AT&T Wireless 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

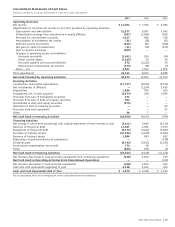

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

48

| 2007 AT&T Annual Report

We enter into foreign currency contracts to minimize our

exposure to risk of adverse changes in currency exchange

rates. We are subject to foreign exchange risk for foreign

currency-denominated transactions, such as debt issued,

recognized payables and receivables and forecasted transac-

tions. At December 31, 2007, our foreign currency exposures

were principally Euros, British pound sterling, Danish krone

and Japanese yen.

QUANTITATIVE INFORMATION ABOUT MARKET RISK

In order to determine the changes in fair value of our various

financial instruments, we use certain financial modeling

techniques. We apply rate-sensitivity changes directly to our

interest rate swap transactions and forward rate sensitivity to

our foreign currency-forward contracts.

The changes in fair value, as discussed below, assume the

occurrence of certain market conditions, which could have an

adverse financial impact on AT&T and do not represent

projected gains or losses in fair value that we expect to incur.

Future impacts would be based on actual developments in

global financial markets. We do not foresee any significant

changes in the strategies used to manage interest rate risk,

foreign currency rate risk or equity price risk in the near future.

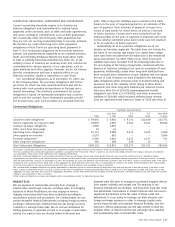

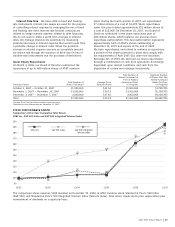

Interest Rate Sensitivity The principal amounts by

expected maturity, average interest rate and fair value of our

liabilities that are exposed to interest rate risk are described

in Notes 8 and 9. Following are our interest rate derivatives,

subject to interest rate risk as of December 31, 2007. The

interest rates illustrated in the interest rate swaps section

of the table below refer to the average expected rates we

would receive and the average expected rates we would

pay based on the contracts. The notional amount is the

principal amount of the debt subject to the interest rate

swap contracts. The net fair value asset (liability) represents

the amount we would receive or pay if we had exited the

contracts as of December 31, 2007.

Maturity

After Fair Value

2008 2009 2010 2011 2012 2012 Total 12/31/07

Interest Rate Derivatives

Interest Rate Swaps:

Receive Fixed/Pay Variable Notional Amount — — — $1,250 $2,000 — $3,250 $88

Variable Rate Payable1 4.6% 4.4% 5.1% 5.4% 5.3% —

Weighted-Average Fixed Rate Receivable 6.0% 6.0% 6.0% 6.0% 5.9% —

1Interest payable based on current and implied forward rates for Three or Six Month LIBOR plus a spread ranging between approximately 64 and 170 basis points.

We had fair value interest rate swaps with a notional value

of $3,250 at December 31, 2007, and $5,050 at

December 31, 2006, with a net carrying and fair value asset

of $88 and liability of $80, respectively. The net fair value

liability at December 31, 2006, was comprised of a liability

of $86 and an asset of $6. Included in the fair value interest

rate swap notional amount for 2006 were interest rate swaps

with a notional value of $1,800, which were acquired as a

result of our acquisition of BellSouth on December 29, 2006.

These swaps were unwound in January 2007.

Foreign Exchange Forward Contracts The fair value of

foreign exchange contracts is subject to changes in foreign

currency exchange rates. For the purpose of assessing specific

risks, we use a sensitivity analysis to determine the effects

that market risk exposures may have on the fair value of our

financial instruments and results of operations. To perform

the sensitivity analysis, we assess the risk of loss in fair

values from the effect of a hypothetical 10% change in the

value of foreign currencies (negative change in the value

of the U.S. dollar), assuming no change in interest rates.

See Note 9 to the consolidated financial statements for

additional information relating to notional amounts and

fair values of financial instruments.

For foreign exchange forward contracts outstanding at

December 31, 2007, assuming a hypothetical 10% depreciation

of the U.S. dollar against foreign currencies from the

prevailing foreign currency exchange rates, the fair value of

the foreign exchange forward contracts (net liability) would

have decreased approximately $29. Because our foreign

exchange contracts are entered into for hedging purposes,

we believe that these losses would be largely offset by

gains on the underlying transactions.

The risk of loss in fair values of all other financial instru-

ments resulting from a hypothetical 10% change in market

prices was not significant as of December 31, 2007.

QUALITATIVE INFORMATION ABOUT MARKET RISK

Foreign Exchange Risk From time to time, we make

investments in businesses in foreign countries, are paid

dividends and receive proceeds from sales or borrow funds

in foreign currency. Before making an investment, or in

anticipation of a foreign currency receipt, we often will enter

into forward foreign exchange contracts. The contracts are

used to provide currency at a fixed rate. Our policy is to

measure the risk of adverse currency fluctuations by

calculating the potential dollar losses resulting from

changes in exchange rates that have a reasonable

probability of occurring. We cover the exposure that

results from changes that exceed acceptable amounts.

We do not speculate in foreign exchange markets.