APS 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

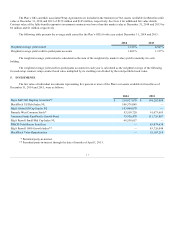

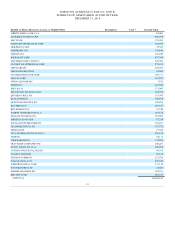

Consists primarily of mutual funds that seek to provide safety of principal, daily liquidity and a

competitive yield by investing in US Government Securities, or money market funds. Valuation is based on the quoted net asset value

of shares held by the Plan, consistent with the methodology for valuing mutual funds as discussed above.

Consists primarily of common stocks, cash equivalents, and mutual funds, which are

managed directly by participants. Common stocks are valued at the closing price reported on the active market in which the individual

security trades. Cash and cash equivalents are valued based on observable market prices. Mutual funds are valued at the quoted net

asset value.

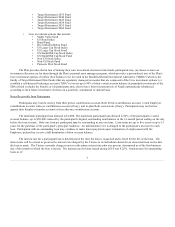

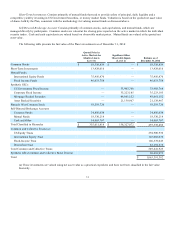

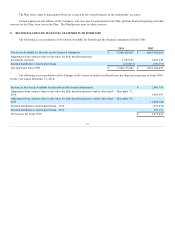

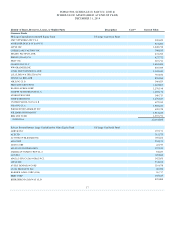

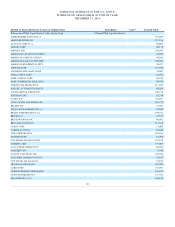

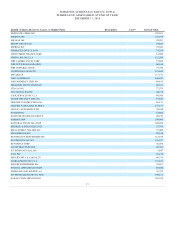

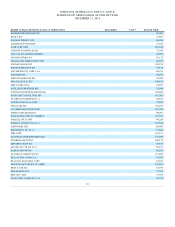

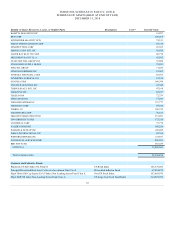

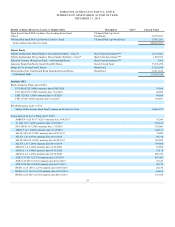

The following table presents the fair value of the Plan’s investments as of December 31, 2014:

Common Stocks

$ 58,330,839

$ —

$ 58,330,839

Short-Term Investments

13,929,016

—

13,929,016

Mutual Funds:

International Equity Funds

75,956,470

—

75,956,470

Fixed Income Funds

46,033,754

—

46,033,754

Synthetic GICs:

US Government Fixed Income

—

33,903,768

33,903,768

Corporate Fixed Income

—

35,223,185

35,223,185

Mortgage Backed Securities

—

48,061,152

48,061,152

Asset Backed Securities

—

21,138,967

21,138,967

Pinnacle West Common Stock

93,510,720

—

93,510,720

Self-Directed Brokerage Account:

Common Stocks

34,856,634

—

34,856,634

Mutual Funds

18,330,214

—

18,330,214

Cash and Other

14,063,767

—

14,063,767

Total Classified in Hierarchy

$ 355,011,414

$ 138,327,072

493,338,486

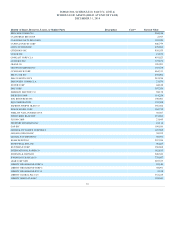

Common and Collective Trusts (a):

US Equity Trusts

294,900,930

International Equity Trust

103,068,070

Fixed-Income Trust

106,378,045

Diversified Trust

45,294,878

Total Common and Collective Trusts

549,641,923

Synthetic GICs Common and Collective Bond Trust (a)

20,410,973

Total

$ 1,063,391,382

(a) These investments are valued using net asset value as a practical expedient, and have not been classified in the fair value

hierarchy.

14