AT&T Wireless 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

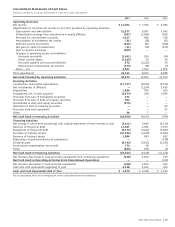

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

46

| 2007 AT&T Annual Report

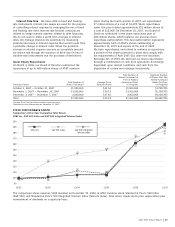

At December 31, 2007, we had $6,860 of debt maturing

within one year, which included $4,939 of long-term debt

maturities and $1,921 of commercial paper borrowings and

other borrowings. All of our commercial paper borrowings are

due within 90 days. We continue to examine our mix of

short- and long-term debt in light of interest rate trends.

During 2007, we received net proceeds of $11,367 from

the issuance of $11,499 in long-term debt. Debt proceeds

were used for general corporate purposes and parts of the

proceeds were used for repurchases of our common stock.

Long-term debt issuances consisted of:

• $2,000 of 6.3% global notes due in 2038.

• $2,000 of 6.5% global notes due in 2037.

• €1.25 billion of 4.375% notes due in 2013 (equivalent

to U.S. $1,641 when issued).

• $1,500 of floating-rate notes due in 2010.

• $1,200 of 6.375% retail notes due in 2056.

• £600 million of 5.5% notes due in 2027 (equivalent

to U.S. $1,158 when issued).

• $1,000 of 4.95% global notes due in 2013.

• $500 of 5.625% notes due in 2016.

• $500 of zero-coupon puttable notes due in 2022.

In February 2008, we received net proceeds of $3,972 from

the issuance of $4,000 in long-term debt. The long-term debt

issued consisted of the following:

• $2,500 of 5.5% global notes due in 2018.

• $750 of 4.95% global notes due in 2013.

• $750 of 6.3% global notes due in 2038.

Beginning in May 2009, the $500 zero-coupon puttable

note may be presented for redemption by the holder at

specified dates but not more frequently than annually,

excluding 2011. If the note is held to maturity in 2022, the

redemption amount will be $1,030.

We entered into fixed-to-fixed cross-currency swaps on our

two foreign-currency-denominated debt instruments to hedge

our exposure to changes in foreign currency exchange rates.

These hedges also include interest rate swaps of a fixed

foreign-denominated rate to a fixed U.S.-denominated interest

rate, which results in a U.S.-denominated rate of 5.31% on

our Euro-denominated notes and 5.97% on our British pound

sterling-denominated notes.

During 2007, debt repayments totaled $10,183 and

consisted of:

• $3,871 related to debt repayments with a weighted-

average interest rate of 6.1%, which included the early

redemption of debt related to a put exercise on $1,000

of our 4.2% Puttable Reset Securities and called debt of

$500 with an interest rate of 7.0%.

• $3,411 related to repayments of commercial paper and

other short-term bank borrowings.

• $1,735 related to the early redemption of Dobson debt

acquired with a par value of $1,599 and a weighted-

average interest rate of 9.1%.

• $904 related to the early repayment of a Dobson

long-term credit facility.

• $218 related to the early redemption of a convertible

note held by Dobson.

• $44 related to scheduled principal payments on other

debt and repayments of other borrowings.

We have a five-year $10,000 credit agreement with a

syndicate of investment and commercial banks, which we

have the right to increase up to an additional $2,000, provided

no event of default under the credit agreement has occurred.

The current agreement will expire in July 2011. We also

have the right to terminate, in whole or in part, amounts

committed by the lenders under this agreement in excess

of any outstanding advances; however, any such terminated

commitments may not be reinstated. Advances under this

agreement may be used for general corporate purposes,

including support of commercial paper borrowings and other

short-term borrowings. There is no material adverse change

provision governing the drawdown of advances under this

credit agreement. This agreement contains a negative pledge

covenant, which requires that, if at any time we or a subsid-

iary pledge assets or otherwise permits a lien on its proper-

ties, advances under this agreement will be ratably secured,

subject to specified exceptions. We must maintain a debt-to-

EBITDA (earnings before interest, income taxes, depreciation

and amortization, and other modifications described in the

agreement) financial ratio covenant of not more than three-

to-one as of the last day of each fiscal quarter for the four

quarters then ended. We comply with all covenants under the

agreement. At December 31, 2007, we had no borrowings

outstanding under this agreement. (See Note 8)

During 2007, proceeds of $1,986 from the issuance of

treasury shares were related to the exercise of stock-based

compensation.

During 2007, we paid $190 to minority interest holders

and $47 to terminate interest rate swaps with notional

amounts totaling $1,800 acquired as a result of our

acquisition of BellSouth.

Other

Our total capital consists of debt (long-term debt and

debt maturing within one year) and stockholders’ equity.

Our capital structure does not include debt issued by our

international equity investees. Our debt ratio was 35.7%,

34.1% and 35.9% at December 31, 2007, 2006 and 2005.

The debt ratio is affected by the same factors that affect

total capital. Total capital increased $4,146 in 2007 compared

to more than $90,000 in 2006. The 2007 total capital

increase was due to an increase in debt of $4,319 related

to our financing activities. Our stockholders’ equity balance

was down $173 and included our increase in net income and

current adjustments for unrealized pension and postretire-

ment gains, which were more than offset by our increased

share repurchase activity and dividend distributions.

The primary factor contributing to the decline in our 2006

debt ratio was the acquisition of BellSouth, which increased

our stockholders’ equity approximately 105% and our total

long-term debt by 96%. The 2006 total capital increase was

primarily due to the purchase of BellSouth (see Note 2).

For 2006, our common stock outstanding and capital in

excess of par value increased by $60,850 and our current

and long-term debt increased by $29,226. The increase in

total debt was primarily due to acquired debt from BellSouth

and AT&T Mobility of $28,321, an increase in commercial

paper and other short-term borrowings of $3,649 and debt

issuances of $1,500, partially offset by long-term debt

repayments of $4,242 during 2006. Stockholders’ equity

also increased due to our net income and was partially offset

by dividend payments and our repurchases of common shares

through our stock repurchase program.