AT&T Wireless 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

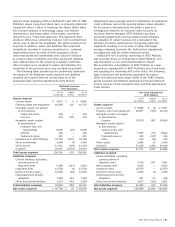

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68

| 2007 AT&T Annual Report

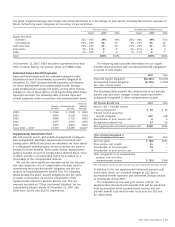

During 2007, we received net proceeds of $11,367 from

the issuance of $11,499 in long-term debt. Debt proceeds

were used for general corporate purposes, and parts of the

proceeds were used for repurchases of our common stock.

Long-term debt issuances consisted of:

• $2,000 of 6.3% global notes due in 2038.

• $2,000 of 6.5% global notes due in 2037.

• €1.25 billion of 4.375% notes due in 2013 (equivalent

to U.S. $1,641 when issued).

• $1,500 of floating-rate notes due in 2010.

• $1,200 of 6.375% retail notes due in 2056.

• £600 million of 5.5% notes due in 2027 (equivalent

to U.S. $1,158 when issued).

• $1,000 of 4.95% notes due in 2013.

• $500 of 5.625% notes due in 2016.

• $500 of zero-coupon puttable notes due in 2022.

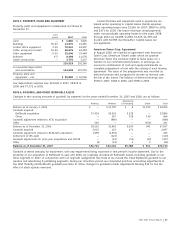

In February 2008, we received net proceeds of $3,972 from

the issuance of $4,000 in long-term debt. The long-term debt

issued consisted of the following:

• $2,500 of 5.5% global notes due in 2018.

• $750 of 4.95% global notes due in 2013.

• $750 of 6.3% global notes due in 2038.

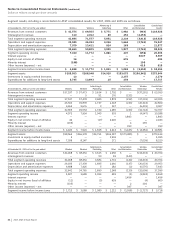

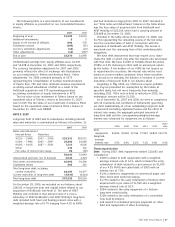

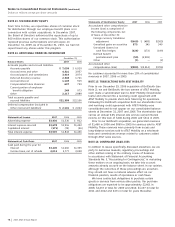

Debt maturing within one year consists of the following

at December 31:

2007 2006

Commercial paper $1,859 $5,214

Current maturities of long-term debt 4,939 4,414

Bank borrowings1 62 105

Total $6,860 $9,733

1

Primarily represents borrowings, the availability of which is contingent on the level of

cash held by some of our foreign subsidiaries.

The weighted-average interest rate on commercial paper debt at

December 31, 2007 and 2006 was 4.2% and 5.3%, respectively.

Credit Facility We have a five-year $10,000 credit

agreement with a syndicate of investment and commercial

banks, which we have the right to increase up to an

additional $2,000, provided no event of default under the

credit agreement has occurred. The current agreement will

expire in July 2011. We also have the right to terminate, in

whole or in part, amounts committed by the lenders under

this agreement in excess of any outstanding advances;

however, any such terminated commitments may not be

reinstated. Advances under this agreement may be used

for general corporate purposes, including support of com-

mercial paper borrowings and other short-term borrowings.

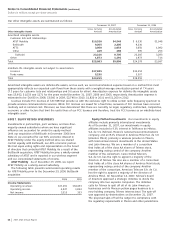

There is no material adverse change provision governing

the drawdown of advances under this credit agreement.

This agreement contains a negative pledge covenant, which

requires that, if at any time we or a subsidiary pledge assets

or otherwise permits a lien on its properties, advances

under this agreement will be ratably secured, subject to

specified exceptions. We must maintain a debt-to-EBITDA

(earnings before interest, income taxes, depreciation and

amortization, and other modifications described in the

agreement) financial ratio covenant of not more than three-

to-one as of the last day of each fiscal quarter for the four

quarters then ended. We comply with all covenants under

the agreement. We had no borrowings outstanding under

committed lines of credit as of December 31, 2007 or 2006.

Defaults under the agreement, which would permit the

lenders to accelerate required payment, include nonpayment

of principal or interest beyond any applicable grace period;

failure by AT&T or any subsidiary to pay when due other debt

above a threshold amount that results in acceleration of that

debt (commonly referred to as “cross-acceleration”) or

commencement by a creditor of enforcement proceedings

within a specified period after a money judgment above a

threshold amount has become final; acquisition by any person

of beneficial ownership of more than 50% of AT&T common

shares or a change of more than a majority of AT&T’s directors

in any 24-month period other than as elected by the

remaining directors (commonly referred to as a “change-

of-control”); material breaches of representations in the

agreement; failure to comply with the negative pledge or

debt-to-EBITDA ratio covenants described above; failure to

comply with other covenants for a specified period after

notice; failure by AT&T or certain affiliates to make certain

minimum funding payments under Employee Retirement

Income Security Act of 1974, as amended (ERISA); and

specified events of bankruptcy or insolvency.

