Whirlpool 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Whirlpool Corporation 2001 Annual Report 33

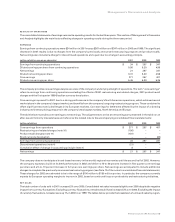

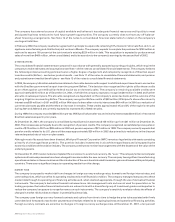

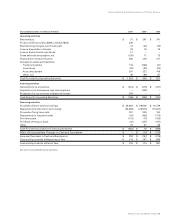

CASH FLOWS

The statements of cash flows reflect the changes in cash and equivalents for the last three years by classifying transactions into three

major categories: operating, investing and financing activities.

OPERATING ACTIVITIES

The company’s main source of cash flow is from operating activities consisting of net earnings from operations adjusted for changes

in operating assets and liabilities such as receivables, inventories and payables and for non-cash operating items such as depreciation.

Cash provided by operating activities totalled $1,024 million in 2001, $445 million in 2000 and $801 million in 1999. The increase in

2001 includes a $527 million improvement in working capital cash flows versus 2000, of which $464 million was in accounts receivable.

The decrease in 2000 versus 1999 was due primarily to an increase in accounts receivable and prepaid pension costs, partially offset

by an increase in accounts payable.

INVESTING ACTIVITIES

The principal recurring investing activities are property additions. Net property additions were $378 million, $375 million and $437

million in 2001, 2000 and 1999.

On October 5, 2001, the company sold its position in a portfolio of cross currency interest rate swaps resulting in the receipt of $209 million.

On January 7, 2000, the company completed its tender offer for the outstanding publicly traded shares in Brazil of its subsidiaries

Brasmotor and Multibras S.A. Eletrodomesticos (Multibras). In completing the offer, the company purchased additional shares of

Brasmotor and Multibras for $283 million, bringing its equity interest in these companies to approximately 94%. With this additional

investment, the company’s equity interest in all its Brazilian subsidiaries increased from approximately 55% to approximately 87%.

FINANCING ACTIVITIES

Dividends paid to stockholders totaled $113 million, $70 million and $103 million in 2001, 2000 and 1999. The increase in 2001 was

affected by the timing of funding for the fourth quarter 2000 payment, which was paid on January 2, 2001.

On July 3, 2001, the company issued 300 million euro denominated 5.875% Notes due 2006. The notes are general obligations of the

company and the proceeds were used for general corporate purposes.

Under its stock repurchase program, the company purchased 0.7 million shares ($43 million) in 2001, 8.7 million shares ($427 million)

in 2000 and 2.6 million shares ($167 million) in 1999. See Note 8 of the notes to consolidated financial statements for additional detail

on the company’s stock repurchase program.

The company’s net borrowings decreased by $569 million in 2001, excluding the effect of currency fluctuations. The decrease was in

short-term notes payable and funded by cash generated from operations.

The company’s net borrowings increased by $546 million in 2000, excluding the effect of currency fluctuations. The primary increase

was in short-term notes payable.

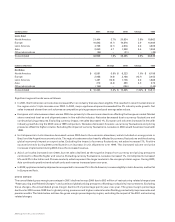

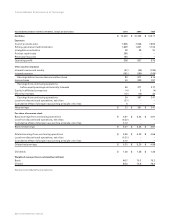

FINANCIAL CONDITION AND LIQUIDITY

The financial position of the company remains strong as evidenced by the December 31, 2001 balance sheet. The company’s total

assets were $7.0 billion and stockholders’ equity was $1.5 billion at the end of 2001 versus $6.9 billion and $1.7 billion respectively at

the end of 2000. The decrease in stockholders’ equity during 2001 was due primarily to $184 million of foreign currency translation

and $90 million in dividends declared.

The overall debt to invested capital ratio of 48.0% in 2001 was down from 49.4% in 2000 due to lower short-term borrowings more than

offsetting an increase in long-term debt and lower stockholders’ equity. The increase in long-term debt is due to the reclassification

on January 1, 2001, of a $221 million positive cash position on previously held net investment hedges from a contra debt account to

other long-term assets in accordance with SFAS No. 133, and the 300 million euro denominated notes issuance. The company’s

debt continues to be rated investment grade by Moody’s Investors Service Inc. (Baa1), Standard and Poor’s (BBB+) and Fitch IBCA,

Duff & Phelps (A-).

On June 1, 2001, the company entered into an $800 million five-year committed credit agreement and a committed $400 million

364-day credit agreement that provide backup liquidity. At December 31, 2001, there were no borrowings under these agreements,

which represent the company’s total committed credit lines. See Note 6 of the notes to consolidated financial statements for

additional details on the company’s committed credit facilities and the company’s debt obligations.