APS 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

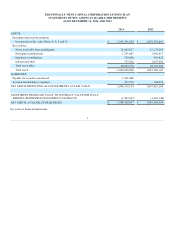

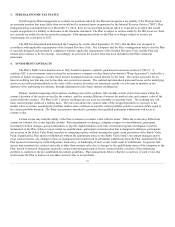

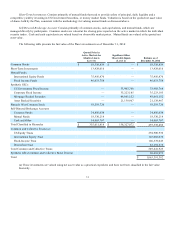

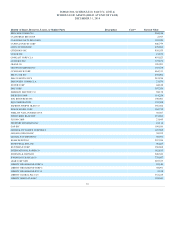

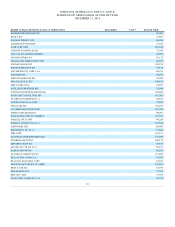

The Plan’s investments (including gains and losses on investments purchased and sold, as well as held during the year)

appreciated (depreciated) in value for the year ended December 31, 2014, as follows:

Common and Collective Trusts $ 23,934,970

Pinnacle West Stock Fund 22,825,248

Mutual Funds 12,004,621

Common Stocks 1,830,248

Self-Directed Brokerage Account (222,597)

Net realized/unrealized appreciation in fair value of investments $ 60,372,490

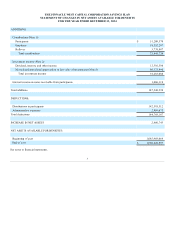

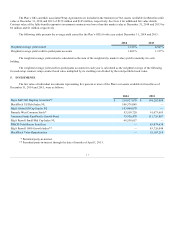

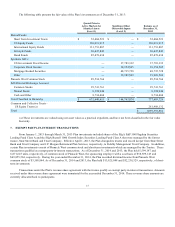

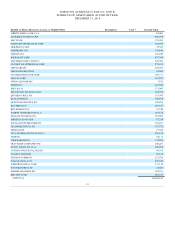

The Plan applies fair value measurements to investments and provides disclosure of fair value of certain assets according to a

fair value hierarchy. The hierarchy ranks the quality and reliability of the inputs used to determine fair values, which are then classified

and disclosed in one of three categories. The three levels of the fair value hierarchy are:

— Quoted prices in active markets for identical assets or liabilities. Active markets are those in which transactions for

the asset or liability occur in sufficient frequency and volume to provide information on an ongoing basis.

— Quoted prices in active markets for similar assets or liabilities; quoted prices in markets that are not active; and

model-derived valuations whose inputs are observable.

— Model-derived valuations with unobservable inputs that are supported by little or no market activity.

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement. Valuation

methodologies maximize the use of observable inputs and minimize the use of unobservable inputs. The Plan’s assessment of the

significance of a particular input to the fair value measurement requires judgment and may affect the valuation of fair value assets and

liabilities and their placement within the fair value hierarchy levels. The Plan recognizes transfers among Level 1, Level 2, and Level 3

based on the fair values at the beginning of the period and are triggered by a change in the lowest significant input as of the end of the

period. There were no transfers between the hierarchy levels during the years ended December 31, 2014 and December 31, 2013.

Investments valued using net asset value as a practical expedient are not classified within the fair value hierarchy.

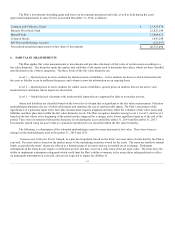

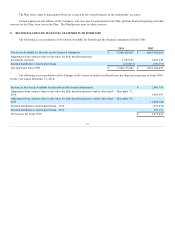

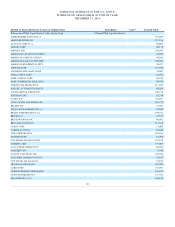

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no

changes in the methodologies used at December 31, 2014 and 2013.

: Valued, as a practical expedient, based on the trusts’ net asset value of units held by the Plan at

year-end. Net asset value is based on the market prices of the underlying securities owned by the trusts. The trusts are similar to mutual

funds, except that the trusts’ shares are offered to a limited group of investors and are not traded on an exchange. Participant

redemptions in the trusts do not require a notification period, and may occur on a daily basis at the net asset value. The trusts have the

ability to implement redemption safeguards which could limit the Plan’s ability to transact in the trusts; these safeguards had no effect

on participant redemptions at year-end, and are not expected to impact the abilities of

12