APS 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

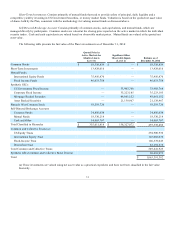

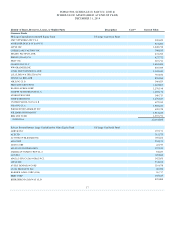

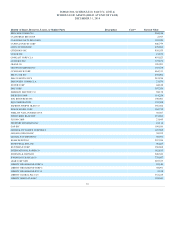

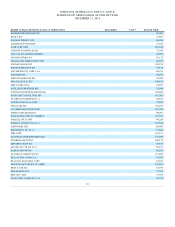

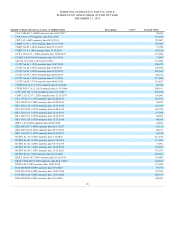

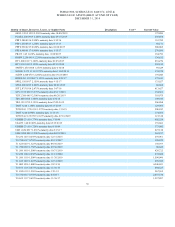

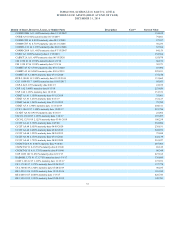

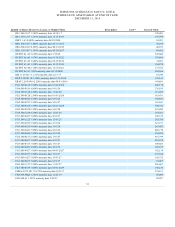

FORM 5500, SCHEDULE H: PART IV, LINE 4i

SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2014

SSgA Russell Small/Mid Cap Index Non-Lending Series Fund

Class A

US Small/Mid Cap Stock

Fund/Index

68,558,657

William Blair Small/Mid Cap Growth Collective Fund US Small/Mid Cap Stock Fund 15,415,203

Total common and collective trusts 549,641,923

Fidelity Institutional Money Market: Government Portfolio - Class I* Short-Term Investments*** 12,719,461

Fidelity Institutional Money Market: Money Market Portfolio - Class I* Short-Term Investments*** 1,205,587

Federated Treasury Obligations Fund — Institutional Shares Short-Term Investments*** 3,968

American Funds EuroPacific Growth Fund R6 Shares Non-US Stock Fund 75,956,470

Dodge & Cox Income Fund 1 Shares Bond Fund 23,022,646

Metropolitan West Total Return Bond Fund Institutional Shares Bond Fund 23,011,108

Total mutual funds 135,919,240

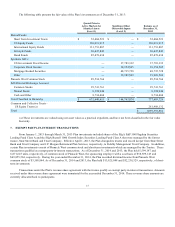

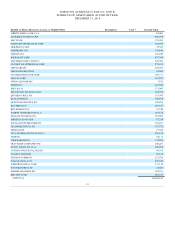

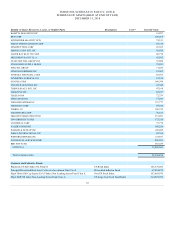

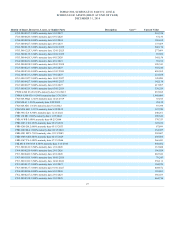

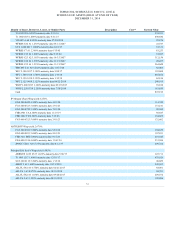

Bank of America Wrap yield 2.544%

FG 5.000 0220 5.000% maturity date 02/01/2020 76,100

FG 5.500 0722 5.500% maturity date 7/01/2022 64,908

FHR 3728 EA 3.500% maturity date 9/15/2020 49,469

FNR 15 CB 5.000% maturity date 3/25/2018 359,687

RGA Reinsurance yield 1.747%

Morley Stable Income Bond Fund Common and Collective Trust 20,410,973

Transamerica Life Ins Co Wrap yield 1.549%

ABBNVX 1.625 0517 1.625 % maturity date 5/08/2017 50,284

T 1.400 1217 1.400% maturity date 12/01/2017 654,148

SO 5.200 0116 5.200% maturity date 1/15/2016 350,080

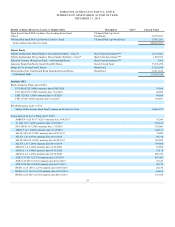

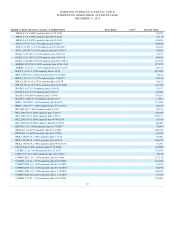

AMOT 5 A2 1.6000% maturity date 10/15/2019 244,513

ALLYL SN1 A3 0.750% maturity date 02/21/2017 74,886

ALLYA 1 A3 0.970% maturity date 10/15/2018 89,716

ALLYL SN2 A3 1.030% maturity date 09/20/2017 204,582

ALLYA 2 A3 1.250% maturity date 04/15/2019 199,806

AMXCA 2 A 1.260% maturity date 01/15/2020 59,890

AMXCA 3 A 1.490% maturity date 04/15/2020 75,118

AMXCA 4 A 1.430% maturity date 06/15/2020 209,724

AXP 2.375 0317 2.375% maturity date 3/24/2017 493,943

AXP 2.125 0319 2.125% maturity date 03/18/2019 85,410

AXP 2.250 0819 2.250% maturity date 08/15/2019 90,779

HNDA 1.125 1016 1.125% maturity date 10/07/2016 20,145

HNDA 2.125 1018 2.125% maturity date 10/10/2018 60,652

HNDA 2.250 0819 2.250% maturity date 08/15/2019 343,474

24