APS 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

terminated employment. If a former participant who received a distribution and terminated service prior to full vesting at March 31,

2011, and retained non-vested funds in the plan, becomes re-employed prior to the end of the fifth calendar year following the calendar

year in which the participant’s earlier termination of employment occurred, the forfeited Employer contributions will be restored to the

participant’s Employer contribution account and they will earn additional service and be subject to the graduated vesting on these

funds. Forfeitures will be restored only if the participant repays the full amount previously distributed to them within five years of their

date of re-employment or, if earlier, the last day of the fifth calendar year following the calendar year in which the distribution

occurred. As of March 31, 2016, all forfeitures will either be fully vested or used to reduce future Employer contributions to the Plan.

Termination of the Plan

It is the Company’s present expectation that the Plan and the payment of Employer contributions will be continued indefinitely.

However, continuance of any feature of the Plan is not assumed as a contractual obligation. The Company, at its discretion, may

terminate the Plan and distribute net assets, subject to the provisions set forth in ERISA and the Internal Revenue Code, or discontinue

contributions. In this event, the balance credited to the accounts of participants at the date of termination or discontinuance will be fully

vested and nonforfeitable.

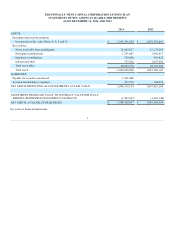

Basis of Accounting

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the

United States of America ("GAAP").

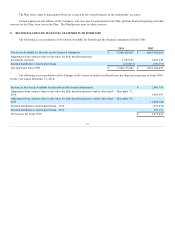

New Accounting Standard

In May 2015, new guidance was issued that removes the requirements to categorize within the fair value hierarchy certain

investments that are valued using net asset value as a practical expedient and removes other disclosure requirements relating to these

investments. The Plan adopted this guidance during 2014 and has applied the guidance retrospectively to all periods presented. The

adoption of this guidance modifies the Plan's fair value disclosures, but does not impact the Plan's Statement of Net Assets Available for

Benefits or Statements of Changes in Net Asset Available for Benefits. See Note 6 for fair value disclosures.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and

assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities.

Actual results could differ from those estimates.

Risks and Uncertainties

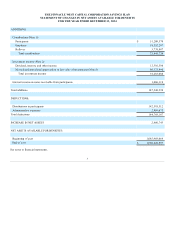

The Plan utilizes various investment instruments, including mutual funds, common and collective trusts, stocks, bonds, and a

stable value fund. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, liquidity risk, and

overall market volatility. Due to the level of risk associated with certain investment securities, it is possible that changes in the value of

investment securities may occur in the near term and that such changes could materially affect the amounts reported in the financial

statements.

8