APS 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

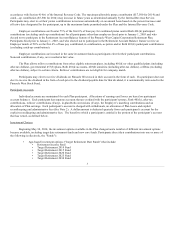

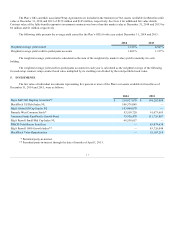

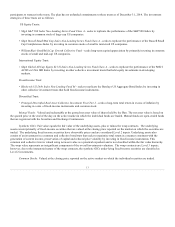

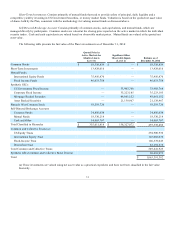

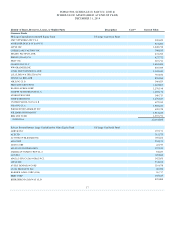

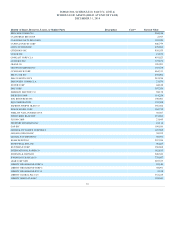

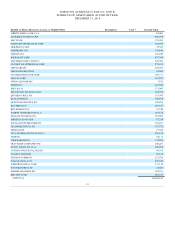

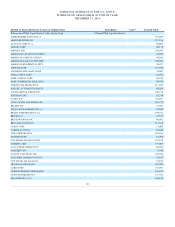

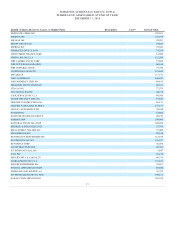

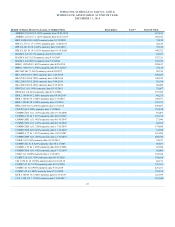

The following table presents the fair value of the Plan’s investments as of December 31, 2013:

Mutual Funds:

Short Term Investment Trusts

$ 52,404,523

$ —

$ 52,404,523

US Equity Funds

130,019,915

—

130,019,915

International Equity Funds

131,753,807

—

131,753,807

Lifestyle Funds

96,647,843

—

96,647,843

Bond Funds

85,478,634

—

85,478,634

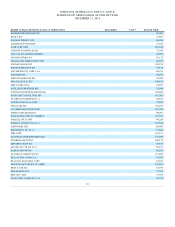

Synthetic GICs:

US Government Fixed Income

—

37,783,332

37,783,332

Corporate Fixed Income

—

38,254,505

38,254,505

Mortgage Backed Securities

—

48,735,728

48,735,728

Other

—

19,989,509

19,989,509

Pinnacle West Common Stock

89,534,766

—

89,534,766

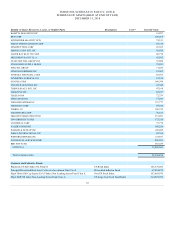

Self-Directed Brokerage Account:

Common Stocks

29,741,761

—

29,741,761

Mutual Funds

8,324,946

—

8,324,946

Cash and Other

8,734,460

—

8,734,460

Total Classified in Hierarchy

$ 632,640,655

$ 144,763,074

777,403,729

Common and Collective Trusts -

US Equity Trusts (a)

281,988,132

Total

$ 1,059,391,861

(a) These investments are valued using net asset value as a practical expedient, and have not been classified in the fair value

hierarchy.

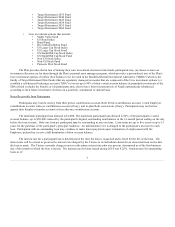

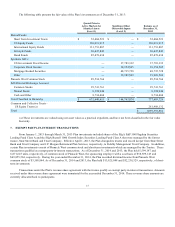

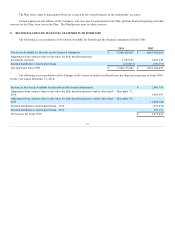

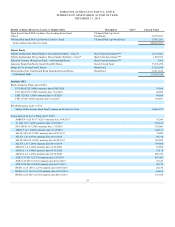

From January 1, 2013 through March 31, 2013 Plan investments included shares of the SSgA S&P 500 Flagship Securities

Lending Fund Class A and the SSgA Russell 1000 Growth Index Securities Lending Fund Class A that were managed by the former

trustee, State Street Bank and Trust Company. Effective April 1, 2013, the Plan changed its trustee and record keeper from State Street

Bank and Trust Company and J.P. Morgan Retirement Plan Services, respectively, to Fidelity Management Trust Company. In addition,

certain Plan investments consist of Pinnacle West common stock and short-term investments which are managed by the Trustee. These

transactions qualified as exempt party-in-interest transactions. As of December 31, 2014 and 2013, the Plan held 5,599,147 and

6,871,625 units, respectively, of common stock of Pinnacle West, the sponsoring employer with a cost basis of $58,929,143 and

$69,855,564, respectively. During the year ended December 31, 2014, the Plan recorded dividend income from Pinnacle West

common stock of $3,588,844. As of December 31, 2014 and 2013, the Plan held $13,925,048 and $52,238,329, respectively, of short-

term investments.

Transactions under the Plan's revenue share agreement with the trustee qualify as exempt party-in-interest transactions. Amounts

received under this revenue share agreement were immaterial for the year ended December 31, 2014. These revenue share amounts are

currently allocated back to participants.

15