AT&T Wireless 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 69

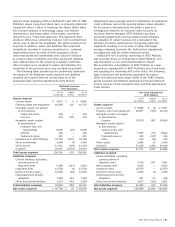

Derivatives We use interest rate swaps, interest rate

forward contracts and foreign currency exchange contracts to

manage our market risk changes in interest rates and foreign

exchange rates. We do not use financial instruments for

trading or speculative purposes. Each swap matches the exact

maturity dates of the underlying debt to which they are

related, allowing for perfectly-effective hedges. Each utilized

forward contract matches the interest payments of the

underlying debt to which they are related, allowing for

perfectly-effective hedges.

Interest Rate Swaps We had fair value interest rate swaps

with a notional value of $3,250 at December 31, 2007, and

$5,050 at December 31, 2006, with a net carrying and fair

value asset of $88 and liability of $80, respectively. The net fair

value liability at December 31, 2006 was comprised of a

liability of $86 and an asset of $6. Included in the fair value

interest rate swap notional amount for 2006 were interest rate

swaps with a notional value of $1,800, which were acquired as

a result of our acquisition of BellSouth on December 29, 2006.

These swaps were unwound in January 2007.

Interest Rate Foreign Currency Swaps We have combined

interest rate foreign currency swap agreements for Euro-

denominated debt and British pound sterling-denominated

debt, which hedge our risk to both interest rate and currency

movements. In March 2007, we entered into fixed-to-fixed

cross-currency swaps on foreign-currency-denominated debt

instruments with a U.S. dollar notional value of $2,799 to

hedge our exposure to changes in foreign currency exchange

rates. These hedges include initial and final exchanges of

principal from fixed foreign denominations to fixed

U.S.-denominated amounts, to be exchanged at a specified

rate, which was determined by the market spot rate upon

issuance. They also include an interest rate swap of a fixed

foreign-denominated rate to a fixed U.S.-denominated interest

rate. These derivatives have been designated at inception and

qualify as cash flow hedges with a net fair value of $114 at

December 31, 2007. These swaps are valued using current

market quotes, which were obtained from dealers.

In November 2006, we repaid the notional amount of a

foreign currency swap of $636. Upon repayment we unwound

our swap asset of $284. Additionally, we repaid the collateral

associated with the swap contract of $150, which was

received by us over the term of the swap agreement.

Interest Rate Locks We entered into interest rate forward

contracts to partially hedge interest expense related to our

debt issuances. During 2008, we expect to reclassify into

earnings net settlement expenses of approximately $8 to $9,

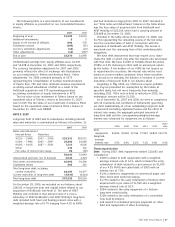

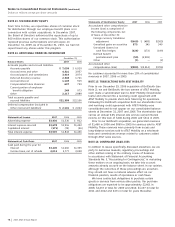

net of tax. The following table summarizes our interest rate

lock activity:

Utilized Settlement

Rate Lock Notional Notional Settlement Gain/(Cost) –

Execution Period Amount Amount Gain/(Cost) net of tax

2007 $1,800 $1,800 $ (8) $ (5)

2006 750 600 4 3

2005 500 500 (2) (1)

2004 5,250 5,250 (302) (196)

Foreign Currency Forward Contracts We enter into foreign

currency forward contracts to manage our exposure to

changes in currency exchange rates related to foreign-

currency-denominated transactions. At December 31, 2007

and 2006, our foreign exchange contracts consisted principally

of Euros, British pound sterling, Danish krone and Japanese

yen. At December 31, 2007, the notional amounts under

contract were $345, of which none were designated as net

investment hedges. At December 31, 2006, the notional

amounts under contract were $440, of which $6 were

designated as net investment hedges. The remaining contracts

in both periods were not designated for accounting purposes.

At December 31, 2007 and 2006, these foreign exchange

contracts had a net carrying and fair value liability of less

than $2. These contracts were valued using current market

quotes, which were obtained from independent sources.

