APS 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken

an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service ("IRS"). Plan

management has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken that would

require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by the IRS, however, there

are currently no audits for any tax periods in progress. Plan management believes the Plan is no longer subject to income tax

examinations for years prior to 2011.

The IRS has determined and informed the Company by a letter dated September 19, 2013, that the Plan was designed in

accordance with applicable requirements of the Internal Revenue Code. The Company and the Plan’s management believe that the Plan

is currently designed and operated in compliance with the applicable requirements of the Internal Revenue Code, and the Plan and

related trust continue to be tax-exempt. Accordingly, no provision for income taxes has been included in the Plan’s financial

statements.

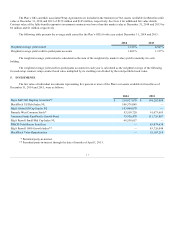

The Plan’s Stable Value Fund invests in fully-benefit responsive synthetic guaranteed investment contracts ("GICs"). A

synthetic GIC is an investment contract issued by an insurance company or other financial institution ("Wrap Agreement"), backed by a

portfolio of bonds, mortgages, or other fixed income instruments that are owned directly by the fund. The contract provides for an

interest crediting rate that may not be less than zero percent per annum. The realized and unrealized gains and losses on the underlying

assets are not reflected immediately in the value of the contract, but rather are amortized, usually over the time to maturity or the

duration of the underlying investments, through adjustments to the future interest crediting rate.

Primary variables impacting future interest crediting rates of the synthetic GICs include current yield of the assets within the

contract, duration of the assets covered by the contract, and the existing difference between the market value and contract value of the

assets within the contract. The Plan’s GIC’s interest crediting rates are reset on a monthly or quarterly basis. The crediting rate will

track current market yields on a trailing basis. The rate reset allows the contract value of the wrapped portfolio to converge to the

market value over time, assuming the portfolio market value continues to earn the current portfolio yield for a period of time equal to

the current portfolio duration. The Wrap Agreement is intended to guarantee that qualified participant withdrawals will occur at

contract value.

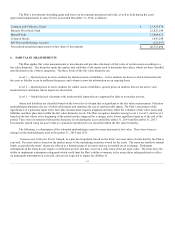

Certain events may limit the ability of the Plan to transact at contract value with the issuer. While the events may differ from

contract to contract, the events typically include: Plan amendments or changes, company mergers or consolidations, participant

investment election changes, group terminations or layoffs, implementation of an early retirement program, termination or partial

termination of the Plan, failure to meet certain tax qualifications, participant communication that is designed to influence participants

not to invest in the Stable Value Fund, transfers to competing options without meeting the equity wash provisions of the Stable Value

Fund (if applicable), Plan sponsor withdrawals without the appropriate notice to the Stable Value Fund’s investment manager and/or

wrap contract issuers, any changes in laws or regulations that would result in substantial withdrawals from the Plan, and default by the

Plan sponsor in honoring its credit obligations, insolvency, or bankruptcy if such events could result in withdrawals. In general, GIC

issuers may terminate the contract and settle at other than contract value due to changes in the qualification status of the company or the

Plan, breach of material obligations under the contract and misrepresentation by the contract holder, or failure of the underlying

portfolio to conform to the pre-established investment guidelines. Plan management believes that the occurrence of such events that

would cause the Plan to transact at less than contract value is not probable.

10