APS 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

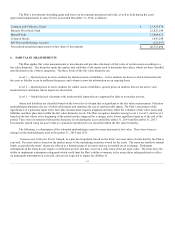

• Target Retirement 2035 Fund

• Target Retirement 2040 Fund

• Target Retirement 2045 Fund

• Target Retirement 2050 Fund

• Target Retirement 2055 Fund

• Target Retirement 2060 Fund

• Core investment options that include:

• Stable Value Fund

• US Bond Index

• Bond Fund

• Diversified Inflation Fund

• US Large Cap Stock Index

• US Large Cap Stock Fund

• US Small/Mid Cap Stock Index

• US Small/Mid Cap Stock Fund

• Non-US Stock Index

• Non-US Stock Fund

• Pinnacle West Stock Fund

The Plan provides that in lieu of making their own investment elections in the funds, participants may (a) choose to have an

investment allocation set for them through the Plan's personal asset manager program, which provides a personalized mix of the Plan's

Core investment options; (b) allow their balance to be invested in the Qualified Default Investment Alternative ("QDIA") which is the

family of Target Retirement Date Funds (that are separately managed accounts) that are composed of the Core investment options; (c)

establish a self-directed brokerage account ("SDA") to invest up to 90% of their vested account balance in permitted investments of the

SDA (which excludes the Funds); or (d) participants may elect to have their investment mix of Funds automatically rebalanced

according to their future investment elections on a quarterly, semiannual or annual basis.

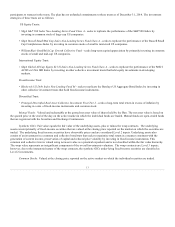

Notes Receivable from Participants

Participants may borrow money from their pretax contributions account, Roth 401(k) contributions account, vested Employer

contributions account, rollover contributions account (if any), and in-plan Roth conversions (if any). Participants may not borrow

against their Employer transfer account or their after-tax contributions account.

The minimum participant loan allowed is $1,000. The maximum participant loan allowed is 50% of the participant’s vested

account balance, up to $50,000 reduced by the participant’s highest outstanding loan balance in the 12-month period ending on the day

before the loan is made. Only one loan per participant may be outstanding at any one time. Loan terms are up to five years or up to 15

years for the purchase of the participant’s principal residence. An administrative fee is charged to the participant’s account for each

loan. Participants with an outstanding loan may continue to make loan repayments upon termination of employment with the

Employer, unless they receive a full distribution of their account balance.

The interest rate for a participant loan is determined at the time the loan is requested and is fixed for the life of the loan. The

interest rate will be at least as great as the interest rate charged by the Trustee to its individual clients for an unsecured loan on the date

the loan is made. The Trustee currently charges interest at the prime interest rate plus one percent, determined as of the first business

day of the month in which the loan is issued. The interest rate for loans issued during 2014 was 4.25%. Interest rates for outstanding

loans as of

6