AT&T Wireless 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

42

| 2007 AT&T Annual Report

significant impact on our financial statements than others.

The policies below are presented in the order in which the

topics appear in our consolidated statements of income.

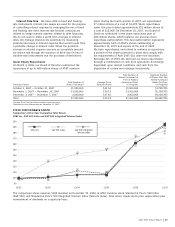

Allowance for Uncollectibles We maintain an allowance

for doubtful accounts for estimated losses that result from the

failure of our customers to make required payments. When

determining the allowance, we consider the probability of

recoverability based on past experience, taking into account

current collection trends; as well as general economic factors,

including bankruptcy rates. Credit risks are assessed based on

historical write-offs, net of recoveries, and an analysis of the

aged accounts receivable balances with reserves generally

increasing as the receivable ages. Accounts receivable may

be fully reserved for when specific collection issues are

known to exist, such as pending bankruptcy or catastrophes.

The analysis of receivables is performed monthly and the

bad-debt allowances are adjusted accordingly. A 10% change

in the amounts estimated to be uncollectible would result

in a change in uncollectible expense of approximately $140.

Pension and Postretirement Benefits Our actuarial

estimates of retiree benefit expense and the associated

significant weighted-average assumptions are discussed in

Note 11. One of the most significant of these assumptions is

the return on assets assumption, which was 8.5% for the year

ended December 31, 2007. This assumption will remain

unchanged for 2008. If all other factors were to remain

unchanged, we expect that a 1% decrease in the expected

long-term rate of return would cause 2008 combined

pension and postretirement cost to increase $814 over 2007.

The 10-year return on our pension plan assets was 9.18%

through 2007. Under GAAP, the expected long-term rate of

return is calculated on the market-related value of assets

(MRVA). GAAP requires that actual gains and losses on

pension and postretirement plan assets be recognized in the

MRVA equally over a period of up to five years. We use a

methodology, allowed under GAAP, under which we hold the

MRVA to within 20% of the actual fair value of plan assets,

which can have the effect of accelerating the recognition of

excess actual gains and losses into the MRVA in less than

five years. This methodology did not have a significant

additional effect on our 2007, 2006 or 2005 combined

net pension and postretirement costs. Note 11 also discusses

the effects of certain changes in assumptions related to

medical trend rates on retiree health care costs.

Depreciation Our depreciation of assets, including use of

composite group depreciation and estimates of useful lives, is

described in Notes 1 and 5. We assign useful lives based on

periodic studies of actual asset lives. Changes in those lives

with significant impact on the financial statements must be

disclosed, but no such changes have occurred in the three

years ended December 31, 2007. However, if all other factors

were to remain unchanged, we expect that a one-year

increase in the useful lives of the largest categories of our

plant in service (which accounts for more than three-fourths

of our total plant in service) would result in a decrease of

between approximately $1,810 and $1,860 in our 2008

depreciation expense and that a one-year decrease would

result in an increase of between $2,230 and $2,330 in our

2008 depreciation expense.

Asset Valuations and Impairments We account for

acquisitions using the purchase method as required by

FAS 141. Under FAS 141, we allocate the purchase price to

the assets acquired and liabilities assumed based on their

estimated fair values. The estimated fair values of intangible

assets acquired are based on the expected discounted cash

flows of the identified customer relationships, patents, trade-

names and licenses. In determining the future cash flows we

consider demand, competition and other economic factors.

Customer relationships, which are finite-lived intangible

assets, are primarily amortized using the sum-of-the-months-

digits method of amortization over the period in which those

relationships are expected to contribute to our future cash

flows. The sum-of-the-months-digits method is a process

of allocation, not of valuation, and reflects our belief that

we expect greater revenue generation from these customer

relationships during the earlier years of their lives.

Alternatively, we could have chosen to amortize customer

relationships using the straight-line method, which would

allocate the cost equally over the amortization period.

Amortization of other intangibles, including patents and

amortizable tradenames, is determined using the straight-

line method of amortization over the expected remaining

useful lives. We do not amortize indefinite-lived intangibles,

such as wireless FCC licenses or certain tradenames.

(See Note 6)

Goodwill is not amortized but is tested for impairment in

accordance with Statement of Financial Accounting Standards

No. 142, “Goodwill and Other Intangible Assets” (FAS 142).

We review goodwill, indefinite-lived intangibles and other

long-lived assets for impairment under FAS 142 or Statement

of Financial Accounting Standards No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets” either

annually or whenever events or circumstances indicate

that the carrying amount may not be recoverable over

the remaining life of the asset or asset group. In order to

determine that the asset is recoverable, we verify that the

expected future cash flows directly related to that asset

exceed its fair value, which is based on the undiscounted

cash flows. The discounted cash flow calculation uses

various assumptions and estimates regarding future revenue,

expense and cash flows projections over the estimated

remaining useful life of the asset.

Cost investments are evaluated to determine whether

mark-to-market declines are temporary and reflected in other

comprehensive income, or other than temporary and recorded

as an expense in the income statement. This evaluation is

based on the length of time and the severity of decline in

the investment’s value.

Income Taxes Our estimates of income taxes and the

significant items giving rise to the deferred assets and

liabilities are shown in Note 10 and reflect our assessment

of actual future taxes to be paid on items reflected in the

financial statements, giving consideration to both timing and

probability of these estimates. Actual income taxes could

vary from these estimates due to future changes in income

tax law or results from the final review of our tax returns by

federal, state or foreign tax authorities. We have considered

these potential changes and, for years prior to 2007, have

provided amounts within our deferred tax assets and liabilities