AT&T Wireless 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

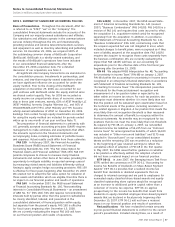

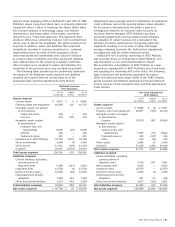

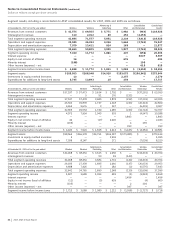

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

60

| 2007 AT&T Annual Report

the variability of cash flows to be received or paid related to a

recognized asset or liability (cash flow hedge). Our derivative

financial instruments primarily include interest rate swap

agreements and foreign currency exchange contracts. For

example, we use interest rate swaps to manage our exposure

to changes in interest rates on our debt obligations (see

Note 9). We account for our interest rate swaps using mark-

to-market accounting and include gains or losses from

interest rate swaps when paid or received in interest expense

in our consolidated statements of income. Amounts paid or

received on interest rate forward contracts are amortized

over the period of the related interest payments.

All other derivatives are not formally designated for

accounting purposes (undesignated). These derivatives,

although undesignated for accounting purposes, are entered

into to hedge economic risks.

We record changes in the fair value of fair value hedges,

along with the changes in the fair value of the hedged asset or

liability that is attributable to the hedged risk. Gains or losses

upon termination of our fair value hedges are recognized as

interest expense when the hedge instrument is settled.

We record changes in the fair value of cash flow hedges,

along with the changes in the fair value of the hedged asset

or liability that is attributable to the hedged risk, in “Accumu-

lated other comprehensive income,” which is a component of

Stockholders’ Equity. The settlement gains or costs on our

cash flow hedges are amortized as interest expense over the

term of the interest payments of the related debt issuances.

Changes in the fair value of undesignated derivatives

are recorded in other income (expense), net, along with

the change in fair value of the underlying asset or liability,

as applicable.

Cash flows associated with derivative instruments are

presented in the same category on the consolidated

statements of cash flows as the item being hedged.

When hedge accounting is discontinued, the derivative

is adjusted for changes in fair value through other income

(expense), net. For fair value hedges, the underlying asset or

liability will no longer be adjusted for changes in fair value,

and any asset or liability recorded in connection with the

hedging relationship (including firm commitments) will be

removed from the balance sheet and recorded in current-

period earnings. For cash flow hedges, gains and losses that

were accumulated in other comprehensive income as a

component of stockholders’ equity in connection with hedged

assets or liabilities or forecasted transactions will be recog-

nized in other income (expense) – net, in the same period the

hedged item affects earnings.

Employee Separations In accordance with Statement

of Financial Accounting Standards No. 112, “Employers’

Accounting for Postemployment Benefits,” (FAS 112) we

establish obligations for expected termination benefits

provided under existing plans to former or inactive employees

after employment but before retirement. These benefits

include severance payments, workers’ compensation,

disability, medical continuation coverage and other benefits.

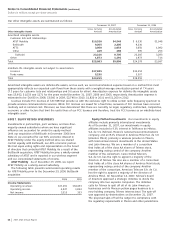

At December 31, 2007, we had severance accruals under

FAS 112 of $153, of which $99 was established as

merger-related severance accruals. At December 31, 2006,

we had severance accruals of $286.

Pension and Postretirement Benefits See Note 11 for a

comprehensive discussion of our pension and postretirement

benefit expense, including a discussion of the actuarial

assumptions.

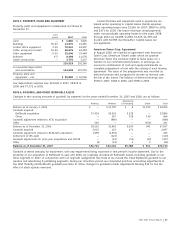

NOTE 2. ACQUISITIONS, DISPOSITIONS, VALUATION AND

OTHER ADJUSTMENTS

Acquisitions

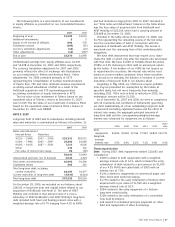

Dobson In November 2007, we acquired Dobson Commu-

nications Corporation (Dobson) for approximately $2,500.

Under the purchase method of accounting, the transaction

was valued, for accounting purposes, at $2,580. Our

December 31, 2007 consolidated balance sheet includes

the preliminary valuation of the fair value of Dobson’s assets

and liabilities, including goodwill of $2,623, licenses of

$2,230, customer lists of $517 and other intangible assets

totaling $8 associated with this transaction. The values of

the assets and liabilities are subject to adjustment as

additional information becomes available. When finalized,

material adjustments to goodwill may result.

Dobson marketed wireless services under the Cellular One

brand and had provided roaming services to AT&T subsidiaries

since 1990. Dobson had 1.7 million subscribers across

17 states, mostly in rural and suburban areas with a population

covered of more than 12.6 million people. Dobson’s

operations were incorporated into our wireless operations

following the date of acquisition.

BellSouth Corporation In December 2006, we acquired

BellSouth, issuing 2.4 billion shares. BellSouth was the leading

communications service provider in the southeastern U.S.,

providing wireline communications services, including local

exchange, network access, long-distance services and Internet

services to substantial portions of the population across

nine states. BellSouth also provided long-distance services

to enterprise customers throughout the country.

We and BellSouth jointly owned AT&T Mobility and the

Internet-based publisher YPC. In the AT&T Mobility joint

venture, we held a 60% economic interest and BellSouth

held a 40% economic interest, and in the YPC joint venture,

we held a 66% economic interest and BellSouth held a 34%

economic interest. For each joint venture, control was shared

equally. We and BellSouth each accounted for the joint

ventures under the equity method of accounting, recording

the proportional share of AT&T Mobility’s and YPC’s income

as equity in net income of affiliates on the respective

consolidated statements of income and reporting the

ownership percentage of AT&T Mobility’s net assets as

“Investments in and Advances to AT&T Mobility” and the

ownership percentage of YPC’s net assets as “Investments

in Equity Affiliates” on the respective consolidated balance

sheets. After the BellSouth acquisition, BellSouth, AT&T

Mobility and YPC became wholly-owned subsidiaries of

AT&T, and the operational results of these companies have

been included in our consolidated financial statements

since the December 29, 2006 acquisition date.

Under the purchase method of accounting, the transaction

was valued, for accounting purposes, at approximately

$66,800. We conducted an appraisal of the assets and

liabilities of BellSouth and AT&T Mobility for inclusion in the