AT&T Wireless 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 61

balance sheet, adjusting 100% of BellSouth’s and 40% of AT&T

Mobility’s values. Long-lived assets such as property, plant and

equipment reflect a value of replacing the assets, which takes

into account changes in technology, usage, and relative

obsolescence and depreciation of the assets, sometimes

referred to as a “Greenfield approach.” This approach often

results in differences, sometimes material, from recorded book

values even if, absent the acquisition, the assets would not be

impaired. In addition, assets and liabilities that would not

normally be recorded in ordinary operations (i.e., customer

relationships) were recorded at their acquisition values.

Debt instruments and investments were valued in relation

to current market conditions and other assets and liabilities

were valued based on the acquiring company’s estimates.

After all values were assigned to assets and liabilities, the

remainder of the purchase price was recorded as goodwill.

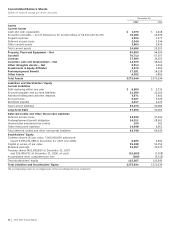

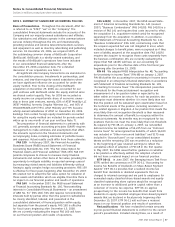

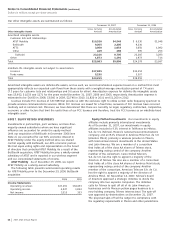

The following table summarizes the preliminary estimated

fair values of the BellSouth assets acquired and liabilities

assumed and related deferred income taxes as of the

acquisition date and final adjustments made thereto.

BellSouth Purchase

Price Allocation

As of Adjust- As of

12/31/06 ments 12/29/07

Assets acquired

Current assets $ 4,875 $ 6 $ 4,881

Property, plant and equipment 18,498 225 18,723

Intangible assets not subject

to amortization:

Trademark/name 330 — 330

Licenses 214 100 314

Intangible assets subject

to amortization:

Customer lists and

relationships 9,230 (25) 9,205

Patents 100 — 100

Trademark/name 211 — 211

Investments in AT&T Mobility 32,759 2,039 34,798

Other investments 2,446 (3) 2,443

Other assets 11,211 (168) 11,043

Goodwill 26,467 (1,554) 24,913

Total assets acquired 106,341 620 106,961

Liabilities assumed

Current liabilities, excluding

current portion of

long-term debt 5,288 (427) 4,861

Long-term debt 15,628 (4) 15,624

Deferred income taxes 10,318 (89) 10,229

Postemployment benefit

obligation 7,086 163 7,249

Other noncurrent liabilities 1,223 941 2,164

Total liabilities assumed 39,543 584 40,127

Net assets acquired $ 66,798 $ 36 $ 66,834

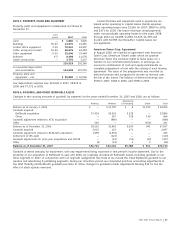

Adjustments were primarily related to finalization of participant

count estimates used in the opening balance sheet valuation

for the pension and postretirement plans, a gain on a

contingency related to an insurance claim recovery for

Hurricane Katrina damages, AT&T Mobility’s purchase

accounting adjustments and tax impacts related thereto,

the valuation of certain licenses and a decrease in the

estimate of relative obsolescence of property, plant and

equipment resulting in an increase in value and longer

average remaining economic life. Deferred tax adjustments

are associated with the above-mentioned items.

BellSouth’s 40% economic ownership of AT&T Mobility

was recorded above as “Investment in AT&T Mobility” and

was eliminated on our consolidated balance sheets.

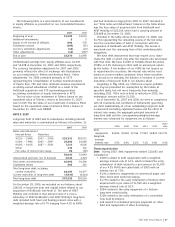

We recorded the consolidation of AT&T Mobility as a step

acquisition, retaining 60% of AT&T Mobility’s prior book value

and adjusting the remaining 40% to fair value. The following

table summarizes the preliminary estimated fair values

(40%) and historical book values (60%) of the AT&T Mobility

assets acquired and liabilities assumed and related deferred

income taxes as of the acquisition date and final adjustments

made thereto.

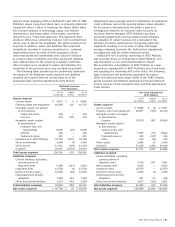

Fair Value Adjustments

AT&T Mobility

As of Adjust- As of

12/31/06 ments 12/29/07

Assets acquired

Current assets $ 6,988 $ (1) $ 6,987

Property, plant and equipment 19,687 (569) 19,118

Intangible assets not subject

to amortization:

Licenses 33,979 887 34,866

Intangible assets subject

to amortization:

Customer lists and

relationships 7,583 479 8,062

Trademark/names 343 (127) 216

Other 176 (44) 132

Other assets 1,086 13 1,099

Goodwill 27,429 1,989 29,418

Total assets acquired 97,271 2,627 99,898

Liabilities assumed

Current liabilities, excluding

current portion of

long-term debt 7,014 647 7,661

Intercompany debt 9,043 — 9,043

Long-term debt 12,559 — 12,559

Deferred income taxes 5,459 (1) 5,458

Postemployment benefit

obligation 301 93 394

Other noncurrent liabilities 2,007 (106) 1,901

Total liabilities assumed 36,383 633 37,016

Net assets acquired $60,888 $1,994 $62,882