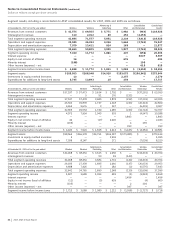

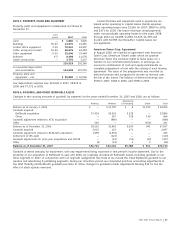

NOTE 10. INCOME TAXES

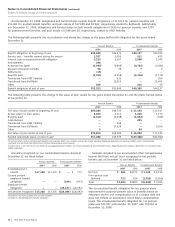

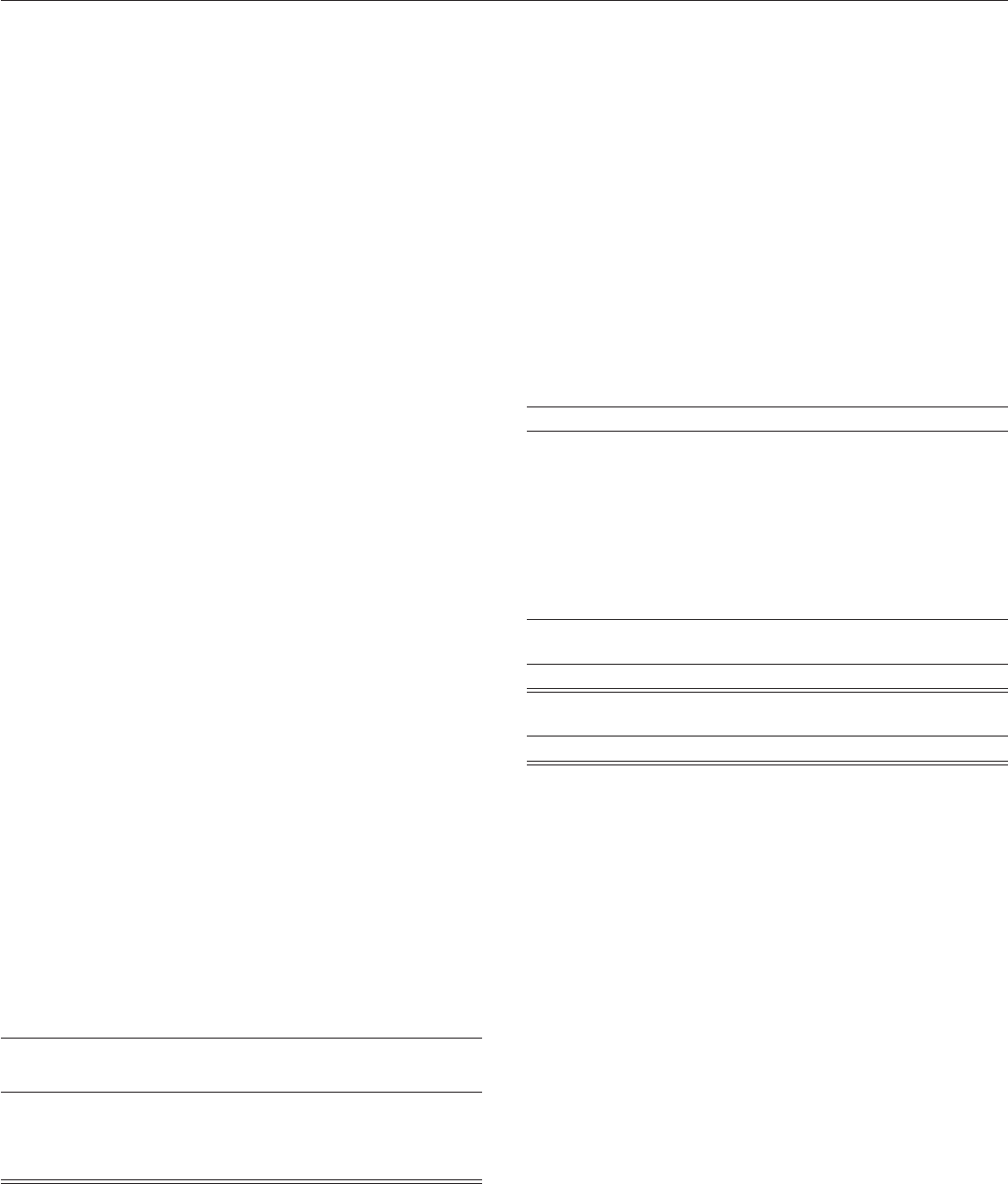

Significant components of our deferred tax liabilities (assets)

are as follows at December 31:

2007 2006

Depreciation and amortization $17,004 $21,016

Intangibles (nonamortizable) 1,990 2,271

Equity in foreign affiliates 231 515

Employee benefits (6,121) (9,667)

Currency translation adjustments (287) (261)

Allowance for uncollectibles (388) (385)

Net operating loss and other carryforwards (2,838) (2,981)

Investment in wireless partnership 13,997 12,580

Other – net (1,763) 300

Subtotal 21,825 23,388

Deferred tax assets valuation allowance 1,070 984

Net deferred tax liabilities $22,895 $24,372

Net long-term deferred tax liabilities $24,939 $27,406

Less: Net current deferred tax assets (2,044) (3,034)

Net deferred tax liabilities $22,895 $24,372

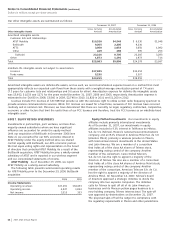

At December 31, 2007, we had combined net operating and

capital loss carryforwards (tax effected) for federal, and for

state and foreign income tax purposes of $1,289 and $1,207,

respectively, expiring through 2026. The federal net operating

loss carryforward primarily relates to the acquisitions of

AT&T Wireless Services, Inc. in 2004 and Dobson in 2007.

Additionally, we had federal and state credit carryforwards of

$100 and $242, respectively, expiring primarily through 2024.

We recognize a valuation allowance if, based on the

weight of available evidence, it is more-likely-than-not that

some portion, or all, of a deferred tax asset will not be

realized. Our valuation allowances at December 31, 2006 and

2007 relate primarily to state net operating loss carryforwards.

The net increase in the valuation allowance for 2007 results

from the acquisition of Dobson and the generation of

additional state net operating losses, the ultimate realization

of which are not more-likely-than-not. Future adjustments

(prior to the effective date of FAS 141(R)) to the valuation

allowance attributable to the ATTC, BellSouth, AT&T Mobility,

and Dobson opening balance sheet items may be required

to be allocated to goodwill and other purchased intangibles.

After the effective date of FAS 141(R), changes to these

valuation allowances may be reflected in income tax expense.