AT&T Wireless 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

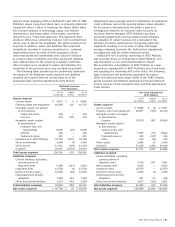

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

52

| 2007 AT&T Annual Report

CAUTIONARY LANGUAGE CONCERNING

FORWARD-LOOKING STATEMENTS

Information set forth in this report contains forward-looking

statements that are subject to risks and uncertainties, and

actual results could differ materially. Many of these factors are

discussed in more detail in the “Risk Factors” section. We

claim the protection of the safe harbor for forward-looking

statements provided by the Private Securities Litigation

Reform Act of 1995.

The following factors could cause our future results to

differ materially from those expressed in the forward-looking

statements:

• Adverse economic changes in the markets served by us

or in countries in which we have significant investments.

• Changes in available technology and the effects of such

changes including product substitutions and deployment

costs.

• Increases in our benefit plans’ costs including increases

due to adverse changes in the U.S. and foreign securities

markets, resulting in worse-than-assumed investment

returns and discount rates, and adverse medical cost

trends.

• The final outcome of Federal Communications Commission

proceedings and reopenings of such proceedings and

judicial review, if any, of such proceedings, including

issues relating to access charges, broadband

deployment, unbundled loop and transport elements

and wireless services.

• The final outcome of regulatory proceedings in the states

in which we operate and reopenings of such proceed-

ings, and judicial review, if any, of such proceedings,

including proceedings relating to interconnection terms,

access charges, universal service, unbundled network

elements and resale and wholesale rates, broadband

deployment including our U-verse services, performance

measurement plans, service standards and traffic

compensation.

• Enactment of additional state, federal and/or foreign

regulatory and tax laws and regulations pertaining to

our subsidiaries and foreign investments.

• Our ability to absorb revenue losses caused by increasing

competition, including offerings using alternative

technologies (e.g., cable, wireless and VoIP), and our

ability to maintain capital expenditures.

• The extent of competition and the resulting pressure

on access line totals and wireline and wireless

operating margins.

• Our ability to develop attractive and profitable product/

service offerings to offset increasing competition in our

wireless and wireline markets.

• The ability of our competitors to offer product/service

offerings at lower prices due to lower cost structures and

regulatory and legislative actions adverse to us, including

state regulatory proceedings relating to unbundled

network elements and nonregulation of comparable

alternative technologies (e.g., VoIP).

• The timing, extent and cost of deployment of our U-verse

services (our Lightspeed initiative); the development of

attractive and profitable service offerings; the extent to

which regulatory, franchise fees and build-out require-

ments apply to this initiative; and the availability, cost

and/or reliability of the various technologies and/or

content required to provide such offerings.

• The outcome of pending or threatened litigation

including patent claims by or against third parties.

• The impact on our networks and business of major

equipment failures, severe weather conditions, natural

disasters or terrorist attacks.

• The issuance by the Financial Accounting Standards

Board or other accounting oversight bodies of new

accounting standards or changes to existing standards.

• The issuance by the Internal Revenue Service and/or

state tax authorities of new tax regulations or changes to

existing standards and actions by federal, state or local

tax agencies and judicial authorities with respect to

applying applicable tax laws and regulations; and the

resolution of disputes with any taxing jurisdictions.

• Our ability to adequately fund our wireless operations,

including access to additional spectrum; network

upgrades and technological advancements.

• The impact of our acquisition of BellSouth, including

the risk that the businesses will not be integrated

successfully; the risk that the cost savings and any

other synergies from the acquisition may take longer

to realize than expected or may not be fully realized;

and disruption from the acquisition may make it more

difficult to maintain relationships with customers,

employees or suppliers.

• Changes in our corporate strategies, such as changing

network requirements or acquisitions and dispositions,

to respond to competition and regulatory, legislative

and technological developments.

Readers are cautioned that other factors discussed in this

report, although not enumerated here, also could materially

affect our future earnings.