Operating expenses $ 98,524 $ 52,767 $ 37,596 $ 34,832 $ 34,214

Operating income $ 20,404 $ 10,288 $ 6,168 $ 5,901 $ 6,284

Interest expense $ 3,507 $ 1,843 $ 1,456 $ 1,023 $ 1,191

Equity in net income of affiliates $ 692 $ 2,043 $ 609 $ 873 $ 1,253

Other income (expense) – net $ 615 $ 393 $ 397 $ 1,414 $ 2,370

Income taxes $ 6,253 $ 3,525 $ 932 $ 2,186 $ 2,857

Income from continuing operations $ 11,951 $ 7,356 $ 4,786 $ 4,979 $ 5,859

Income from discontinued operations, net of tax4 $ — $ — $ — $ 908 $ 112

Income before extraordinary item and

cumulative effect of accounting changes $ 11,951 $ 7,356 $ 4,786 $ 5,887 $ 5,971

Net income5 $ 11,951 $ 7,356 $ 4,786 $ 5,887 $ 8,505

Earnings per common share:

Income from continuing operations $ 1.95 $ 1.89 $ 1.42 $ 1.50 $ 1.77

Income before extraordinary item and

cumulative effect of accounting changes $ 1.95 $ 1.89 $ 1.42 $ 1.78 $ 1.80

Net income5 $ 1.95 $ 1.89 $ 1.42 $ 1.78 $ 2.56

Earnings per common share – assuming dilution:

Income from continuing operations $ 1.94 $ 1.89 $ 1.42 $ 1.50 $ 1.76

Income before extraordinary item and

cumulative effect of accounting changes $ 1.94 $ 1.89 $ 1.42 $ 1.77 $ 1.80

Net income5 $ 1.94 $ 1.89 $ 1.42 $ 1.77 $ 2.56

Total assets $275,644 $270,634 $145,632 $110,265 $102,016

Long-term debt $ 57,255 $ 50,063 $ 26,115 $ 21,231 $ 16,097

Construction and capital expenditures $ 17,717 $ 8,320 $ 5,576 $ 5,099 $ 5,219

Dividends declared per common share6 $ 1.47 $ 1.35 $ 1.30 $ 1.26 $ 1.41

Book value per common share $ 19.09 $ 18.52 $ 14.11 $ 12.27 $ 11.57

Ratio of earnings to fixed charges 4.91 5.01 4.11 6.32 6.55

Debt ratio 35.7% 34.1% 35.9% 40.0% 32.0%

Weighted-average common shares

outstanding (000,000) 6,127 3,882 3,368 3,310 3,318

Weighted-average common shares

outstanding with dilution (000,000) 6,170 3,902 3,379 3,322 3,329

End of period common shares outstanding (000,000) 6,044 6,239 3,877 3,301 3,305

Operating Data

Wireless customers (000)7 70,052 60,962 54,144 49,132 24,027

In-region network access lines in service (000)8 61,582 66,469 49,413 52,356 54,683

Broadband connections (000)9 14,156 12,170 6,921 5,104 3,515

Number of employees 309,050 304,180 189,950 162,700 168,950

1

Amounts in the above table have been prepared in accordance with U.S. generally accepted accounting principles.

2

Our 2006 income statement amounts reflect results from BellSouth Corporation (BellSouth) and AT&T Mobility LLC (AT&T Mobility), formerly Cingular Wireless LLC, for

the two days following the December 29, 2006 acquisition. Our 2006 balance sheet and end-of-year metrics include 100% of BellSouth and AT&T Mobility. Prior to the

December 29, 2006 BellSouth acquisition, AT&T Mobility was a joint venture in which we owned 60% and was accounted for under the equity method.

3

Our 2005 income statement amounts reflect results from AT&T Corp. for the 43 days following the November 18, 2005 acquisition. Our 2005 balance sheet and

end-of-year metrics include 100% of AT&T Corp.

4

Our financial statements reflect results from our sold directory advertising business in Illinois and northwest Indiana as discontinued operations. The operational results

and the gain associated with the sale of that business are presented in “Income from discontinued operations, net of tax.”

5

Amounts include the following extraordinary item and cumulative effect of accounting changes: 2003, extraordinary loss of $7 related to the adoption of FIN 46

“Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51” and the cumulative effect of accounting changes of $2,541, which includes a $3,677

benefit related to the adoption of SFAS No. 143, “Accounting for Asset Retirement Obligations” and a $1,136 charge related to the January 1, 2003 change in the

method in which we recognize revenues and expenses related to publishing directories from the “issue basis” method to the “amortization” method.

6

Dividends declared per common share in 2003 included three additional dividends totaling $0.25 per share above our regular quarterly dividend payout.

7

The number presented represents 100% of AT&T Mobility cellular/PCS customers. The 2004 number includes customers from the acquisition of AT&T Wireless Services, Inc.

8

In-region represents access lines serviced by our incumbent local exchange companies (in 22 states since the BellSouth acquisition and in 13 states prior to that

acquisition). Beginning in 2006 the number includes BellSouth lines in service.

9

Broadband connections include in-region DSL lines, in-region U-verse high-speed Internet access and satellite broadband.

Selected Financial and Operating Data

Dollars in millions except per share amounts