APS 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

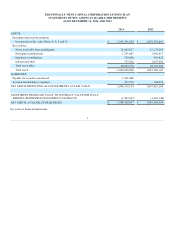

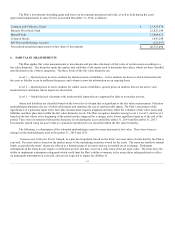

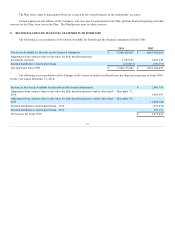

Investment Valuation

The Plan’s investments are stated at fair value, less costs to sell, if those costs are significant. Fair value is the price that would

be received upon the sale of an asset or the amount paid to transfer a liability in an orderly transaction between market participants at

the measurement date. See Note 6 for fair value measurements and disclosures of the Plan’s investments.

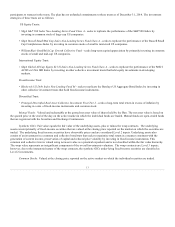

In accordance with GAAP, fully benefit-responsive investment contracts held in the Stable Value Fund are included at fair value

in the statements of net assets available for benefits, and an additional line item is presented representing the adjustments from fair value

to contract value. Contract value is the amount Plan participants would receive if they were to initiate permitted transactions under the

terms of the Plan. The statement of changes in net assets available for benefits is presented on a contract value basis. (See Note 4).

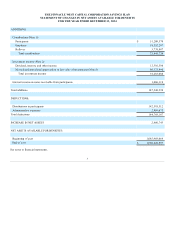

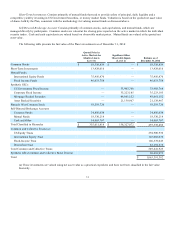

Income Recognition

Purchases and sales of securities are recorded as of the trade date. Interest income is recorded on the accrual basis. Dividend

income is recorded as of the ex-dividend date.

Administrative Expenses

Participants pay a quarterly Plan recordkeeping fee. Participants may also pay administrative fees for the origination of a loan or

for other services provided by the Trustee. Participants pay investment, sales, recordkeeping and administrative expenses charged by

the Funds, if any, which are deducted from income and reflected as a reduction of investment return for the Fund. Pinnacle West pays

the remaining Plan administrative expenses, such as legal and trustee expenses of the Plan.

Management fees and operating expenses charged to the Plan for investments in mutual funds are deducted from income earned

on a daily basis and are not separately reflected. Consequently, management fees are reflected as a reduction of investment return for

such investments.

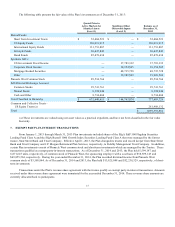

Notes Receivable From Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest.

Delinquent participant loans are recorded as distributions based on the terms of the Plan.

Payment of Benefits

Benefit payments to participants are recorded upon distribution. As of December 31, 2014 and 2013, there were no amounts

allocated to accounts of persons who have elected to withdraw from the Plan, but have not yet been paid.

Excess Contributions Payable

The Plan is required to return contributions received during the Plan year in excess of the Internal Revenue Code limits.

9