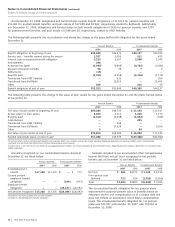

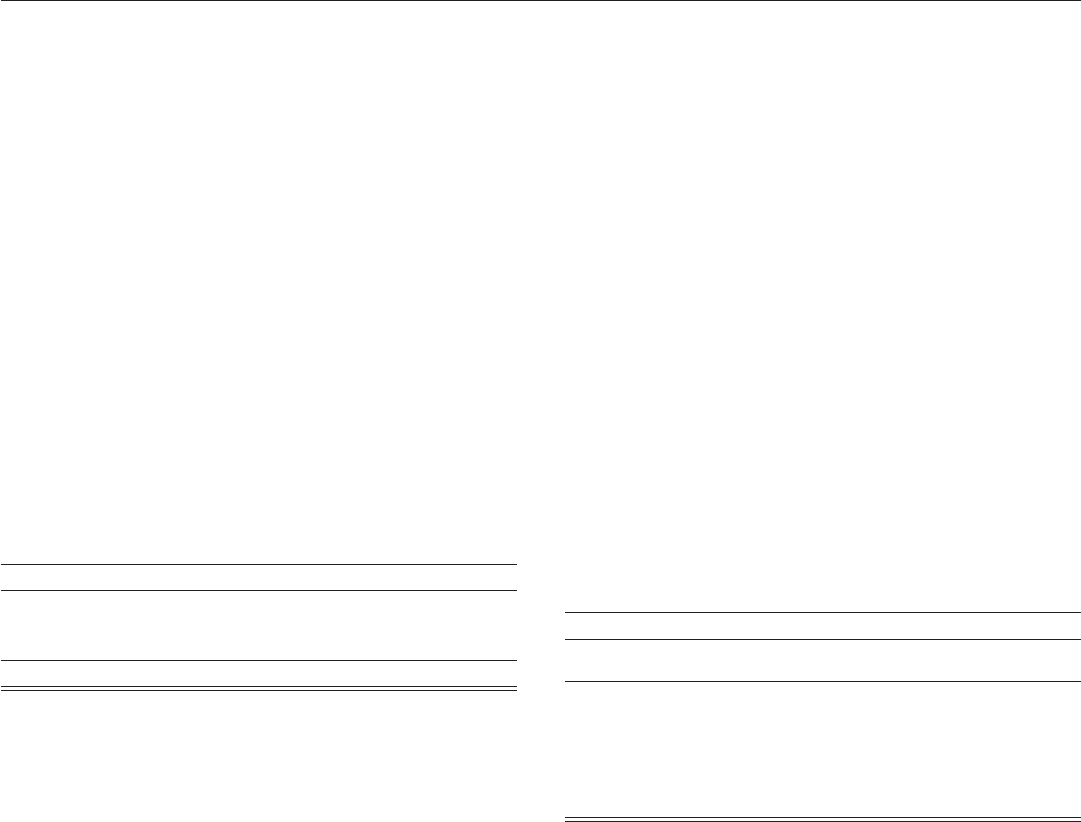

NOTE 9. FINANCIAL INSTRUMENTS

The carrying amounts and estimated fair values of our long-

term debt, including current maturities, and other financial

instruments, are summarized as follows at December 31:

2007 2006

Carrying Fair Carrying Fair

Amount Value Amount Value

Notes and debentures $61,993 $62,544 $54,266 $54,566

Commercial paper 1,859 1,859 5,214 5,214

Bank borrowings 62 62 105 105

Available-for-sale

equity securities 2,735 2,735 2,731 2,731

EchoStar note receivable 491 489 478 467

The fair values of our notes and debentures were estimated

based on quoted market prices, where available, or on the

net present value method of expected future cash flows

using current interest rates. The carrying value of debt with

an original maturity of less than one year approximates

market value.

The fair value of our EchoStar note receivable was

estimated based on a valuation. The carrying amount of this

note was based on the present value of cash and interest

payments, which will be accreted on the note up to the face

value of $500 on a straight-line basis through August 2008.

Our available-for-sale equity securities are carried at fair

value, and realized gains and losses on these equity securities

were included in “Other income (expense) – net” in the

consolidated statements of income. The fair value of our

available-for-sale equity securities was principally determined

based on quoted market prices, and the carrying amount

of the remaining securities approximates fair value.

Our short-term investments, other short-term and long-

term held-to-maturity investments and customer deposits

are recorded at amortized cost, and the carrying amounts

approximate fair values. We held other short-term marketable

securities of $1 at December 31, 2007 compared to $477

at December 31, 2006.