Whirlpool 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

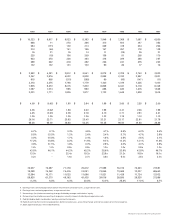

Notes to Consolidated Financial Statements54

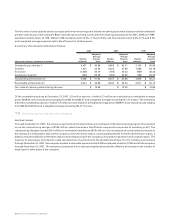

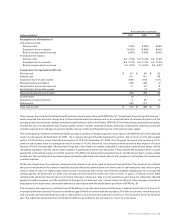

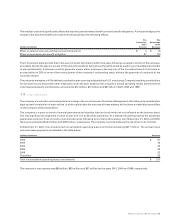

Various actuarial assumptions are used, including the discount rate and the expected trend in health care costs, to estimate the costs

and benefit obligations for the company’s retiree health plan. The discount rate is estimated looking at the rates of return on high

quality, fixed income investments that receive one of the two highest ratings given by a recognized ratings agency. At December 31,

2001, the company assumed a discount rate of 7.5%, a reduction from 2000 reflecting the declining interest rate environment. In

addition, the decrease in the discount rate increased the company’s retiree health benefit liability by approximately $35 million at

December 31, 2001. The majority of the retiree health benefit liability increase has been deferred in accordance with the amortization

provisions of SFAS No. 106. At December 31, 2001, the company’s assumed health care cost trend rate for 2002 was 8.5% to 10.5%

depending on the employees age, or an increase of 2.5% to 4.5% over the prior year. This increase was primarily due to the recent

increases in the price of medical services provided by the plan. The ultimate long-term trend rate was assumed to decrease gradually

to 6.0% by 2006 and remain at that level thereafter.

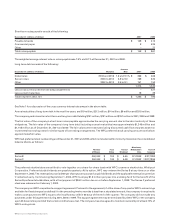

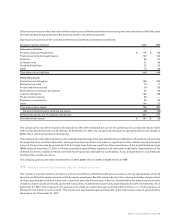

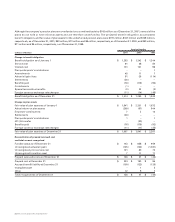

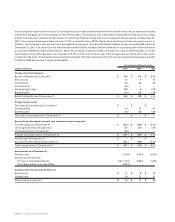

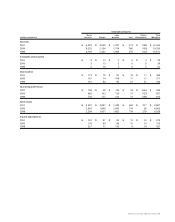

Postretirement Medical Benefits

(millions of dollars) 2001 2000 1999

Change in benefit obligation

Benefit obligation as of January 1 $ 439 $ 414 $ 428

Service cost 11 9 10

Interest cost 34 32 30

Amendments (43) ––

Actuarial (gain) loss 108 6 (34)

Benefits paid (24) (22) (20)

Benefit obligation as of December 31 $ 525 $ 439 $ 414

Change in plan assets

Fair value of plan assets as of January 1 $ – $ – $ –

Contributions 24 22 20

Benefits paid (24) (22) (20)

Fair value of plan assets as of December 31 $ – $ – $ –

Reconciliation of prepaid (accrued) cost and total amount recognized

Funded status as of December 31 $ (525) $ (439) $ (414)

Unrecognized actuarial (gain) loss 87 (21) (27)

Unrecognized prior service cost (43) ––

Prepaid (accrued) cost as of December 31 $ (481) $ (460) $ (441)

Prepaid cost at December 31 $ – $ – $ –

Accrued benefit liability at December 31 (481) (460) (441)

Total recognized as of December 31 $ (481) $ (460) $ (441)

Assumptions as of December 31

Discount rate 7.50% 8.00% 8.00%

Medical costs trend rate:

For year ending December 31 8.5 –10.5% 6.00% 7.00%

Ultimate medical trend rate (2006) 6.00%

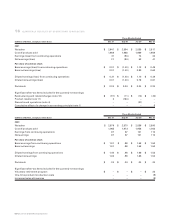

Components of net periodic benefit cost

Service cost $11$ 9$10

Interest cost 34 32 30

Net periodic benefit cost $45$41$40