Whirlpool 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

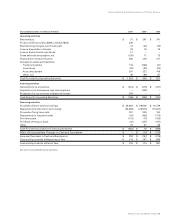

Notes to Consolidated Financial Statements48

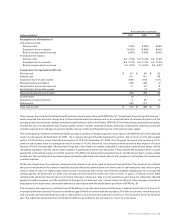

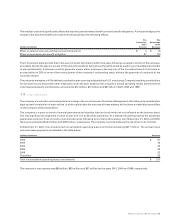

The fair value of stock options used to compute proforma net earnings and diluted net earnings per share disclosures is the estimated

present value at grant date using the Black-Scholes option-pricing model with the following assumptions for 2001, 2000 and 1999:

expected volatility factor of .326, .286 and .255; dividend yield of 2.3%, 2.7% and 2.2%; risk-free interest rate of 4.3%, 5.1% and 6.4%

and a weighted-average expected option life of 5 years for all three years.

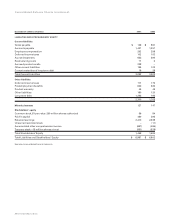

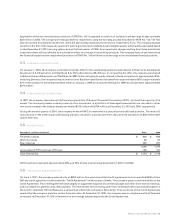

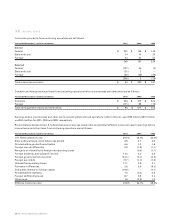

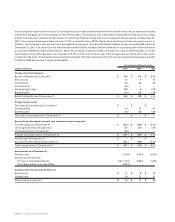

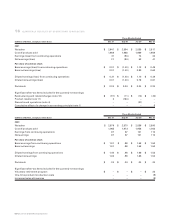

A summary of stock option information follows:

2001 2000 1999

Weighted Weighted Weighted

Average Average Average

Number Exercise Number Exercise Number Exercise

(thousands of shares, except per share data) of Shares Price of Shares Price of Shares Price

Outstanding at January 1 6,437 $ 50.86 4,605 $ 52.21 4,120 $ 50.59

Granted 1,401 54.30 2,222 47.59 1,629 53.19

Exercised (1,508) 50.19 (190) 42.23 (960) 46.35

Canceled or expired (264) 50.49 (200) 53.83 (184) 55.30

Outstanding at December 31 6,066 $ 51.83 6,437 $ 50.86 4,605 $ 52.21

Exercisable at December 31 3,574 $ 52.68 3,545 $ 52.44 2,611 $ 50.14

Fair value of options granted during the year $ 15.59 $ 12.23 $ 14.59

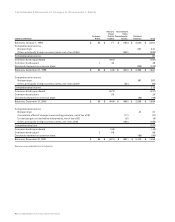

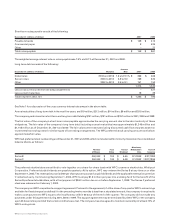

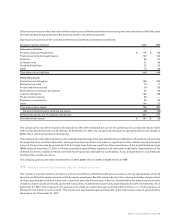

Of the outstanding options at December 31, 2001, 3.5 million options, of which 2.3 million are exercisable at a weighted-average

price of $49.34, have exercise prices ranging from $34.94 to $52.47 and a weighted-average remaining life of 7.2 years. The remaining

2.6 million outstanding options, of which 1.2 million are exercisable at a weighted-average price of $59.07, have exercise prices ranging

from $53.06 to $72.34 and a weighted-average remaining life of 7.2 years.

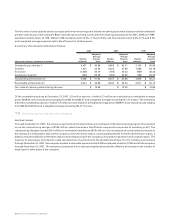

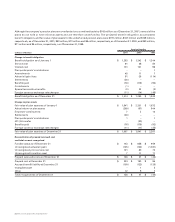

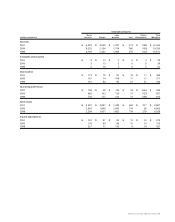

10 RESTRUCTURING AND RELATED CHARGES

RESTRUCTURING

Through December 31, 2001, the company approved and implemented various phases of the restructuring program that resulted

in pre-tax restructuring charges of $150 million, which have been identified as a separate component of operating profit. The

restructuring charges included $134 million in termination benefits and $16 million in non-employee exit costs related primarily to

the closing of a refrigeration plant in the company’s Latin American region, a parts packing facility in the North American region, a

plastic components facility in the Asian region and a restructuring of the company’s microwave business in its European region. The

majority of employees terminated to date represent hourly personnel at the identified facilities. For the initiatives announced

through December 31, 2001, the company expects to eliminate approximately 5,000 employees of which 3,700 had left the company

through December 31, 2001. The reduction in positions due to restructuring has been partially offset by an increase in the number of

employees in other areas of the company.