APS 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

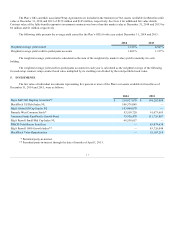

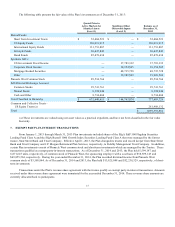

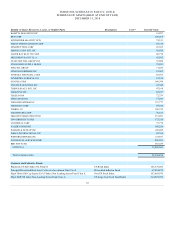

participants to transact in the trusts. The plan has no unfunded commitments to these trusts as of December 31, 2014. The investment

strategies of these trusts are as follows:

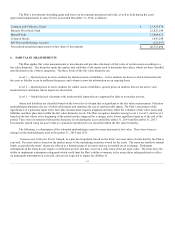

US Equity Trusts:

•seeks to replicate the performance of the S&P 500 Index by

investing in common stock of large-cap US companies.

seeks to replicate the performance of the Russell Small

Cap Completeness Index by investing in common stocks of small to mid-sized US companies.

seeks long-term capital appreciation by primarily investing in common

stocks of small and mid-cap US companies.

International Equity Trust:

•seeks to replicate the performance of the MSCI

ACWI ex USA IMI Index by investing in other collective investment trusts that hold equity investments in developing

markets.

Fixed-Income Trust:

seeks to replicate the Barclays US Aggregate Bond Index by investing in

other collective investment trusts that hold fixed-income instruments.

Diversified Trust:

• seeks a long-term total return in excess of inflation by

investing in a mix of fixed-income instruments and common stock.

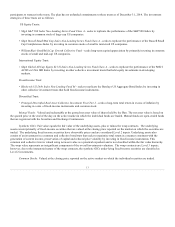

Valued and redeemable at the quoted net asset value of shares held by the Plan. The net asset value is based on

the quoted price at the end of the day on the active market in which the individual funds are traded. Mutual funds are open-ended funds

that are registered with the Securities and Exchange Commission.

Fair value equals the fair value of the underlying assets, plus or minus the wrap contracts. The underlying

assets consist primarily of fixed-income securities that are valued at the closing price reported on the market on which the securities are

traded. The underlying fixed-income securities have observable prices and are considered Level 2 inputs. Underlying assets also

consist of an investment in a common and collective bond trust that seeks to maximize total return in a manner consistent with the

generation of current income, preservation of capital and reduced price volatility by investing in fixed income instruments. This

common and collective trust is valued using net asset value as a practical expedient and is not classified within the fair value hierarchy.

The wrap value represents an insignificant component of the overall investments valuation. The wrap contracts are Level 3 inputs;

however, due to the immaterial nature of the wrap contracts, the synthetic GICs under-lying fixed-income securities are classified as

Level 2 investments.

Valued at the closing price reported on the active market on which the individual securities are traded.

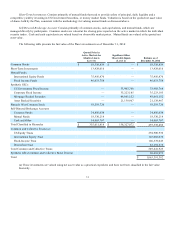

13