APS 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accordance with Section 414(v) of the Internal Revenue Code. The maximum allowable pretax contribution ($17,500 for 2014) and

catch—up contribution ($5,500 for 2014) may increase in future years as determined annually by the Internal Revenue Service.

Participants may elect to set their pretax contributions to increase automatically on an annual basis based on the percent increase and

effective date designated by the participant, up to the maximum limits permitted under the Plan and the Internal Revenue Code.

Employer contributions are fixed at 75% of the first 6% of base pay for combined pretax and/or Roth 401(k) participant

contributions (excluding catch-up contributions) for all participants other than employees hired prior to January 1, 2003 and who

elected not to participate in the Retirement Account Balance feature of the Pinnacle West Capital Corporation Retirement Plan.

Participants hired prior to January 1, 2003, and who elected not to participate in the Retirement Account Balance feature receive an

Employer match of 50% on the first 6% of base pay contributed, in combination, as pretax and/or Roth 401(k) participant contributions

(excluding catch-up contributions).

Employer contributions are invested in the same investment funds as participants elect for their participant contributions.

Noncash contributions, if any, are recorded at fair value.

The Plan allows rollover contributions from other eligible retirement plans, including 401(k) or other qualified plans (including

after-tax dollars), governmental 457(b) plans, Roth 401(k) accounts, 403(b) annuities (including after-tax dollars), or IRAs (excluding

after-tax dollars), subject to certain criteria. Rollover contributions are not eligible for company match.

Participants may elect to receive dividends on Pinnacle West stock in their account in the form of cash. If a participant does not

elect to receive the dividend in the form of cash prior to the dividend payable date for that dividend, it is automatically reinvested in the

Pinnacle West Stock Fund.

Participant Accounts

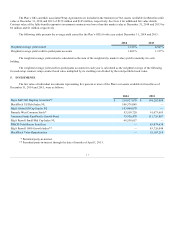

Individual accounts are maintained for each Plan participant. Allocations of earnings and losses are based on participant

account balances. Each participant has separate accounts that are credited with the participant’s pretax, Roth 401(k), after-tax

contributions, rollover contributions (if any), in-plan Roth conversions (if any), the Employer’s matching contributions and an

allocation of Plan earnings. Each participant’s account is charged with withdrawals, an allocation of Plan losses and explicit

recordkeeping and administrative fees (See Note 2). A dollar amount is deducted quarterly from each participant’s account for the

explicit recordkeeping and administrative fees. The benefit to which a participant is entitled is the portion of the participant’s account

that has vested, as defined below.

Investment Choices

Beginning May 30, 2014, the investment options available in the Plan changed and a number of different investment options

became available, including target date retirement funds and new core funds. Participants direct their contributions into one or more of

the following (collectively, the "Funds"):

• Age-based investment options ("Target Retirement Date Funds") that include:

• Retirement Income Fund

• Target Retirement 2010 Fund

• Target Retirement 2015 Fund

• Target Retirement 2020 Fund

• Target Retirement 2025 Fund

• Target Retirement 2030 Fund

5