Whirlpool 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

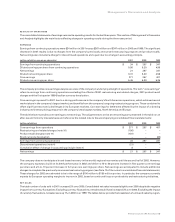

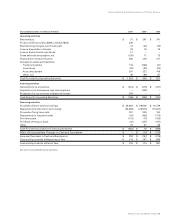

Management’s Discussion and Analysis34

The company has external sources of capital available and believes it has adequate financial resources and liquidity to meet

anticipated business needs and to fund future growth opportunities. The company currently does not have any off-balance-

sheet financing arrangements. See Note 14 of the notes to consolidated financial statements for detail on the company’s

contingent liabilities.

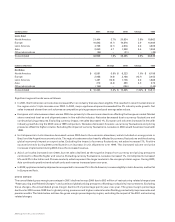

In February 2002, the company reached an agreement in principle to acquire the remaining 51% interest in Vitromatic S.A. de C.V., an

appliance manufacturing and distribution joint venture in Mexico. The company expects to complete the purchase for $150 million in

cash and to assume 100 percent of the joint venture’s existing $220 million in debt. This acquisition is expected to produce annual

sales of more than $400 million, when consolidated, and to be accretive to the company’s earnings by the second half of 2002.

OTHER MATTERS

The consolidated financial statements are prepared in accordance with generally accepted accounting principles, which require the

company to make estimates and assumptions (see Note 1 of the notes to consolidated financial statements). The company believes

the following critical accounting policies involve a higher degree of judgement and complexity: recognition of Brazilian export

incentive credits (Befiex) – see below; product recalls – see Note 11 of the notes to consolidated financial statements; and pension

and postretirement medical benefit plans – see Note 13 of the notes to consolidated financial statements.

In1996, the company’s Brazilian subsidiaries obtained a favorable decision with respect to additional export incentives in connection

with the Brazilian government’s export incentive program (Befiex). This decision also recognized the right to utilize these credits

as an offset against current Brazilian federal excise tax on domestic sales. The company’s remaining available credits were

approximately $315 million as of December 31, 2001, of which the company expects to recognize $40 million in 2002 and further

amounts in subsequent years. The amounts recognized are dependent on the company’s excise tax levels and the outcome of the

ongoing litigation surrounding Befiex. The company recognized Befiex credits of $53 million (Whirlpool’s share after minority

interest was $50 million) in 2001 and $52 million (Whirlpool’s share after minority interest was $49 million) in 2000 as a reduction of

current excise taxes payable and therefore an increase in net sales. These credits approximated 4% and 3% of the region’s net sales

during 2001 and 2000 and are currently expected to represent 3% of 2002 net sales.

During 1999, the company recorded $58 million pre-tax (Whirlpool’s share after-tax and minority interest was $20 million) of recovered

Brazilian sales taxes paid in prior years.

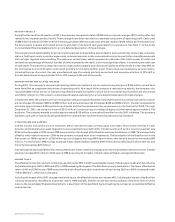

At December 31, 2001, the company’s consolidated prepaid pension asset was $136 million up from $47 million at December 31,

2000. The increase was principally due to the recognition of pension credits. The company recognized consolidated pre-tax pension

credits of $70 million in 2001 and $98 million in 2000 and pension expense of $21 million in 1999. The company currently expects that

pension credits related to its U.S. plans will decrease approximately $30 million in 2002 due primarily to reductions in the discount

rate and expected rate of return on plan assets.

Although most of its assets have been divested, Whirlpool Financial Corporation (WFC) remains a legal entity with assets consisting

primarily of a leveraged lease portfolio. The portfolio includes investments in aircraft leveraged leases and is impacted by the

economic conditions of the aviation industry. The company continues to monitor its arrangements with the lessees and the value of the

underlying assets.

On December 31, 2001, twelve nations completed the conversion to a common currency, the “euro.” The company’s internal computer

systems and business processes have been changed to accommodate the new currency. The company has significant manufacturing

operations and sales in these countries and the introduction of the euro has eliminated transaction gains and losses within participating

countries. There was no significant impact on operating results from this change.

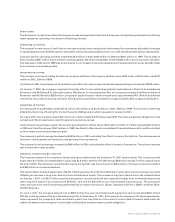

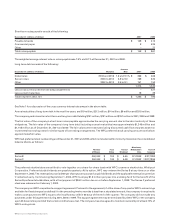

MARKET RISK

The company is exposed to market risk from changes in foreign currency exchange rates, domestic and foreign interest rates, and

commodity prices, which can affect its operating results and overall financial condition. The company manages its exposure to these

market risks through its operating and financing activities and, when deemed appropriate, through the use of derivative financial

instruments. The company’s derivative financial instruments are risk management tools and are not used for speculation or for

trading purposes. Derivative financial instruments are entered into with a diversified group of investment grade counterparties to

reduce the company’s exposure to nonperformance on such instruments. The company’s sensitivity analysis reflects the effects of

changes in market risk but does not factor in potential business risks.

The company uses foreign currency forward contracts and options from time to time to hedge the price risk associated with firmly

committed and forecasted cross-border payments and receipts related to its ongoing business and operational financing activities.

Foreign currency contracts are sensitive to changes in foreign currency exchange rates. At December 31, 2001, a ten percent