Whirlpool 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

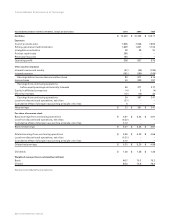

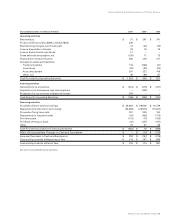

Management’s Discussion and Analysis32

PRODUCT RECALLS

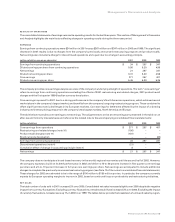

During the third and fourth quarters of 2001, the company recognized a total of $295 million of pre-tax charges ($181 million after-tax)

related to two separate product recalls. These charges have been recorded as a separate component of operating profit. Cash costs

of $56 million were paid in 2001 and the remaining projected after-tax cash costs of these recalls of $125 million will be realized over

the next several quarters and funded primarily with cash on hand and cash generated from operations. See Note 11 of the notes

to consolidated financial statements for a more detailed description of these charges.

The company’s estimated liability for product recall expenses is impacted by several factors such as customer contact rate, consumer

options, field repair costs, inventory repair costs, extended warranty costs, communication structure and other miscellaneous costs

such as legal, logistics and consulting. The customer contact rates, which represent an estimate of the total number of units to be

serviced as a percentage of the total number of units impacted by the recall, is the most significant factor in estimating the total cost

of each recall. The customer contact rate used to measure the company’s product recall liability as of December 31, 2001 was 65% for

the microwave hood combination units recall and 50% for the dehumidifier recall. These rates are impacted by several factors,

including the type of product, the year manufactured, age of products sold and current and past experience factors. A 10% shift in

this rate would cause an approximate 10% to 15% change in the cost of the recalls.

RESTRUCTURING AND RELATED CHARGES

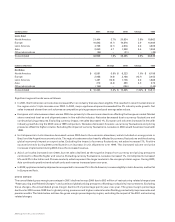

During 2001, the company’s various restructuring initiatives resulted in pre-tax restructuring charges of $150 million, which have

been identified as a separate component of operating profit. As a result of the company’s restructuring activity, the company also

recognized $62 million pre-tax of restructuring related charges during 2001, which were recorded primarily within cost of products

sold. Refer to Note 10 of the notes to consolidated financial statements for a more detailed description of these charges.

In December 2000, the company announced a global restructuring plan that when fully implemented is currently expected to result in

pre-tax charges of between $300 and $350 million and annualized savings of between $225 and $250 million. The plan is expected to

eliminate approximately 6,000 positions worldwide and the final phases will be announced over the first half of 2002. Through

December 31, 2001, the company incurred $212 million in restructuring and related charges and eliminated approximately 3,700

positions. The company expects to realize approximately $135 million in annualized benefits from the 2001 initiatives. The company

expects to use cash on hand and cash generated from operations to fund the remaining restructuring initiatives.

OTHER INCOME AND EXPENSE

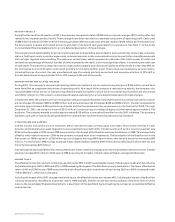

Interest income and sundry income (expense), which includes foreign currency gains and losses, financial service fees in Latin

America and miscellaneous asset dispositions were essentially level with 2000. Interest income and sundry income (expense) was

$145 million favorable in 2000 versus 1999 due primarily to the impact of the Brazilian currency devaluation in 1999. This was partially

offset by lower interest income in 2000 as the company reduced short term investments. The devaluation of the Brazilian real in the

first quarter of 1999 resulted in a $158 million pre-tax charge to earnings (Whirlpool’s share after-tax and minority interest was $60

million). For the full year 1999, foreign exchange losses related to Brazil totalled $192 million pre-tax (Whirlpool’s share after-tax and

minority interest was $76 million).

Interest expense decreased $18 million versus 2000 due to lower overall borrowings and a declining interest rate environment. Interest

expense increased $14 million in 2000 versus 1999 due primarily to higher interest rates and higher average debt balances.

INCOME TAXES

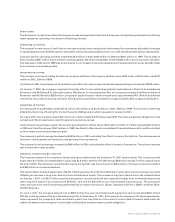

The effective income tax rate from continuing operations was 35% in 2001 (excluding the impact of the product recalls and restructuring

and related charges), 35% in 2000 and 37% in 1999 (excluding the impact of the Brazilian currency devaluation). The lower effective tax

rate for 2001 and 2000 versus 1999 was primarily due to Brazilian export incentives utilized during 2001 and 2000 (discussed under

“Other Matters”), which are nontaxable.

Including the impact of the 2001 charges mentioned above, the effective income tax rate was 46%. Including the impact of the Brazilian

currency devaluation, the effective income tax rate for 1999 was 38%. See the income tax rate reconciliation included in Note 12 of the

notes to the consolidated financial statements for a description of the significant items impacting the company’s consolidated effective

income tax rate.