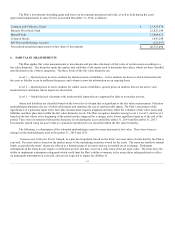

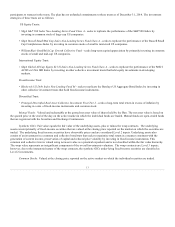

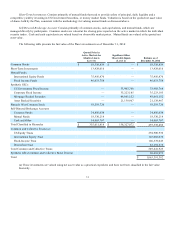

APS 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

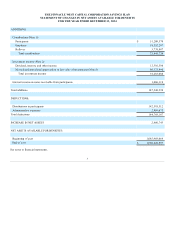

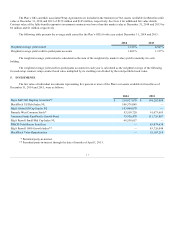

THE PINNACLE WEST CAPITAL CORPORATION SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

The following description of The Pinnacle West Capital Corporation Savings Plan (the “Plan”) provides only general

information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan sponsored by Pinnacle West Capital Corporation (“Pinnacle West” or the “Company”).

The Plan is administered by two committees, the Benefits Administration Committee and the Investment Management Committee,

appointed by the Pinnacle West Board of Directors (together, the “Committee”). The Plan is subject to the provisions of the Employee

Retirement Income Security Act of 1974, as amended ("ERISA"). Effective April 1, 2013, the Plan changed its trustee and record

keeper from State Street Bank and Trust Company and J.P. Morgan Retirement Plan Services, respectively, to Fidelity Management

Trust Company (“Trustee”).

The Trustee is the appointed investment manager of the Pinnacle West Stock Fund, which is an investment option in the Plan.

As the appointed investment manager of this option the Trustee (1) manages the liquidity of the Pinnacle West Stock Fund and

(2) accepts direction regarding the voting of shares held in the Pinnacle West Stock Fund for which no proxies are received. The portion

of the Plan invested in the Pinnacle West Stock Fund is an Employee Stock Ownership Plan. To the extent set forth by the terms of the

Plan, participants may exercise voting rights by providing instructions to the Trustee related to the number of whole shares of stock

represented by the units of the Pinnacle West Stock Fund allocated to their accounts. The Investment Management Committee directs

the Trustee on voting proxies received for shares of Pinnacle West common stock on routine matters (for those shares for which the

Trustee does not receive participant directions).

Eligibility

Generally, as defined by the Plan, most active employees of Pinnacle West and its subsidiaries, including Arizona Public Service

Company, El Dorado Investment Company and Bright Canyon Energy Corporation (collectively, the “Employer”), are eligible to

participate in (1) the pretax, Roth 401(k), and after-tax features of the Plan immediately upon employment or, if later, their attainment of

age 18 and (2) the matching feature on the first day of the month following their attainment of age 18 and completion of six months of

service.

Contributions

The Plan allows participants to contribute up to 50% of their base pay as pretax contributions, Roth 401(k) contributions or

after-tax contributions, provided that in no event can the combined total contributions made by any participant in any year exceed 50%

of their base pay, or the limits imposed by the Internal Revenue Code. Eligible employees who do not affirmatively elect to participate

or opt out of the Plan are automatically enrolled as soon as administratively possible after 60 days of employment. Employees

automatically enrolled contribute 3% of their base pay as pretax contributions. The Plan also allows participants attaining the age of 50

before the end of the calendar year to make catch-up contributions in

4