Whirlpool 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

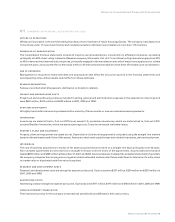

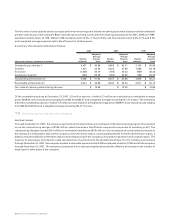

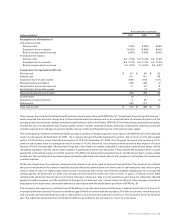

Application of the non-amortization provisions of SFAS No. 142 is expected to result in an increase in net earnings of approximately

$23 million in 2002. The company will test goodwill for impairment using the two-step process described in SFAS No. 142. The first

step is to screen for potential impairment, while the second step measures the amount of impairment, if any. The company expects

to perform the first of the required impairment tests of goodwill and indefinite lived intangible assets, which will be calculated based

on the December 31, 2001 carrying values, during the first quarter of 2002. Any impairment charge resulting from these transitional

impairment tests will be reflected as a cumulative effect of a change in accounting principle. The company has not yet determined

the financial impact that the impairment provisions of SFAS No. 142 will have on its earnings or its consolidated financial position.

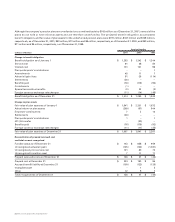

03 BUSINESS ACQUISITIONS

On January 7, 2000, the company completed its tender offer for the outstanding publicly traded shares in Brazil of its subsidiaries

Brasmotor S.A. (Brasmotor) and Multibras S.A. Eletrodomesticos (Multibras). In completing the offer, the company purchased

additional shares of Brasmotor and Multibras for $283 million bringing its equity interest in these companies to approximately 94%.

Including Embraco, the company’s equity interest in its Brazilian subsidiaries increased from approximately 55% to approximately

87%. If this increase in ownership had been made on January 1, 1999, proforma net earnings for 1999 would have been approximately

$311 million.

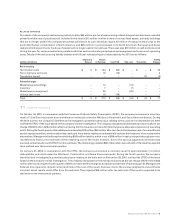

04 DISCONTINUED OPERATIONS

In 1997, the company discontinued its financing operations, Whirlpool Financial Corporation (WFC), and sold the majority of its

assets. The remaining assets consist primarily of an investment in a portfolio of leveraged leases which are recorded in other

non-current assets in the balance sheets and totaled $123 million and $124 million at December 31, 2001 and 2000, respectively.

During the second quarter of 2001, the company wrote off WFC’s investment in a securitized aircraft lease portfolio. The write-off,

due primarily to the softening aircraft leasing industry, resulted in a pre-tax loss from discontinued operations of $35 million ($21

million after-tax).

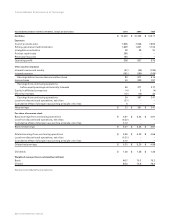

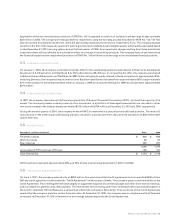

05 INVENTORIES

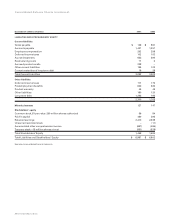

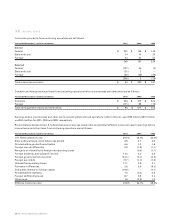

December 31 (millions of dollars) 2001 2000

Finished products $ 949 $ 956

Work in process 58 57

Raw materials 239 257

1,246 1,270

Less excess of FIFO cost over LIFO cost 136 151

Total inventories $ 1,110 $ 1,119

LIFO inventories represent approximately 39% and 33% of total inventories at December 31, 2001 and 2000.

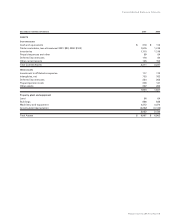

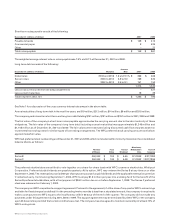

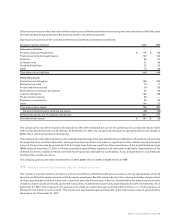

06 FINANCING ARRANGEMENTS

On June 1, 2001, the company entered into an $800 million five-year committed credit agreement and a committed $400 million

364-day credit agreement (collectively the “Credit Agreement”) with a group of banks. The company pays a commitment fee on the

Credit Agreement. The Credit Agreement exists largely to support the issuance of commercial paper and other short-term borrowings,

and is available for general corporate purposes. The interest rate for borrowing under the Credit Agreement is principally based on

the London Interbank Offered Rate plus a spread that reflects the company’s debt rating. The provisions of the Credit Agreement

require that the company maintain certain financial ratios. At December 31, 2001, the company was in compliance with all financial

covenants. At December 31, 2001, there were no borrowings outstanding under the Credit Agreement.

Whirlpool Corporation 2001 Annual Report 43