Whirlpool 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

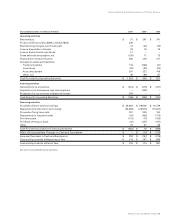

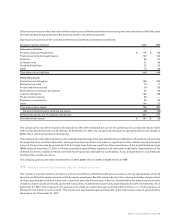

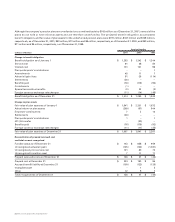

07 DERIVATIVE FINANCIAL INSTRUMENTS

The company is exposed to market risk from changes in foreign currency exchange rates, domestic and foreign interest rates, and

commodity prices, which can affect its operating results and overall financial condition. The company manages its exposure to these

market risks through its operating and financing activities and, when deemed appropriate, through the use of derivative financial

instruments. The company deals only with investment-grade counterparties to these contracts and monitors its overall credit risk

and exposure to individual counterparties. The company does not anticipate nonperformance by any counterparties. The amount of

the exposure is generally the unrealized gains in such contracts. The company does not require, nor does it post, collateral or security

on such contracts. The company does not enter into derivative financial instruments for trading purposes.

The company has entered into foreign currency forward exchange contracts with maturities of up to eighteen months in order to

manage exposures related to forecasted foreign currency denominated expenditures and certain intercompany financing and

royalty agreements. The company also used commodity futures contracts (principally copper and aluminum) with remaining

maturities up to 12 months to hedge the price risk on a portion of raw material purchases used in the manufacturing process. Foreign

currency forward exchange contracts and commodity futures contracts that have been designated and are effective as hedges of

firm commitments or anticipated transactions are treated as cash flow hedges for accounting purposes. The notional amount of

outstanding foreign currency forward contracts was $922 million and $645 million as of December 31, 2001 and 2000, respectively.

The notional amount of outstanding commodity futures contracts was $14 million and $20 million as of December 31, 2001 and 2000,

respectively. Unrealized gains and losses on the above foreign currency exchange contracts and commodities futures contracts

were not significant as of December 31, 2001 and December 31, 2000, respectively.

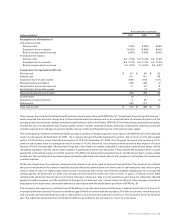

The company has designated a portion of its euro-denominated fixed-rate debt as a hedge of its investments in its European

subsidiaries. Translation adjustments related to this portion of the debt are not included in the income statement, but are shown in

the cumulative translation adjustment account included in accumulated other comprehensive income. During the year ended

December 31, 2001, the company recognized $2 million of unrealized losses included in the cumulative translation adjustment

related to this net investment hedge.

The company is party to a $100 million interest rate swap agreement that effectively converts a portion of its floating-rate obligations

to a fixed-rate basis for the next five years, thus reducing the impact of interest-rate changes on future interest expense. This contract

is designated and is effective as a hedge of future cash payments and is treated as a cash flow hedge for accounting purposes. The

fair value of this contract was a loss of $4 million as of December 31, 2001.

In September 2000, the company entered into additional domestic interest rate swaps that neutralized any potential interest rate

impact from an existing portfolio of domestic interest rate swaps. These contracts are not designated as hedges and are therefore

marked-to-market each period through earnings as a component of interest expense with unrealized gains (losses) on the September

2000 swap contracts offsetting subsequent unrealized (losses) gains on the original swap portfolio.

The company managed a portfolio of domestic and cross currency interest rate swaps that effectively converted U.S. dollar denominated

debt into that of various European currencies. Through May 15, 2000, such local currency denominated debt served as an effective

hedge against the company’s European cash flows and net assets. On May 15, 2000, the company undesignated these contracts as

hedges of the net investment in its European operations and entered into offsetting euro denominated currency swaps, effectively

locking in its positive cash position on the original swap portfolio. These contracts were not designated as hedges and therefore

were marked-to-market each period through earnings as a component of interest expense with unrealized gains (losses) on the May

2000 swap contracts substantially offsetting subsequent unrealized (losses) gains on the original swap portfolio. On October 5, 2001,

the company sold its position in the above-referenced swaps for approximately $209 million.

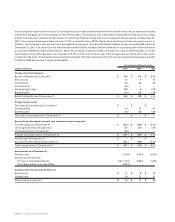

During the year ended December 31, 2001, the company’s gains and losses related to the ineffective portion of its hedging instruments

were immaterial. The company did not recognize any gains or losses during the year ended December 31, 2001 for cash flow hedges

that were discontinued because the forecasted transaction was no longer probable of occurring. The amount of unrealized gains and

losses on derivative instruments included in accumulated other comprehensive income at December 31, 2001 that will be reclassified

into earnings during 2002 is not significant. The net transaction losses recognized in other income (expense), including gains and

losses from those contracts not designated as hedges, was $11 million in 2001, $17 million in 2000 and $201 million in 1999 due

primarily to the Brazilian currency devaluation.

Whirlpool Corporation 2001 Annual Report 45