AT&T Wireless 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 45

• $316 related to the acquisition of Ingenio, a provider

of Pay Per Call search and directory solutions,

and Interwise, a provider of voice, Web and video

conferencing services.

• $190 to satisfy an obligation to Alaska Native Wireless,

LLC to acquire wireless spectrum and the acquisition

of an additional ownership interest in Cellular

Communications of Puerto Rico.

• $136 related to the acquisition of wireless and media

rights, intellectual property and other strategic assets.

In October 2007, we agreed to purchase spectrum licenses

in the 700 MHz frequency band from Aloha Partners, L.P.

for approximately $2,500. We closed this transaction in

February 2008. Additionally, we are an eligible bidder in

the FCC wireless spectrum auctions which began in

January 2008.

Net cash provided by investing activities for 2007 was

$2,663 and consisted of net proceeds of $1,594 from

dispositions of non-strategic assets, $1,033 from the sale of

marketable and equity securities and $36 related to other

activities. Proceeds from dispositions included the following:

• $1,137 from the sale of properties and other non-

strategic assets.

• $301 from the sale of spectrum to Clearwire Corporation,

which includes interest.

• $156 related to T-Mobile’s exercise of its option to

purchase an additional 10 MHz of spectrum in the

San Diego market, the sale of cost investments and

the sale of wireless towers.

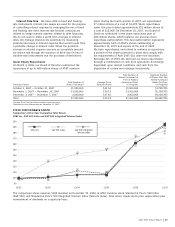

To provide high-quality communications services to our

customers, we must make significant investments in property,

plant and equipment. The amount of capital investment is

influenced by demand for services and products, continued

growth and regulatory considerations. Capital expenditures in

the wireline segment, which represented approximately 77%

of our capital expenditures, increased 68% in 2007, reflecting

the acquisition of BellSouth. Our capital expenditures are

primarily for our wireline subsidiaries’ networks, our U-verse

services, merger-integration projects and support systems for

our long-distance service. Because of opportunities made

available by the continued changing regulatory environment

and our acquisitions of ATTC and BellSouth, we expect that

our capital expenditures for 2008, which include wireless

network expansion and U-verse services, will be in the

midteens as a percentage of consolidated revenue. We expect

to fund 2008 capital expenditures for our wireline and

wireless segments, including international operations, using

cash from operations and incremental borrowings depending

on interest rate levels and overall market conditions.

During 2007, we spent $3,745 in the wireless segment

primarily for Universal Mobile Telecommunications System/

High-Speed Packet Access (UMTS/HSPA) network expansion,

GSM/EDGE (Enhanced Data Rates for Global Evolution)

network capacity expansion and upgrades, as well as for IT

and other support systems for our wireless service. The

network capacity requirements and expansion of our UMTS/

HSPA wireless networks will continue to require substantial

amounts of capital through 2008. In 2008, our wireless capital

expenditures should be in the lower double-digit range as a

percent of our wireless revenues for the integration and

expansion of our networks and the installation of UMTS/HSPA

technology in a number of markets.

We spent approximately $2,500 on our U-verse services in

2007 and expect spending to be approximately $2,500 in 2008

for capital expenditures on our U-verse services for initial

network-related deployment costs. We expect to pass approxi-

mately 30 million living units by the end of 2010. Additional

customer activation capital expenditures are not included in

this capital spending forecast. We expect that the business

opportunities made available, specifically in the data/broad-

band area, will allow us to expand our products and services

(see “U-verse Services” discussed in “Expected Growth Areas”).

The other segment capital expenditures were less than

1.5% of total capital expenditures for 2007. Included in the

other segment are equity investments, which should be

self-funding as they are not direct AT&T operations; as well

as corporate, diversified business and Sterling operations,

which we expect to fund using cash from operations.

We expect to fund any advertising & publishing segment

capital expenditures using cash from operations.

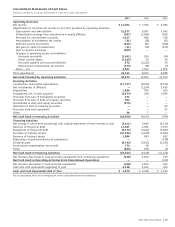

Cash Used in or Provided by Financing Activities

We plan to fund our 2008 financing activities through a

combination of debt issuances and cash from operations.

Our financing activities include funding share repurchases

and the repayment of debt. We will continue to examine

opportunities to fund our activities by issuing debt at

favorable rates and with cash from the disposition of

certain other non-strategic investments.

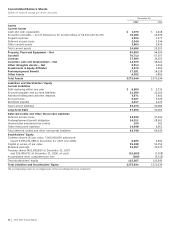

On March 4, 2006, our Board of Directors authorized the

repurchase of up to 400 million shares of AT&T common

stock. During 2007, we repurchased 267 million shares at a

cost of $10,390. Share repurchases under this plan totaled

approximately 351 million shares at a cost of $13,068.

On December 10, 2007, our Board of Directors authorized

a new share repurchase plan of 400 million shares, which

replaces our previous share repurchase authorization.

This new authorization represents approximately 6.6 percent

of AT&T’s shares outstanding at December 31, 2007 and

expires at the end of 2009. We have repurchased, and intend

to continue to repurchase, a portion of the shares pursuant

to plans that comply with the requirements of Rule 10b5-1(c)

under the Securities Exchange Act of 1934. We will fund

our additional share repurchases through a combination

of cash from operations, borrowings dependent upon

market conditions, and cash from the disposition of certain

non-strategic investments.

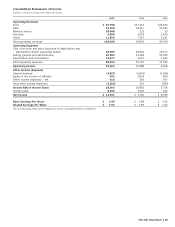

We paid dividends of $8,743 in 2007, $5,153 in 2006 and

$4,256 in 2005, reflecting the issuance of additional shares

for the BellSouth and ATTC acquisitions and dividend increases.

In December 2007, our Board of Directors approved a

12.7% increase in the quarterly dividend from $0.355 to

$0.40 per share. This increase recognizes our strong growth

and positive outlook and follows a 6.8% dividend increase

approved by AT&T’s Board in December 2006. Dividends

declared by our Board of Directors totaled $1.465 per share

in 2007, $1.35 per share in 2006 and $1.30 per share in 2005.

Our dividend policy considers both the expectations and

requirements of stockholders, internal requirements of AT&T

and long-term growth opportunities. It is our intent to provide

the financial flexibility to allow our Board of Directors to

consider dividend growth and to recommend an increase in

dividends to be paid in future periods. All dividends remain

subject to approval by our Board of Directors.