Whirlpool 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

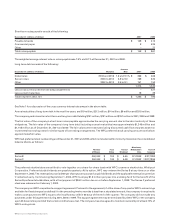

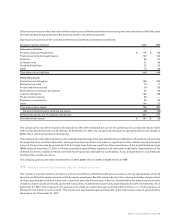

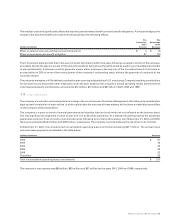

RELATED CHARGES

As a result of the company’s restructuring activity to date, $62 million pre-tax of restructuring related charges have also been recorded

primarily within cost of products sold. Included in this total is $12 million in write-downs of various fixed assets, primarily buildings

that are no longer used in the company’s business activities in its Latin American region, $7 million of excess inventory due to the

parts distribution consolidation in North America, and $25 million in various assets in its North American, European and Asian

regions which was primarily made up of equipment no longer used in its business. There was also $18 million in cash costs incurred

during the year for various restructuring related activities such as relocating employees and equipment and concurrent operating

costs. Details of the restructuring liability balance and full year restructuring and related activity for 2001 are as follows:

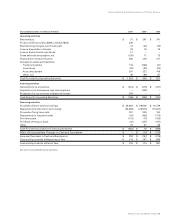

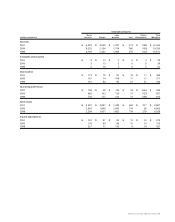

Beginning Charge Ending

(millions of dollars) Balance to Earnings Cash Paid Non-cash Translation Balance

Restructuring

Termination costs $ 5 $ 134 $ (64) $ – $ – $ 75

Non-employee exit costs 16 (12) ––4

Translation impact ––––(2) (2)

Related charges

Miscellaneous buildings –12 –(12) ––

Inventory –7 –(7) ––

Miscellaneous equipment –25 –(25) ––

Various cash costs –18 (18) –––

Total $ 5 $ 212 $ (94) $ (44) $ (2) $ 77

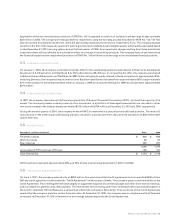

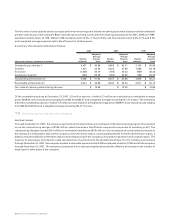

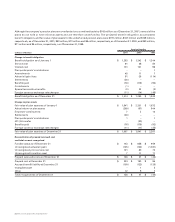

11 PRODUCT RECALLS

On October 16, 2001, in cooperation with the Consumer Products Safety Commission (CPSC), the company announced a voluntary

recall of 1.8 million microwave hood combination units sold under the

Whirlpool

,

KitchenAid

, and Sears

Kenmore

brands. During

the third quarter, the company identified and investigated a potential safety issue relating to the units and on September 24, 2001

notified the CPSC of the issue based on the company’s initial investigation. The company recognized an estimated product recall pre-tax

charge of $300 million ($184 million after-tax) during the third quarter and recorded this charge as a separate component of operating

profit. During the fourth quarter, this liability was reduced by $79 million ($48 million after-tax) due to the development of a more efficient

service repair procedure, which enables less costly and more timely repairs and substantially reduces the frequency of more expensive

alternatives. Management believes the remaining $165 million liability, which is net of $56 million in cash costs paid through year-end,

represents its best current estimate of the remaining cost of the recall; however, due to the various judgments and estimates

involved, actual results could differ from this estimate. The remaining projected $80 million after-tax cash cost of the recall is expected

to be realized over the next several quarters.

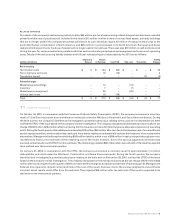

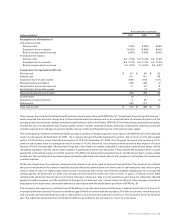

On January 31, 2002, in cooperation with the CPSC, the company announced a voluntary recall of approximately 1.4 million

dehumidifier units sold under the

Whirlpool

,

ComfortAire

, and Sears

Kenmore

brands. During the fourth quarter, the company

identified and investigated a potential safety issue relating to the units and on November 29, 2001 notified the CPSC of the issue

based on the company’s initial investigation. The company recognized an estimated product recall pre-tax charge of $74 million ($45

million after-tax) during the fourth quarter of 2001 and recorded this charge as a separate component of operating profit. Management

believes this represents its best current estimate of the cost of the recall; however, due to the various judgments and estimates

involved, actual results could differ from this estimate. The projected $45 million after-tax cash cost of the recall is expected to be

realized over the next several quarters.

Whirlpool Corporation 2001 Annual Report 49