Whirlpool 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements52

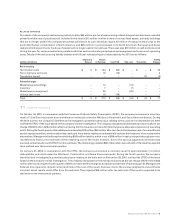

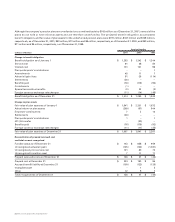

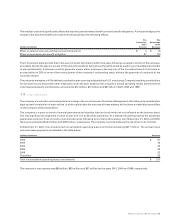

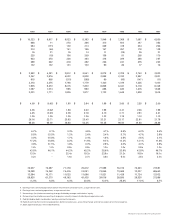

Although the company’s pension plans are overfunded on a combined basis by $143 million as of December 31, 2001, several of the

plans do not hold or have minimal assets and are therefore underfunded. The projected benefit obligation, accumulated

benefit obligation, and fair value of plan assets for the underfunded pension plans were $197 million, $187 million and $109 million,

respectively, as of December 31, 2001, $83 million, $73 million and $6 million, respectively, as of December 31, 2000, and $80 million,

$71 million and $5 million, respectively, as of December 31, 1999.

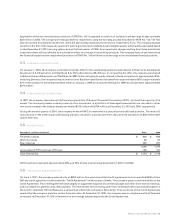

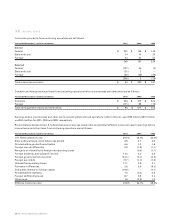

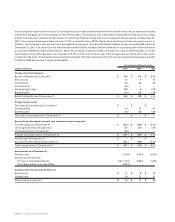

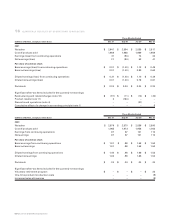

Pension Benefits

(millions of dollars) 2001 2000 1999

Change in benefit obligation

Benefit obligation as of January 1 $ 1,283 $ 1,242 $ 1,344

Service cost 61 48 50

Interest cost 101 101 98

Plan participants’ contributions –– 1

Amendments 45 11 7

Actuarial (gain) loss 51 38 (114)

Settlements (36) ––

Benefits paid (76) (175) (93)

Curtailments (1) – –

Special termination benefits (3) 32 (2)

Foreign currency exchange rate changes (11) (14) (49)

Benefit obligation as of December 31 $ 1,414 $ 1,283 $ 1,242

Change in plan assets

Fair value of plan assets as of January 1 $ 1,941 $ 2,201 $ 1,672

Actual return on plan assets (269) (57) 644

Employer contributions 7 3 12

Settlements (36) ––

Plan participants’ contributions 1 – 1

401 (h) transfer – (20) –

Benefits paid (76) (175) (93)

Foreign currency exchange rate changes (11) (11) (35)

Fair value of plan assets as of December 31 $ 1,557 $ 1,941 $ 2,201

Reconciliation of prepaid (accrued) cost

and total amount recognized

Funded status as of December 31 $ 143 $ 658 $ 959

Unrecognized actuarial (gain) (135) (702) (1,087)

Unrecognized prior service cost 121 80 73

Unrecognized transition asset 7 11 11

Prepaid (accrued) cost as of December 31 $ 136 $ 47 $ (44)

Prepaid cost at December 31 $ 224 $ 160 $ 85

Accrued benefit liability at December 31 (100) (123) (138)

Intangible asset – 1 2

Other 12 9 7

Total recognized as of December 31 $ 136 $ 47 $ (44)